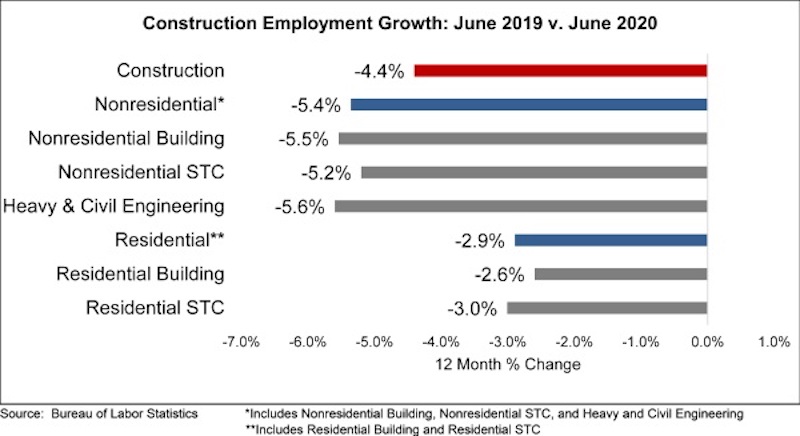

The construction industry added 158,000 jobs on net in June, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Labor Statistics. During the last two months, the industry has added 591,000 jobs, recovering 56% of the industrywide jobs lost since the start of the pandemic.

Nonresidential construction employment added 74,700 jobs on net in June. There was positive job growth in two of the three nonresidential segments, with the largest increase in nonresidential specialty trade contractors, which added 71,300 jobs. Employment in the nonresidential building segment increased by 13,100 jobs, while heavy and civil engineering lost 9,700 jobs.

The construction unemployment rate was 10.1% in June, up 6.1 percentage points from the same time last year but down from 12.7% in May and 16.6% in April. Unemployment across all industries dropped from 13.3% in May to 11.1% in June.

“Since the pandemic devastated the economy, most economists have been predicting a V-shaped recovery,” said ABC Chief Economist Anirban Basu. “To date, this has proven correct. While recovery is likely to become more erratic during the months ahead due to a number of factors, including the reemergence of rapid COVID-19 spread, recent employment, unemployment, residential building permits and retail sales data all highlight the potential of the U.S. economy to experience a rapid rebound in economic activity as 2021 approaches. ABC’s Construction Backlog Indicator rose to 7.9 months in May, an increase of less than 0.1 months from April’s reading, and its Construction Confidence Indicator continued to rebound from the historically low levels observed in the March survey.

“However, even if the broader U.S. economy continues to rebound in 2020, construction is less likely to experience a smooth recovery,” said Basu. “The recession, while brief, wreaked havoc on the economic fundamentals of a number of key segments of the construction market, including office, retail and hotel construction. Moreover, state and local government finances have become increasingly fragile, putting both operational and capital spending at risk.

“After this initial period of recovery in U.S. nonresidential construction, there are likely to be periods of slower growth or even contraction,” said Basu. “Nonresidential construction activity tends to lag the broader economy by 12-18 months, and this suggests that there will be some shaky industry performance in 2021 and perhaps beyond.”

Related Stories

Reconstruction & Renovation | Mar 28, 2022

Is your firm a reconstruction sector giant?

Is your firm active in the U.S. building reconstruction, renovation, historic preservation, and adaptive reuse markets? We invite you to participate in BD+C's inaugural Reconstruction Market Research Report.

Industry Research | Mar 28, 2022

ABC Construction Backlog Indicator unchanged in February

Associated Builders and Contractors reported today that its Construction Backlog Indicator remained unchanged at 8.0 months in February, according to an ABC member survey conducted Feb. 21 to March 8.

Industry Research | Mar 23, 2022

Architecture Billings Index (ABI) shows the demand for design service continues to grow

Demand for design services in February grew slightly since January, according to a new report today from The American Institute of Architects (AIA).

Codes and Standards | Mar 1, 2022

Engineering Business Sentiment study finds optimism despite growing economic concerns

The ACEC Research Institute found widespread optimism among engineering firm executives in its second quarterly Engineering Business Sentiment study.

Codes and Standards | Feb 24, 2022

Most owners adapting digital workflows on projects

Owners are more deeply engaged with digital workflows than other project team members, according to a new report released by Trimble and Dodge Data & Analytics.

Market Data | Feb 23, 2022

2022 Architecture Billings Index indicates growth

The Architectural Billings Index measures the general sentiment of U.S. architecture firms about the health of the construction market by measuring 1) design billings and 2) design contracts. Any score above 50 means that, among the architecture firms surveyed, more firms than not reported seeing increases in design work vs. the previous month.

Market Data | Feb 15, 2022

Materials prices soar 20% between January 2021 and January 2022

Contractors' bid prices accelerate but continue to lag cost increases.

Market Data | Feb 4, 2022

Construction employment dips in January despite record rise in wages, falling unemployment

The quest for workers intensifies among industries.

Market Data | Feb 2, 2022

Majority of metro areas added construction jobs in 2021

Soaring job openings indicate that labor shortages are only getting worse.

Market Data | Feb 2, 2022

Construction spending increased in December for the month and the year

Nonresidential and public construction lagged residential sector.