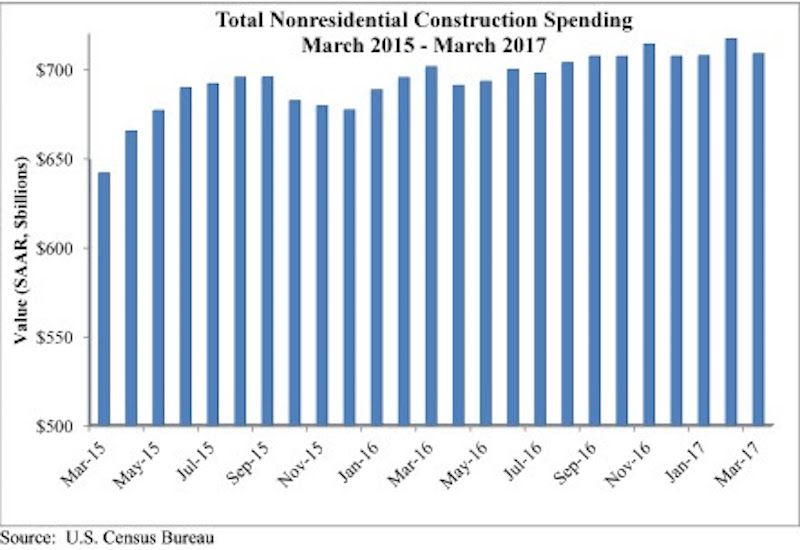

Nonresidential construction spending fell 1.2 percent in March, according to analysis of U.S. Census Bureau data recently released by Associated Builders and Contractors (ABC). Spending in the segment totaled $708.6 billion on a seasonally adjusted, annualized basis, however the decline is less dramatic than it may be perceived to be given that February’s initial estimate of $701.6 billion was upwardly revised to $717 billion, making it the highest level or spending recorded in the data series.

In March, private nonresidential construction spending fell 1.3 percent for the month, but remains up 6.4 percent on a year-ago basis. Public nonresidential spending decreased by 0.9 percent and is down 6.5 percent year over year. Were it not for the manufacturing subsector, where spending has contracted 9.7 percent from the same time last year, overall spending would have increased from February and set a new record high for construction spending.

“There are at least two tales to tell, and neither one of them is particularly uplifting,” said ABC Chief Economist Anirban Basu. “One narrative relates to public spending, which remains soft. Even categories in which one might have expected spending growth have not experienced an increase over past year. For instance, one might have anticipated stepped-up spending in the water supply category given the events in Flint, Mich. But spending in that category is down by roughly 14 percent over the past year. Similarly, one might have predicted spending increases in the highway and street category since the Fixing America’s Surface Transportation Act was passed in December 2015. However, spending in that category is down 2.4 percent on a year-over-year basis.

“Private construction spending has lost momentum as well, perhaps because developers and their financiers are becoming increasingly unnerved by the possibility of mini-bubbles in certain commercial real estate segments,” said Basu. “Many investors may also have adopted a wait-and-see attitude regarding policies coming out of Washington, D.C., including those related to proposed tax reform and infrastructure spending initiatives. Perhaps as a result, office and commercial-related construction spending declined in March. Still, other data suggest lingering momentum in various privately-financed segments, and data from the most recent GDP report indicate that investors continue to invest aggressively in structures. It is for this reason that today’s construction spending release is at least somewhat surprising with respect to private investment in structures. An upward revision to today’s data may be forthcoming.

“Looking ahead, all eyes are on Washington, D.C,” said Basu. “A pro-business agenda remains in the works, but little of it has been implemented thus far. Financial markets continue to express confidence regarding the ultimate execution of significant portions of this agenda, but if it remains bogged down politically, market confidence will wane and private construction spending will continue to be erratic.”

Related Stories

Market Data | Apr 11, 2023

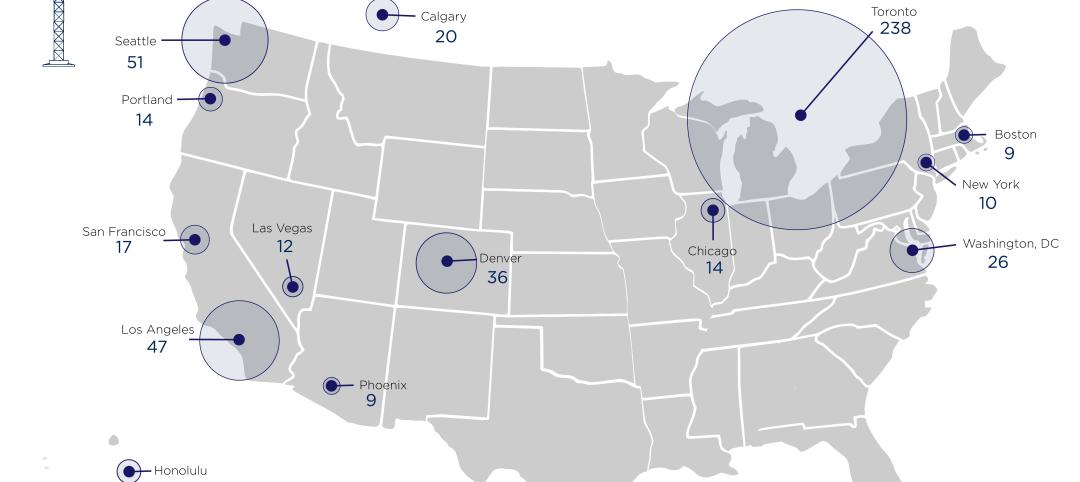

Construction crane count reaches all-time high in Q1 2023

Toronto, Seattle, Los Angeles, and Denver top the list of U.S/Canadian cities with the greatest number of fixed cranes on construction sites, according to Rider Levett Bucknall's RLB Crane Index for North America for Q1 2023.

