The Q1 2018 USG Corporation + U.S. Chamber of Commerce Commercial Construction Index (Index), released today, reveals nearly two-thirds of contractors are highly confident that demand for commercial construction will increase over the next year, however, continued concerns around labor shortages have put even greater pressure on the industry. To increase jobsite efficiency and improve labor productivity, increasingly more builders are turning to alternative construction solutions, like prefabrication and modularization.

The Q1 Index indicates contractors turn to innovations such as prefabricated and modular building materials to create more efficient jobsites (89%), increase labor productivity (85%), drive cost savings (58%), and provide a competitive advantage in the marketplace (51%). In fact, 50% of contractors report their companies already use prefabricated and modular components and the number was even higher among general contractors (72%). Nearly two-thirds (63%) of contractors report at least moderate demand for these building materials.

"Access to skilled labor is a continued concern, which has led contractors to increasingly seek solutions that help offset jobsite challenges,” said Jennifer Scanlon, President and Chief Executive Officer of USG Corporation. “There is significant opportunity to introduce innovations that confront jobsite efficiency and strengthen the industry – such as solutions that enable prefabricated and modular building components.”

Contractors in the Northeast (69%) reported the most frequent usage of prefabricated and modular components, compared to the South where only 24% indicate their companies are using these materials. Firms in the Northeast also expect to hire fewer workers—38% of contractors in the region expect to employ more staff in the next six months, compared with 57% in the South, 59% in the West, and 68% in the Midwest. Across all regions, concern over the cost of hiring skilled labor has remained consistent over the past year—nearly two-thirds (64%) of contractors expect these costs to increase in the next six months.

Despite labor concerns, contractor sentiment remained steady for the first quarter, as a result of strong revenue expectations and higher profit margins, with a composite score of 74.

“As we work to continually build our neighborhoods, towns, regions, and roads, as well as the workforce that supports our growth, innovation becomes a key component in advancing our country into the 21st century,” said Thomas J. Donohue, President and CEO of the U.S. Chamber. “We must invest in a skilled, competitive, motivated workforce and embrace new innovations to ensure we are able to compete on a global scale.”

The Index looks at the results of three leading indicators to gauge confidence in the commercial construction industry – backlog levels, new business opportunities and revenue forecasts – generating a composite index on a scale of 0 to 100 that serves as an indicator of health for the contractor segment on a quarterly basis. The Q1 2018 composite score was 74, holding steady from Q4 2017.

The Q1 2018 results from the three key drivers were:

- Backlog: On average, contractors currently hold 8.9 months of backlog, relatively close to the average ideal amount of 12.2 months, continuing the stability of the market, although there is room for growth. Down two points from Q4 2017, this represents 73% of ideal backlog levels.

- New Business: Nearly all (98%) contractors report high or moderate confidence in the demand for commercial construction. Year-over-year, the number of contractors who have high confidence in demand over the next 12 months jumped 11 percentage points (from 51% in Q1 2017 to 62% in Q1 2018).

- Revenues: Over half (54%) of contractors expect to see revenue gains in the next year. This percentage jumped seven points from last quarter (47% in Q4 2017).

The research was developed with Dodge Data & Analytics (DD&A), the leading provider of insights and data for the construction industry, by surveying commercial and institutional contractors.

Related Stories

Market Data | Apr 4, 2016

ABC: Nonresidential spending slip in February no cause for alarm

Spending in the nonresidential sector totaled $690.3 billion on a seasonally adjusted, annualized basis in February. The figure is a step back but still significantly higher than one year ago.

Market Data | Mar 30, 2016

10 trends for commercial real estate: JLL report

The report looks at global threats and opportunities, and how CRE firms are managing their expectations for growth.

Market Data | Mar 23, 2016

AIA: Modest expansion for Architecture Billings Index

Business conditions softening most in Midwest in recent months.

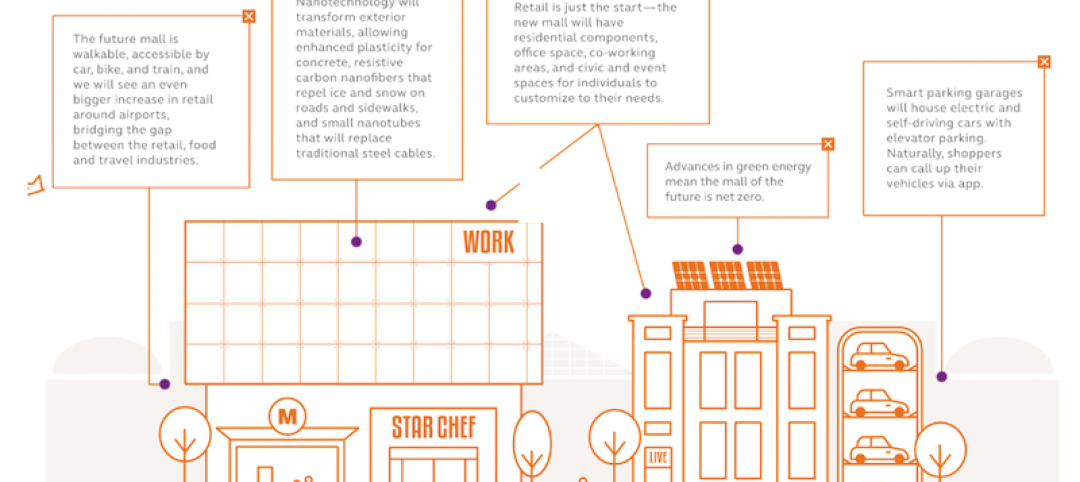

Retail Centers | Mar 16, 2016

Food and technology will help tomorrow’s malls survive, says CallisonRTKL

CallisonRTKL foresees future retail centers as hubs with live/work/play components.

Market Data | Mar 6, 2016

Real estate execs measure success by how well they manage ‘talent,’ costs, and growth

A new CBRE survey finds more companies leaning toward “smarter” workspaces.

Market Data | Mar 1, 2016

ABC: Nonresidential spending regains momentum in January

Nonresidential construction spending expanded 2.5% on a monthly basis and 12.3% on a yearly basis, totaling $701.9 billion. Spending increased in January in 10 of 16 nonresidential construction sectors.

Market Data | Mar 1, 2016

Leopardo releases 2016 Construction Economics Report

This year’s report shows that spending in 2015 reached the highest level since the Great Recession. Total spending on U.S. construction grew 10.5% to $1.1 trillion, the largest year-over-year gain since 2007.

Market Data | Feb 26, 2016

JLL upbeat about construction through 2016

Its latest report cautions about ongoing cost increases related to finding skilled laborers.

Market Data | Feb 17, 2016

AIA reports slight contraction in Architecture Billings Index

Multifamily residential sector improving after sluggish 2015.

Market Data | Feb 11, 2016

AIA: Continued growth expected in nonresidential construction

The American Institute of Architects’ semi-annual Consensus Construction Forecast indicates a growth of 8% in construction spending in 2016, and 6.7% the following year.