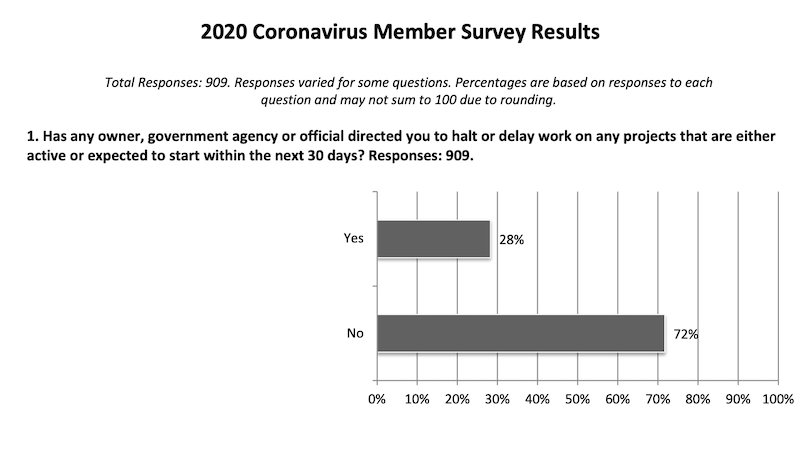

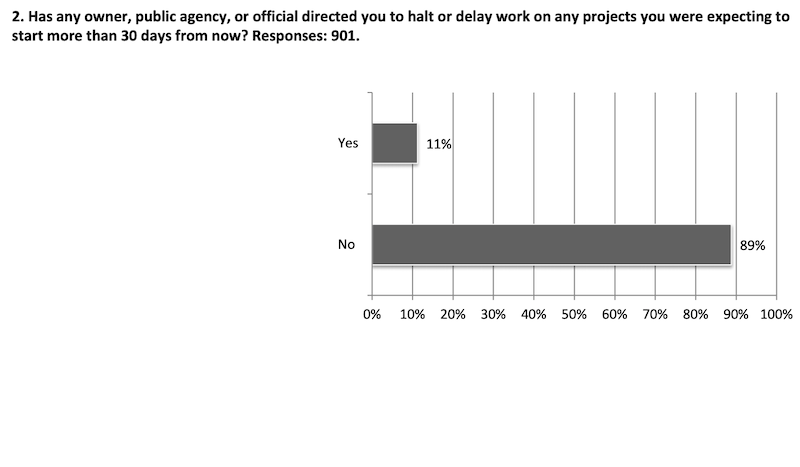

The coronavirus pandemic has caused more than one out of four contractors to halt or delay work on current projects, according to a survey released today by the Associated General Contractors of America. The survey results show how quickly market conditions have changed compared to data showing a majority of metro areas added construction jobs through January. Association officials noted that a relief bill the Senate is considering includes some favorable tax and loan provisions. But they said the bill also needs new infrastructure investments and improvements to the new paid sick and family medical leave measures.

“The coronavirus pandemic has the potential to undermine what had been a very robust construction market, threatening the livelihood of countless workers and the viability of many firms,” said Ken Simonson, the association’s chief economist. “Providing additional tax credits and loans will help, but contractors also need the certainty that comes with infrastructure funding and improvements to the new paid and family leave measures.”

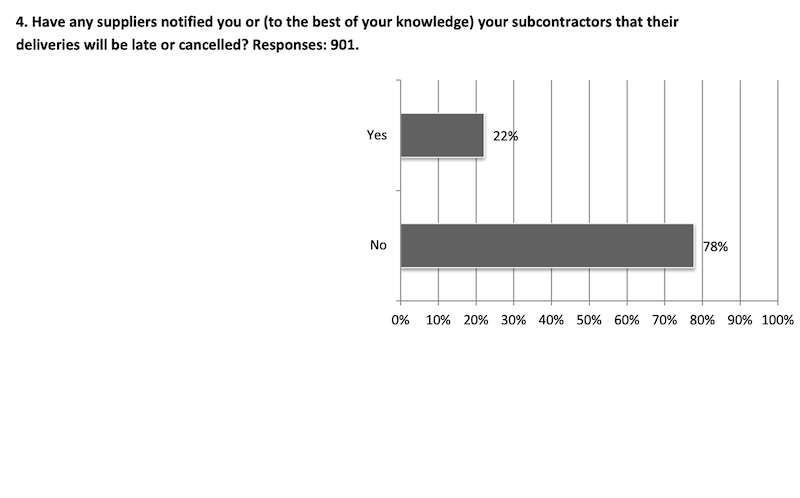

In an online survey conducted by the association between March 17 and 19, 28% of the 909 respondents replied yes to the question, “Has any owner, government agency or official directed you to halt or delay work on any projects that are either active or expected to start within the next 30 days?” In addition, 22% of respondents said a supplier had notified them that deliveries would be late or cancelled.