Contractors | Apr 11, 2023

The average U.S. contractor has 8.7 months worth of construction work in the pipeline, as of March 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.7 months in March, according to an ABC member survey conducted March 20 to April 3. The reading is 0.4 months higher than in March 2022.

Market Data | Apr 6, 2023

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.

Market Data | Apr 4, 2023

Nonresidential construction spending up 0.4% in February 2023

National nonresidential construction spending increased 0.4% in February, according to an Associated Builders and Contractors analysis of data published by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $982.2 billion for the month, up 16.8% from the previous year.

Multifamily Housing | Mar 24, 2023

Average size of new apartments dropped sharply in 2022

The average size of new apartments in 2022 dropped sharply in 2022, as tracked by RentCafe. Across the U.S., the average new apartment size was 887 sf, down 30 sf from 2021, which was the largest year-over-year decrease.

Multifamily Housing | Mar 14, 2023

Multifamily housing rent rates remain flat in February 2023

Multifamily housing asking rents remained the same for a second straight month in February 2023, at a national average rate of $1,702, according to the new National Multifamily Report from Yardi Matrix. As the economy continues to adjust in the post-pandemic period, year-over-year growth continued its ongoing decline.

Contractors | Mar 14, 2023

The average U.S. contractor has 9.2 months worth of construction work in the pipeline, as of February 2023

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 9.2 months in February, according to an ABC member survey conducted Feb. 20 to March 6. The reading is 1.2 months higher than in February 2022.

Industry Research | Mar 9, 2023

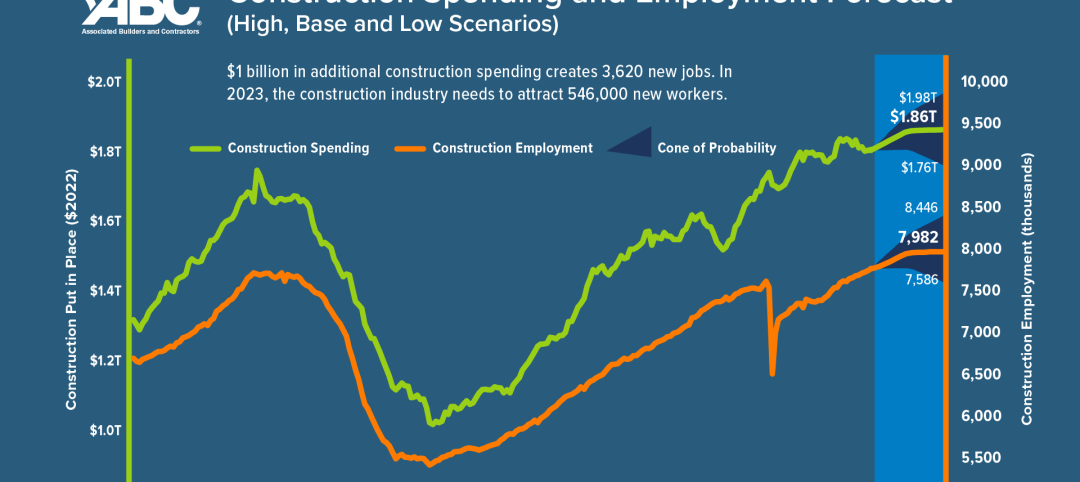

Construction labor gap worsens amid more funding for new infrastructure, commercial projects

The U.S. construction industry needs to attract an estimated 546,000 additional workers on top of the normal pace of hiring in 2023 to meet demand for labor, according to a model developed by Associated Builders and Contractors. The construction industry averaged more than 390,000 job openings per month in 2022.

Market Data | Mar 7, 2023

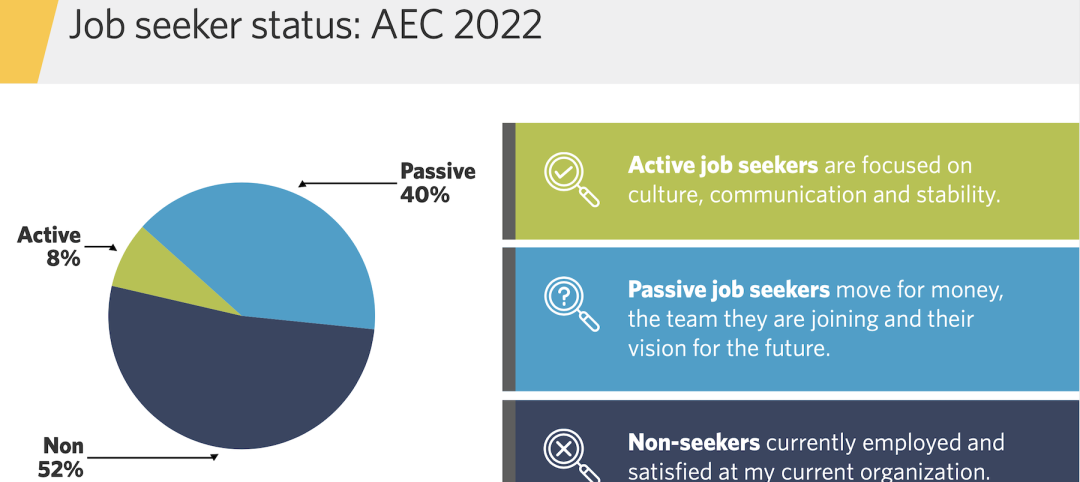

AEC employees are staying with firms that invest in their brand

Hinge Marketing’s latest survey explores workers’ reasons for leaving, and offers strategies to keep them in the fold.

Multifamily Housing | Feb 21, 2023

Multifamily housing investors favoring properties in the Sun Belt

Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix. Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever.