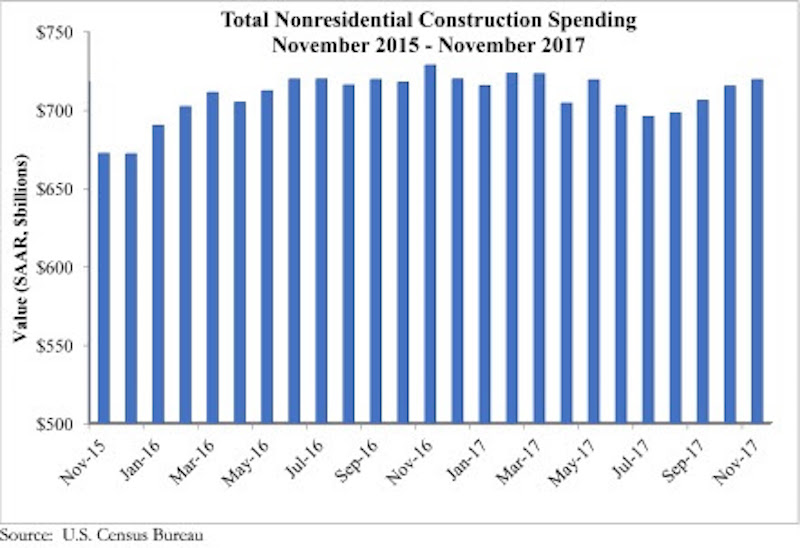

Nonresidential construction spending expanded 0.6 percent in November, totaling $719.2 billion on a seasonally adjusted basis, according to an Associated Builders and Contractors (ABC) analysis of data released today by the U.S. Census Bureau. Despite the month-over-month expansion, nonresidential spending fell 1.3 percent from November 2016.

Private nonresidential construction spending is down 3.1 percent year-over-year, while public sector spending has increased 1.7 percent over the same period. Spending in the manufacturing and power categories, two of the larger nonresidential subsectors, fell by a combined $21.7 billion over the past year.

“The November report represented a stark reversal of preexisting trends,” said ABC Chief Economist Anirban Basu. “For much of the past several years, the pattern in nonresidential construction spending has been one in which a number of private categories expanded briskly, including lodging and office, while a host of public construction categories experienced sluggish spending. That changed in November, with public construction spending rising and private construction spending shrinking on a year-over-year basis.

“There are several possible explanations, including growing concerns about overbuilding in a number of large metropolitan areas in the lodging, office and commercial categories,” said Basu. “Financiers may also be less willing to supply financing to a variety of private projects given such concerns. At the same time, the U.S. housing market is the strongest it has been in at least a decade, raising sales prices and expanding assessable residential tax bases. That in turn has supplied additional resources for infrastructure. Over the past year, this has been particularly apparent in the educational and public safety categories.”

Related Stories

Market Data | Jan 5, 2016

Majority of AEC firms saw growth in 2015, remain optimistic for 2016: BD+C survey

By all indications, 2015 was another solid year for U.S. architecture, engineering, and construction firms.

Market Data | Jan 5, 2016

Nonresidential construction spending falters in November

Only 4 of 16 subsectors showed gains

Market Data | Dec 15, 2015

AIA: Architecture Billings Index hits another bump

Business conditions show continued strength in South and West regions.

Market Data | Dec 7, 2015

2016 forecast: Continued growth expected for the construction industry

ABC forecasts growth in nonresidential construction spending of 7.4% in 2016 along with growth in employment and backlog.