Construction spending was a tale of two industries again in November, as soaring single-family construction masked ongoing downturns in private and public nonresidential construction, according to an analysis of new federal construction spending data by the Associated General Contractors of America. Association officials said the new figures underscore the need for new infrastructure investments and other measures to boost demand for nonresidential construction amid the pandemic.

“Private nonresidential construction declined for the fifth-straight month in November, while public nonresidential spending slipped for the fifth time in the past six months,” said Ken Simonson, the association’s chief economist. “Unfortunately, our latest survey finds contractors expect the volume of projects available to bid on in 2021 will be even more meager.”

Construction spending in November totaled $1.46 trillion at a seasonally adjusted annual rate, an increase of 0.9% from the pace in October and 3.8% higher than in November 2019. But the gains were limited to residential construction, which soared 2.6% for the month and 16.2% year-over-year. Meanwhile, private and public nonresidential spending slumped 0.6% from October and 4.7% from a year earlier.

Private nonresidential construction spending decreased for the fifth month in a row, sliding 0.8% from October to November and 9.5% from November 2019. The largest private nonresidential segment, power construction, declined 0.9% for the month. Among the other large private nonresidential project types, commercial construction—comprising retail, warehouse and farm structures—dipped 0.3% for the month, manufacturing construction inched up 0.1%, office construction gained 0.3%, and healthcare construction fell 1.4%.

Public construction spending declined 0.2% for the month but increased 3.1% year-over-year. There were decreases from October to November for most nonresidential categories, although the two largest segments rose: highway and street construction gained 1.8% for the month, while educational construction increased 0.3%.

Private residential construction spending increased for the sixth consecutive month, rising 2.7% in November. Single-family homebuilding jumped 5.1% for the month, while residential improvements spending ticked up 0.2%. Multifamily construction spending was flat.

Association officials said demand for most types of nonresidential construction was likely to remain down for much of the year. They added that they would have more insights on the state of the industry when the association and Sage release their annual Construction Hiring & Business Outlook on Thursday, January 7. In the meantime, they urged the incoming Congress to act quickly to boost investments in infrastructure and pass liability reforms to protect firms that employ necessary safety protocols to protect theirs workers and the public from meritless coronavirus lawsuits.

“Without additional measures to boost demand for nonresidential construction, this year is likely to be a challenging one for the industry,” said Stephen E. Sandherr, the association’s chief executive officer. “The impacts of the pandemic are clearly accumulating for many construction employers.”

Related Stories

Giants 400 | Sep 5, 2023

Top 80 Construction Management Firms for 2023

Alfa Tech, CBRE Group, Skyline Construction, Hill International, and JLL top the rankings of the nation's largest construction management (as agent) and program/project management firms for nonresidential buildings and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Sep 5, 2023

Top 150 Contractors for 2023

Turner Construction, STO Building Group, DPR Construction, Whiting-Turner Contracting Co., and Clark Group head the ranking of the nation's largest general contractors, CM at risk firms, and design-builders for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Market Data | Sep 5, 2023

Nonresidential construction spending increased 0.1% in July 2023

National nonresidential construction spending grew 0.1% in July, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.08 trillion and is up 16.5% year over year.

Giants 400 | Aug 31, 2023

Top 35 Engineering Architecture Firms for 2023

Jacobs, AECOM, Alfa Tech, Burns & McDonnell, and Ramboll top the rankings of the nation's largest engineering architecture (EA) firms for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

Top 115 Architecture Engineering Firms for 2023

Stantec, HDR, Page, HOK, and Arcadis North America top the rankings of the nation's largest architecture engineering (AE) firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

2023 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

A record 552 AEC firms submitted data for BD+C's 2023 Giants 400 Report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Aug 22, 2023

Top 175 Architecture Firms for 2023

Gensler, HKS, Perkins&Will, Corgan, and Perkins Eastman top the rankings of the nation's largest architecture firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Apartments | Aug 22, 2023

