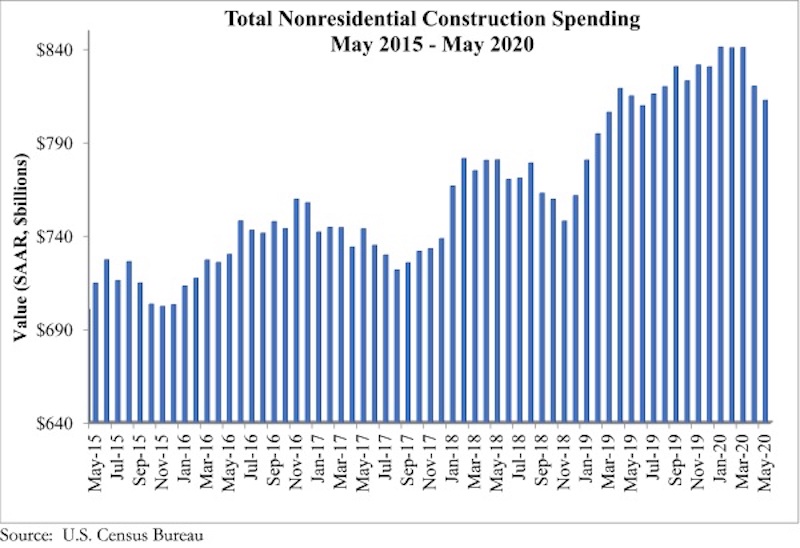

National nonresidential construction spending declined 0.9% in May, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, spending totaled $812.5 billion for the month. Private nonresidential spending declined 2.4% in May and public nonresidential construction spending increased 1.2%.

“Certain aspects of today’s data release are precisely what was anticipated, while other elements are rather surprising,” said ABC Chief Economist Anirban Basu. “For instance, the precipitous 5.3% decline in health care-related construction spending is hardly shocking, as many elective surgeries, dental appointments and wellness checkups were postponed, resulting in billions of dollars of losses among medical systems. In addition, many medical systems have experienced large-scale layoffs in an effort to preserve cash balances.

“Other segments negatively affected include lodging, manufacturing and power, which was expected,” said Basu. “A general lack of travel and occupancy has slowed hotel construction. A shrunken global economy and disrupted worldwide supply chains have pummeled industrial construction. And the energy sector has taken a hit from commodity prices that remain significantly lower than pre-crisis levels, truncating demand for new construction.

“What is surprising is the overall stability of construction spending,” said Basu. “In May, nonresidential construction spending declined by less than 1%, which represents a level of stability not enjoyed by much of the balance of the economy. Spending in a number of categories, mostly public, was higher for the month, including highway/street, public safety, transportation and water supply. Moreover, certain construction segments may experience rapid recovery going forward, including health care, manufacturing and power. For now, construction spending data and ABC’s Construction Backlog Indicator, which stood at 7.9 months in May, show that the industry has managed to remain a bulwark of relative stability in the face of ongoing pandemic-induced economic dislocations.”

Related Stories

Market Data | Sep 5, 2023

Nonresidential construction spending increased 0.1% in July 2023

National nonresidential construction spending grew 0.1% in July, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.08 trillion and is up 16.5% year over year.

Giants 400 | Aug 31, 2023

Top 35 Engineering Architecture Firms for 2023

Jacobs, AECOM, Alfa Tech, Burns & McDonnell, and Ramboll top the rankings of the nation's largest engineering architecture (EA) firms for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

Top 115 Architecture Engineering Firms for 2023

Stantec, HDR, Page, HOK, and Arcadis North America top the rankings of the nation's largest architecture engineering (AE) firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

2023 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

A record 552 AEC firms submitted data for BD+C's 2023 Giants 400 Report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Aug 22, 2023

Top 175 Architecture Firms for 2023

Gensler, HKS, Perkins&Will, Corgan, and Perkins Eastman top the rankings of the nation's largest architecture firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Apartments | Aug 22, 2023

