Two months ago, the town of Summerville, S.C., broke ground on a $19 million, 307,000-sf shell building (expandable to 923,000 sf) at the Charleston Trade Center, a 750-acre shipping complex with access to the Port of Charleston.

At the same time, the South Carolina Ports Authority has embarked on a $1.6 billion program that includes the construction of a $750 million terminal and $350 rail line at the old North Charleston Naval Base. The Ports Authority is also conducting engineering studies to enable dredging of the port to 52 feet from its current depth of 45 feet. The dredging, at a cost of $509 million, would make Charleston the deepest harbor on the East Coast.

BD+C MOVERS AND SHAPERS

The People, Institutions, and Movements that are influencing design and construction in the U.S. and around the world.

Dan Gilbert – Detroit's Catalytic Converter

Judith Rodin – Crusader for Resiliency

Bruce Katz – Urban Evangelist

Millennials – The Disruptors

Alloy LLC – Vertical Integrator

Jerry Yudelson – Green Giant

The PANAMAX Effect – The New Panama Canal

Theaster Gates – Real Estate Artist

Activity of this kind is occurring up and down the Eastern seaboard and Gulf Coast in anticipation of the opening of the expanded Panama Canal on June 26, the first expansion of the waterway since the canal became operational in 1914. The $5.25 billion construction program added a third set of locks and widened and deepened Gatun Lake, various access channels, and the channel that cuts between Panama’s mountains.