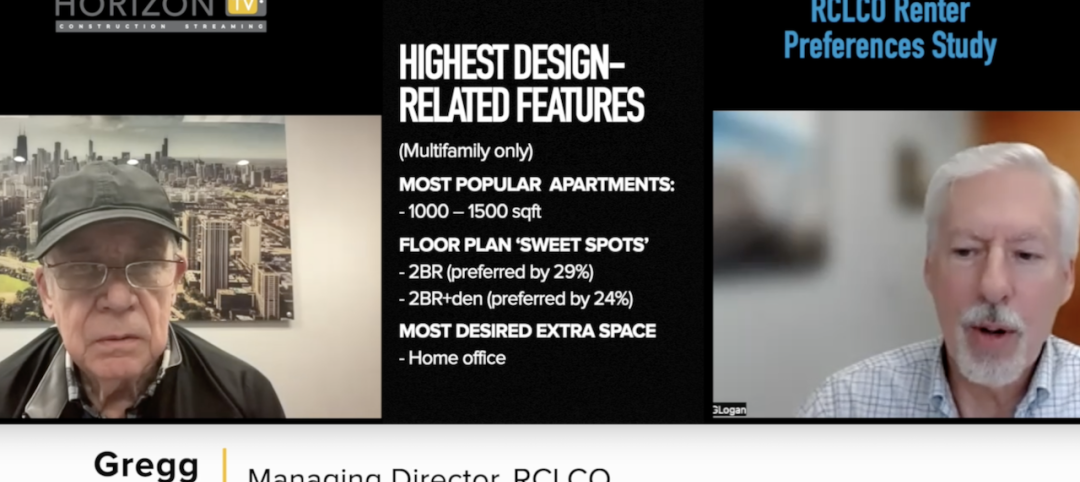

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

Market Data | Aug 18, 2023

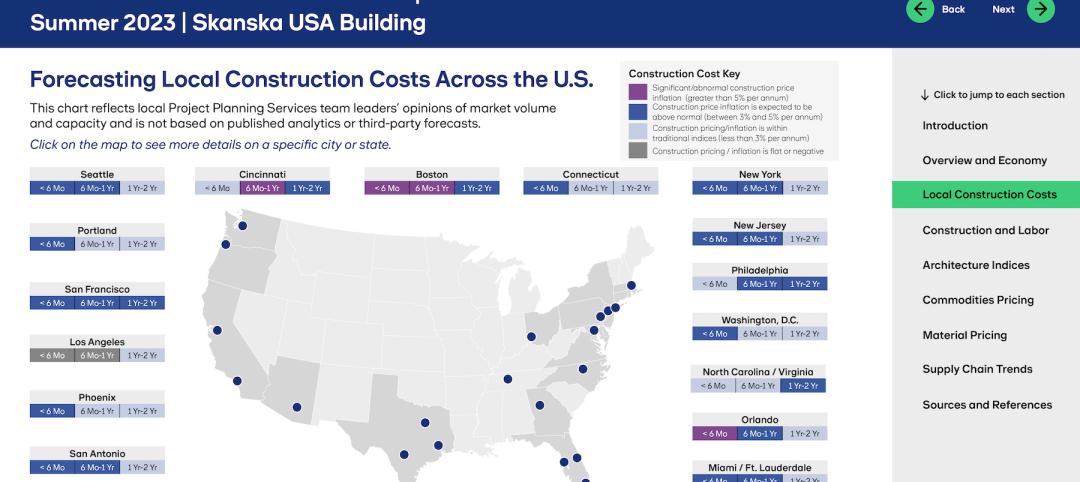

Construction soldiers on, despite rising materials and labor costs

Quarterly analyses from Skanska, Mortenson, and Gordian show nonresidential building still subject to materials and labor volatility, and regional disparities.

Apartments | Aug 14, 2023

Yardi Matrix updates near-term multifamily supply forecast

The multifamily housing supply could increase by up to nearly 7% by the end of 2023, states the latest Multifamily Supply Forecast from Yardi Matrix.