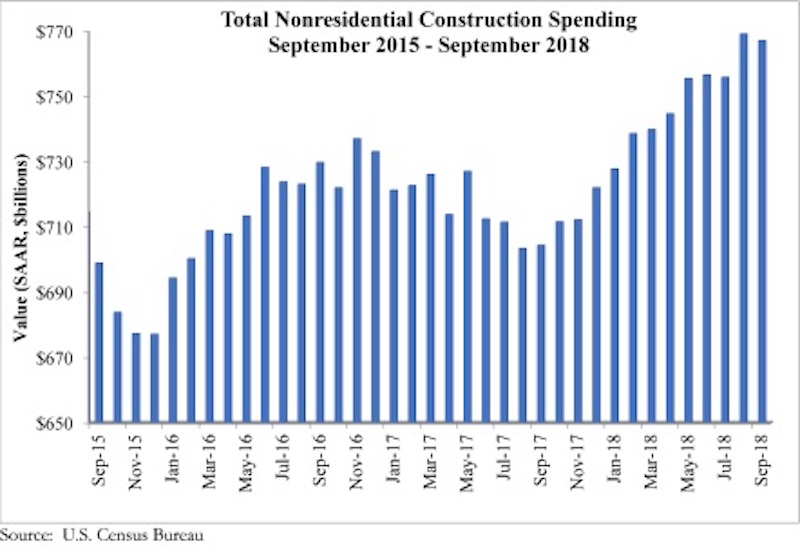

National nonresidential construction spending fell 0.3% in September but remains historically elevated, according to an Associated Builders and Contractors analysis of U.S. Census Bureau data released today. Total nonresidential spending stood at $767.1 billion on a seasonally adjusted, annualized rate in September, an increase of 8.9% on a year-ago basis.

Note that August’s estimate was revised almost a full percent higher from $762.7 billion to $769.1 billion, the highest level in the history of the series. Private nonresidential spending increased 0.1% in September while public nonresidential spending decreased 0.8% for the month.

“Virtually no weight should be placed upon the monthly decline in nonresidential construction spending that occurred in September,” said ABC Chief Economist Anirban Basu. “Rather, we should focus on the massive upward revision to August’s spending data. That revision finally aligns construction spending data with statistics on backlog, employment and other indicators of robust nonresidential construction spending. On a year-over-year basis, nonresidential construction is up nearly 9%, an impressive performance by any standard.

“Unlike previous instances of rapid construction growth, this one is led by a neatly balanced combination of private and public spending growth,” said Basu. “Among the leading sources of spending growth over the past year are water supply, transportation, lodging and office construction. This is not only consistent with an economy that continues to perform splendidly along multiple dimensions, but also with significantly improved state and local government finances, which has helped to support greater levels of infrastructure spending.

“Given healthy backlog and indications that the economy will continue to manifest momentum into 2019, contractors can expect to remain busy,” said Basu. “The most substantial challenges will continue to be rising workforce and input costs. That said, there are indications of softening business investment, which could serve to weaken U.S. economic growth after what is setting up to be a strong first half of 2019.”

Related Stories

Codes and Standards | Oct 26, 2022

‘Landmark study’ offers key recommendations for design-build delivery

The ACEC Research Institute and the University of Colorado Boulder released what the White House called a “landmark study” on the design-build delivery method.

Building Team | Oct 26, 2022

The U.S. hotel construction pipeline shows positive growth year-over-year at Q3 2022 close

According to the third quarter Construction Pipeline Trend Report for the United States from Lodging Econometrics (LE), the U.S. construction pipeline stands at 5,317 projects/629,489 rooms, up 10% by projects and 6% rooms Year-Over-Year (YOY).

Designers | Oct 19, 2022

Architecture Billings Index moderates but remains healthy

For the twentieth consecutive month architecture firms reported increasing demand for design services in September, according to a new report today from The American Institute of Architects (AIA).

Market Data | Oct 17, 2022

Calling all AEC professionals! BD+C editors need your expertise for our 2023 market forecast survey

The BD+C editorial team needs your help with an important research project. We are conducting research to understand the current state of the U.S. design and construction industry.

Market Data | Oct 14, 2022

ABC’s Construction Backlog Indicator Jumps in September; Contractor Confidence Remains Steady

Associated Builders and Contractors reports today that its Construction Backlog Indicator increased to 9.0 months in September, according to an ABC member survey conducted Sept. 20 to Oct. 5.

Market Data | Oct 12, 2022

ABC: Construction Input Prices Inched Down in September; Up 41% Since February 2020

Construction input prices dipped 0.1% in September compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Laboratories | Oct 5, 2022

Bigger is better for a maturing life sciences sector

CRB's latest report predicts more diversification and vertical integration in research and production.

Market Data | Aug 25, 2022

‘Disruptions’ will moderate construction spending through next year

JLL’s latest outlook predicts continued pricing volatility due to shortages in materials and labor

Market Data | Aug 2, 2022

Nonresidential construction spending falls 0.5% in June, says ABC

National nonresidential construction spending was down by 0.5% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Jul 28, 2022

The latest Beck Group report sees earlier project collaboration as one way out of the inflation/supply chain malaise

In the first six months of 2022, quarter-to-quarter inflation for construction materials showed signs of easing, but only slightly.