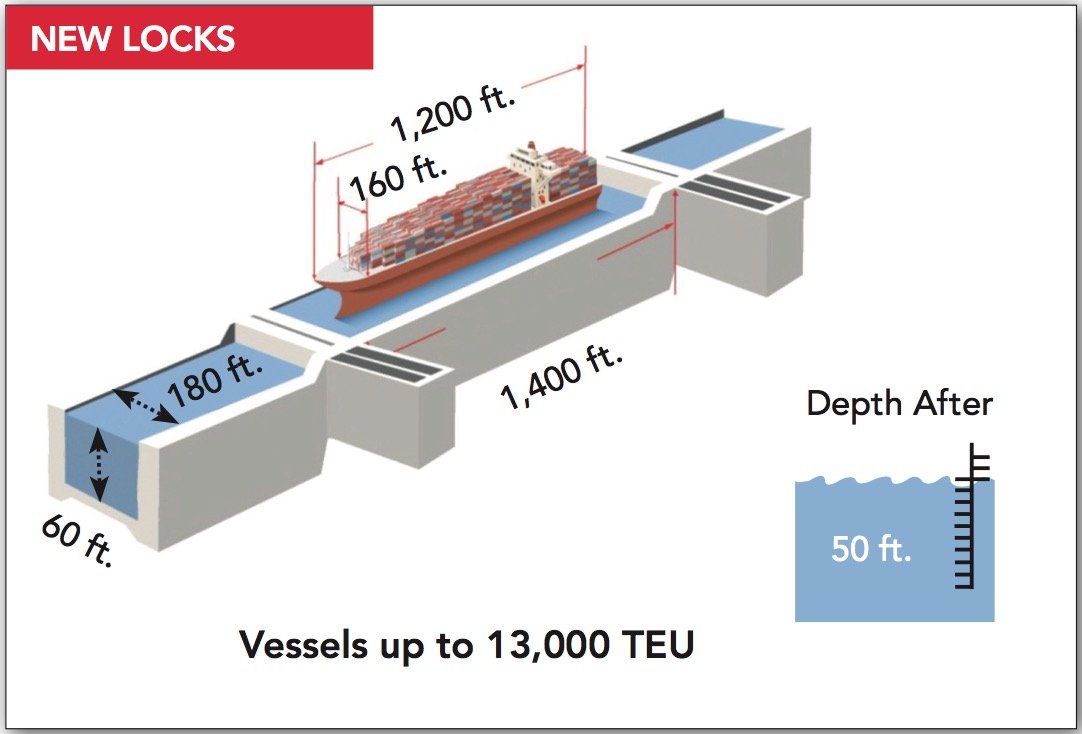

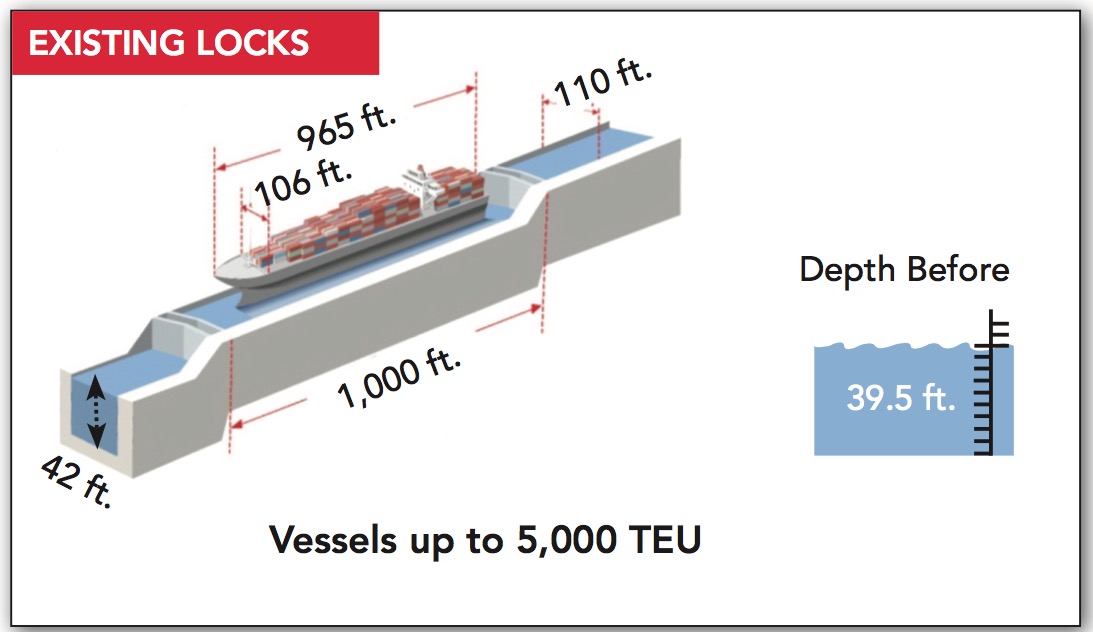

Currently, only ships with cargo no greater than 5,000 TEU (the equivalent of a 20-foot container) can traverse the Panama Canal. The expansion will be able to handle ships up to around 13,000-TEU capacity. The Panama Canal Authority estimates that allowing 12 to 14 larger vessels per day to pass through the new locks would double the canal’s annual activity to 600 million tons of cargo.

Panama Canal traffic flow has been rising in recent years. Last year, a record 340.8 million cargo tons made the 48-mile passage through the channel. The Panama Canal Authority projects that figure to rise to 360 million tons in 2017. But with 56% of the new cargo vessels on order being built to larger-capacity “post-Panamax” standards, expanding the canal became a competitive necessity.

As more traffic starts moving through the canal, U.S. ports that are already congested will have to find ways to become more efficient. In its “2016-2020 Port Planned Infrastructure and Investment Survey,” the American Association of Port Authorities reported that its members and their private-sector partners would spend nearly $155 billion on port-related freight and passenger infrastructure improvements over the next five years. Five years ago, the AAPA survey found that only $46 billion in spending was anticipated.

Whether the canal expansion will shift cargo traffic to East Coast and Gulf Coast ports is an open question. But a report by Boston Consulting Group and the supply-chain provider C.H. Robinson estimates that, by 2020, as much as 10% of container traffic arriving from East Asia could shift from western ports to their eastern rivals.

Where container ships dock often depends on the preferences of vessel operators, some of which own terminals at ports, says Steve Fitzroy, Executive Vice President with the Economic Development Research Group. He is one of the coauthors of a study on the impact of the Panama Canal expansion on ports and cities for the U.S. Maritime Administration.

Several East Coast and Gulf Coast ports are positioning themselves to be the destination of choice for larger vessels. Most new spending—in Charleston, Fort Lauderdale, Miami, New Orleans, and Savannah—revolves around dredging, infrastructure upgrades, and improvements in connections with rail and transit facilities.

In April, the Port Authority of New York and New Jersey weighed in with an RFP for a 30-year master plan for its water port system, the country’s third largest. The goal: to surpass the ports of Los Angeles and Long Beach in cargo volume.

The Port Authority is already spending $5 billion to raise the height of the 5,780-foot-long Bayonne Bridge, which connects Bayonne, N.J., to Staten Island, N.Y., to 215 feet, from the current 151 feet, to accommodate taller vessels. The Port Authority is also making improvements to the port’s water- and landside connections. “On-dock rail and automation are going to separate the men from the boys,” predicts Fitzroy.

Larger cargo vessels will be able to traverse the expanded Panama Canal, which is likely

Larger cargo vessels will be able to traverse the expanded Panama Canal, which is likely

to open up more trade opportunities for Eastern Seaboard and Gulf Coast ports. Click to enlarge.

MORE LANDSIDE DEVELOPMENT?