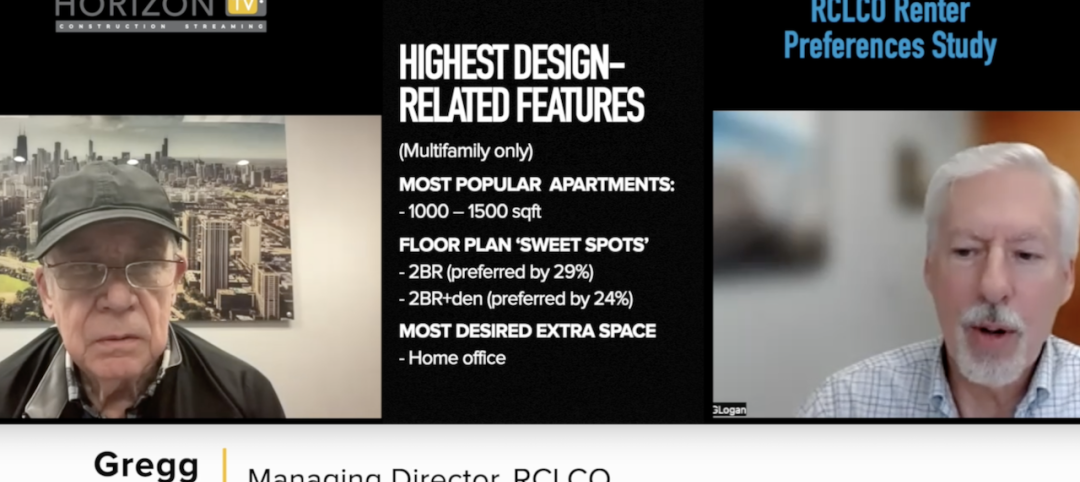

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

Market Data | Aug 18, 2023

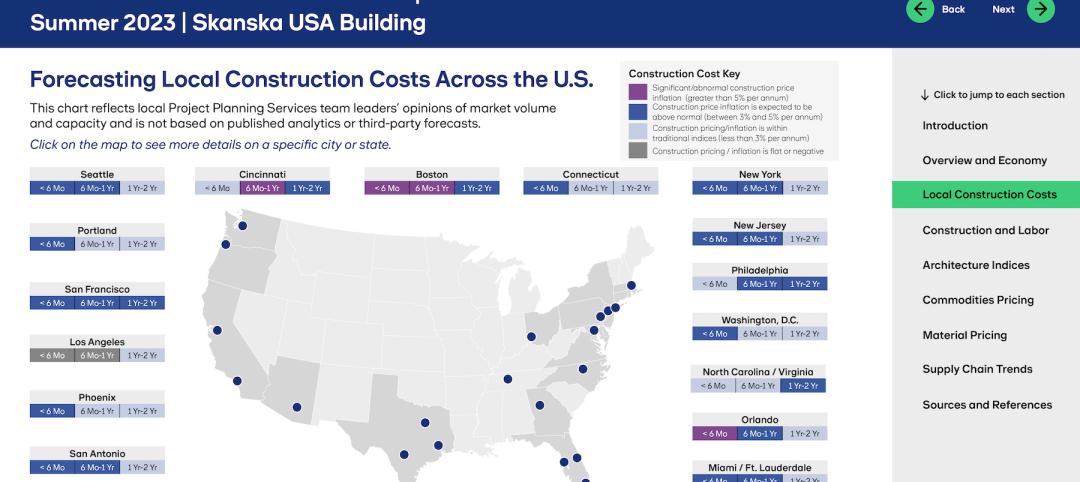

Construction soldiers on, despite rising materials and labor costs

Quarterly analyses from Skanska, Mortenson, and Gordian show nonresidential building still subject to materials and labor volatility, and regional disparities.

Apartments | Aug 14, 2023

Yardi Matrix updates near-term multifamily supply forecast

The multifamily housing supply could increase by up to nearly 7% by the end of 2023, states the latest Multifamily Supply Forecast from Yardi Matrix.

Hotel Facilities | Aug 2, 2023

Top 5 markets for hotel construction

According to the United States Construction Pipeline Trend Report by Lodging Econometrics (LE) for Q2 2023, the five markets with the largest hotel construction pipelines are Dallas with a record-high 184 projects/21,501 rooms, Atlanta with 141 projects/17,993 rooms, Phoenix with 119 projects/16,107 rooms, Nashville with 116 projects/15,346 rooms, and Los Angeles with 112 projects/17,797 rooms.

Market Data | Aug 1, 2023

Nonresidential construction spending increases slightly in June

National nonresidential construction spending increased 0.1% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. Spending is up 18% over the past 12 months. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.07 trillion in June.