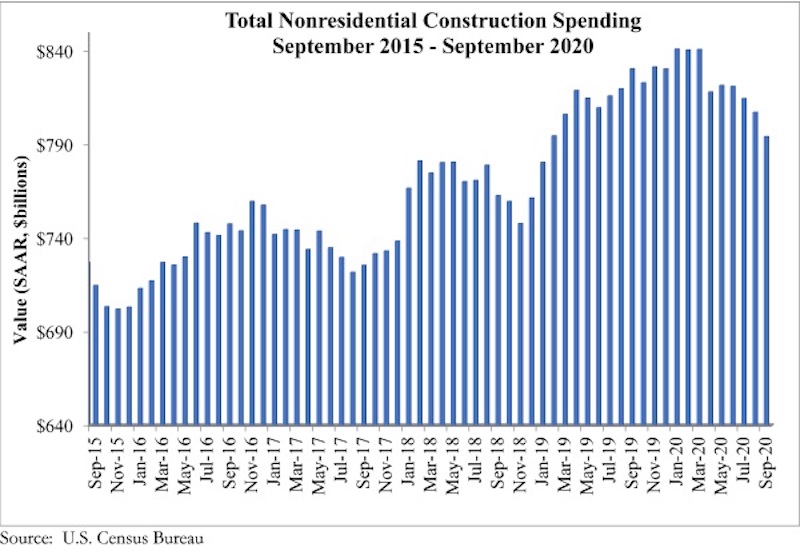

National nonresidential construction spending fell 1.6% in September, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, monthly spending totaled $794.3 billion.

Among the sixteen nonresidential subcategories, thirteen were down on a monthly basis. Private nonresidential spending declined 1.5% in September, while public nonresidential construction spending was down 1.7%.

“The pace is of decline in nonresidential construction spending is accelerating,” said ABC Chief Economist Anirban Basu. “This is precisely what had been predicted. Coming into the crisis, the economy was rolling, helping to lift construction backlog amid elevated developer confidence, according to ABC’s Construction Backlog Indicator and Construction Confidence Index. The crisis shattered that equilibrium, producing distressed commercial real estate fundamentals, diminished confidence, postponed and cancelled projects, the embrace of remote work, tighter credit conditions and damaged state and local government finances.

“Though the initial phase of economic recovery has been brisk, economic outcomes are likely to deteriorate markedly during the months ahead absent further stimulus,” said Basu. “That would further delay nonresidential construction’s eventual recovery. Nonresidential construction spending is down 4.4% from the same time last year, with lodging-related spending down more than 15% and office-related spending down nearly 7%. These are among the segments hardest hit by social distancing directives, and another round of shutdowns would further exacerbate declines in these and other segments.

“The hope is that policymakers in Washington, D.C., will soon see fit to deliver on a long-awaited infrastructure financing and spending program,” said Basu. “Not only would that accelerate the broader economy’s economic recovery, a well-executed infrastructure package would make American workers more productive, unleash new private development opportunities and allow America to better compete in the global marketplace. The longer America has to wait for such a package, however, the more vulnerable its citizens will be to further economic dislocations.”

Related Stories

Hotel Facilities | Jan 13, 2016

Hotel construction should remain strong through 2017

More than 100,000 rooms could be delivered this year alone.

Market Data | Jan 6, 2016

Census Bureau revises 10 years’ worth of construction spending figures

The largest revisions came in the last two years and were largely upward.

Market Data | Jan 5, 2016

Majority of AEC firms saw growth in 2015, remain optimistic for 2016: BD+C survey

By all indications, 2015 was another solid year for U.S. architecture, engineering, and construction firms.

Market Data | Jan 5, 2016

Nonresidential construction spending falters in November

Only 4 of 16 subsectors showed gains

Market Data | Dec 15, 2015

AIA: Architecture Billings Index hits another bump

Business conditions show continued strength in South and West regions.

Market Data | Dec 7, 2015

2016 forecast: Continued growth expected for the construction industry

ABC forecasts growth in nonresidential construction spending of 7.4% in 2016 along with growth in employment and backlog.