Will greater cargo volumes at East Coast and Gulf of Mexico ports lead to a spurt in nonresidential development and construction for surrounding communities? It’s probably going to be some time before post-Panamax vessels will be dropping anchor at eastern and southern U.S. ports. Real estate developers likely will wait and see which ones attract the most activity before investing in new construction. But ever since the Mayflower bumped into Plymouth Rock, ports have fed local economies.

Consider Houston’s harbor. Robert Kramp, CBRE’s Director of Research and Analysis, says more than 1.18 million jobs and $265 million in annual economic activity in Texas can be attributed to the port of Houston. Stepped-up port activity from the Panama Canal expansion could have “an echoing effect” on commercial real estate (notably retail and multifamily housing) and on healthcare, government, and education, says Kramp.

STIRRING THE WATERS

Western ports are preparing for growth, too, as BD+C's John Caulfield reports.

Law firms, insurance companies, trucking services, and others in the supply chain also may wish to locate near ports.

The industrial sector could be the earliest beneficiary of stepped-up port traffic. Kramp notes that, over the past five years, developers have built 382.2 million sf of warehouse space in the U.S., largely to handle the explosive demand in shipping products from ecommerce. Much of the newer warehouse construction has been in markets like Atlanta, Chicago, Cincinnati, Columbus, Memphis, and Kansas City that are nowhere near deep-water ports and rely primarily via rail.

Many of the products purchased online come from manufacturers in China and elsewhere in the Far East. The net result, says Kramp, is that “the expanded Panama Canal is mostly going to be used to get these goods to local business and customer markets faster, cheaper, and easier than ever before.”

Ships carrying the equivalent of 13,000 containers, up from 5,000, will pass through the canal.

Ships carrying the equivalent of 13,000 containers, up from 5,000, will pass through the canal.

Editor's Note: After this story was posted, the New York Times published an extensive investigative article [www.nytimes.com/interactive/2016/06/22/world/americas/panama-canal.html] that raised questions about the Canal expansion's capacity to actually handle Panamax-size vessels. Among the problems the Times cited include design and construction flaws and defects, dredging depth and lock width, and the availability of water.

Related Stories

Laboratories | Apr 12, 2024

Life science construction completions will peak this year, then drop off substantially

There will be a record amount of construction completions in the U.S. life science market in 2024, followed by a dramatic drop in 2025, according to CBRE. In 2024, 21.3 million sf of life science space will be completed in the 13 largest U.S. markets. That’s up from 13.9 million sf last year and 5.6 million sf in 2022.

Industrial Facilities | Apr 9, 2024

Confessions of a cold storage architect

Designing energy-efficient cold storage facilities that keep food safe and look beautiful takes special knowledge.

Data Centers | Feb 28, 2024

What’s next for data center design in 2024

Nuclear power, direct-to-chip liquid cooling, and data centers as learning destinations are among the emerging design trends in the data center sector, according to Scott Hays, Sector Leader, Sustainable Design, with HED.

Designers | Feb 23, 2024

Coverings releases top 2024 tile trends

In celebration of National Tile Day, Coverings, North America's leading tile and stone exhibition, has announced the top 10 tile trends for 2024.

MFPRO+ News | Feb 15, 2024

UL Solutions launches indoor environmental quality verification designation for building construction projects

UL Solutions recently launched UL Verified Healthy Building Mark for New Construction, an indoor environmental quality verification designation for building construction projects.

Industrial Facilities | Jan 29, 2024

How big-ticket, government-funded investments in industrial developments are affecting private construction companies

Large sums of money remain in bank accounts for government-funded programs like the CHIPS Act, the Infrastructure Investment and Jobs Act, and the Inflation Reduction Act. But with opportunities come challenges.

Self-Storage Facilities | Jan 25, 2024

One-quarter of self-storage renters are Millennials

Interest in self-storage has increased in over 75% of the top metros according to the latest StorageCafe survey of self-storage preferences. Today, Millennials make up 25% of all self-storage renters.

Industry Research | Jan 23, 2024

Leading economists forecast 4% growth in construction spending for nonresidential buildings in 2024

Spending on nonresidential buildings will see a modest 4% increase in 2024, after increasing by more than 20% last year according to The American Institute of Architects’ latest Consensus Construction Forecast. The pace will slow to just over 1% growth in 2025, a marked difference from the strong performance in 2023.

Industrial Facilities | Nov 14, 2023

Some AEC firms are plugging into EV charging market

Decentralized electrical distribution is broadening recharger installation to several building types.

Industrial Facilities | Nov 1, 2023

A new concept for multistory warehouses focuses on efficiency

Ware Malcomb’s design idea suggests drone delivery, automated stacked packing, and a sustainable building.