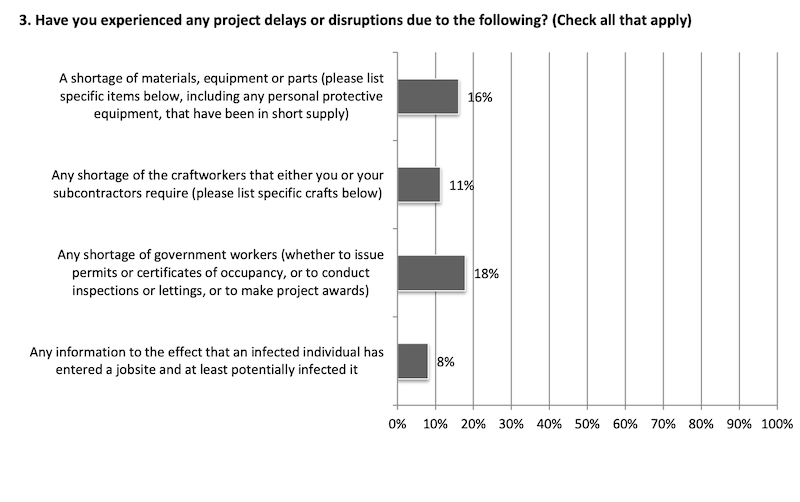

Contractors listed numerous types of delays and shortages. Nearly one out of five (18%) cited shortages of required government actions or personnel, for instance to issue permits or certificates of occupancy, conduct inspections or lettings, or make project awards. Sixteen percent noted a shortage of materials, parts or equipment, including workers’ personal protective equipment such as respirators. Eleven percent reported a shortage of craft workers as individuals self-quarantine or stay home to care for others.

Underscoring how rapidly market conditions have changed, the association also released data on construction employment changes between January 2019 and January 2020 in 358 metro areas that showed how strong the market was two months ago. A majority—200 areas (56%)—added construction jobs, while 95 areas lost jobs, and 63 metros had no change. Houston-The Woodlands-Sugar Land, Texas added the most construction jobs from January 2019 to January 2020 (12,400 jobs, 5%). The largest construction job decline occurred in Baton Rouge, La. (-6,500 jobs, -12%).

Association officials said the newly released Senate relief measure does too little to help the increasingly hard-hit construction industry. They noted that the tax and loan provisions in the measure will help offset declining demand. However, they urged Senate leaders to include new funding for infrastructure projects and to protect the retirements and health care of construction workers in multiemployer plans. They also called for additional fixes to measures enacted earlier this week that force employers to front the cost of newly mandated paid family and sick leave measures.

“The Senate proposal offers a good start to helping offset the sudden drop-off in work many contractors are experiencing,” said Stephen E. Sandherr, the association’s chief executive officer. “But without real investments in new infrastructure, compensation for contractors’ lost work and up-front funding for paid sick and family medical leave, it does too little to help the industry and its nearly eight million employees.”

Related Stories

Construction Costs | May 16, 2024

New download: BD+C's May 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Contractors | May 15, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of April 2024

Associated Builders and Contractors reported that its Construction Backlog Indicator increased to 8.4 months in April, according to an ABC member survey conducted April 22 to May 6. The reading is down 0.5 months from April 2023, but expanded 0.2 months from the prior month.

Healthcare Facilities | May 6, 2024

Hospital construction costs for 2024

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

Contractors | May 1, 2024

Nonresidential construction spending rises 0.2% in March 2024 to $1.19 trillion

National nonresidential construction spending increased 0.2% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.19 trillion.

AEC Tech | Apr 30, 2024

Lack of organizational readiness is biggest hurdle to artificial intelligence adoption

Managers of companies in the industrial sector, including construction, have bought the hype of artificial intelligence (AI) as a transformative technology, but their organizations are not ready to realize its promise, according to research from IFS, a global cloud enterprise software company. An IFS survey of 1,700 senior decision-makers found that 84% of executives anticipate massive organizational benefits from AI.

Hotel Facilities | Apr 24, 2024

The U.S. hotel construction market sees record highs in the first quarter of 2024

As seen in the Q1 2024 U.S. Hotel Construction Pipeline Trend Report from Lodging Econometrics (LE), at the end of the first quarter, there are 6,065 projects with 702,990 rooms in the pipeline. This new all-time high represents a 9% year-over-year (YOY) increase in projects and a 7% YOY increase in rooms compared to last year.

Construction Costs | Apr 18, 2024

New download: BD+C's April 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Market Data | Apr 16, 2024

The average U.S. contractor has 8.2 months worth of construction work in the pipeline, as of March 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 8.2 months in March from 8.1 months in February, according to an ABC member survey conducted March 20 to April 3. The reading is down 0.5 months from March 2023.

K-12 Schools | Apr 10, 2024

Surprise, surprise: Students excel in modernized K-12 school buildings

Too many of the nation’s school districts are having to make it work with less-than-ideal educational facilities. But at what cost to student performance and staff satisfaction?

Multifamily Housing | Apr 9, 2024

March reports record gains in multifamily rent growth in 20 months

Asking rents for multifamily units increased $8 during the month to $1,721; year-over-year growth grew 30 basis points to 0.9 percent—a normal seasonal growth pattern according to Yardi Matrix.