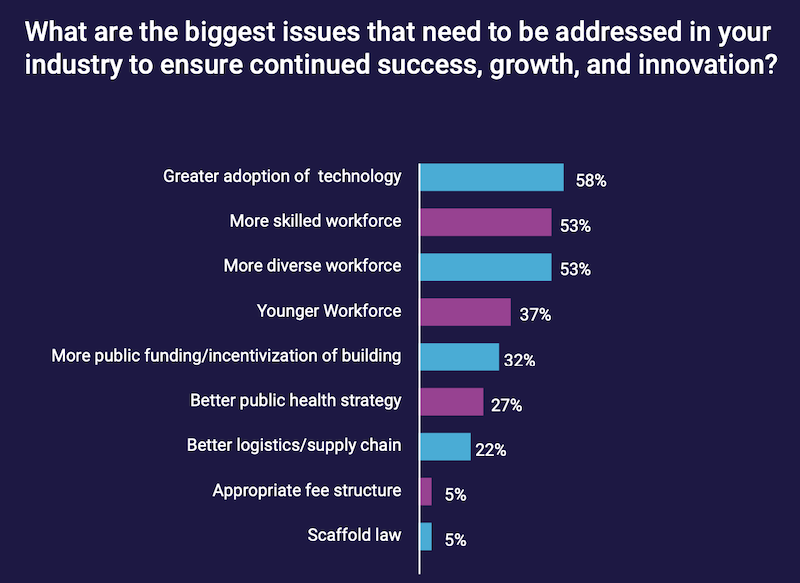

Modernization that leans heavier on technology to attract a younger, diverse, and skilled workforce is likely to determine the future success and growth of New York’s construction industry.

That is one of the key takeaways from a “State of the Construction Industry” survey of 20 New York metro-area AEC firms that the accounting consultancy Anchin, Block & Anchin conducted last November, and whose results it released earlier this month.

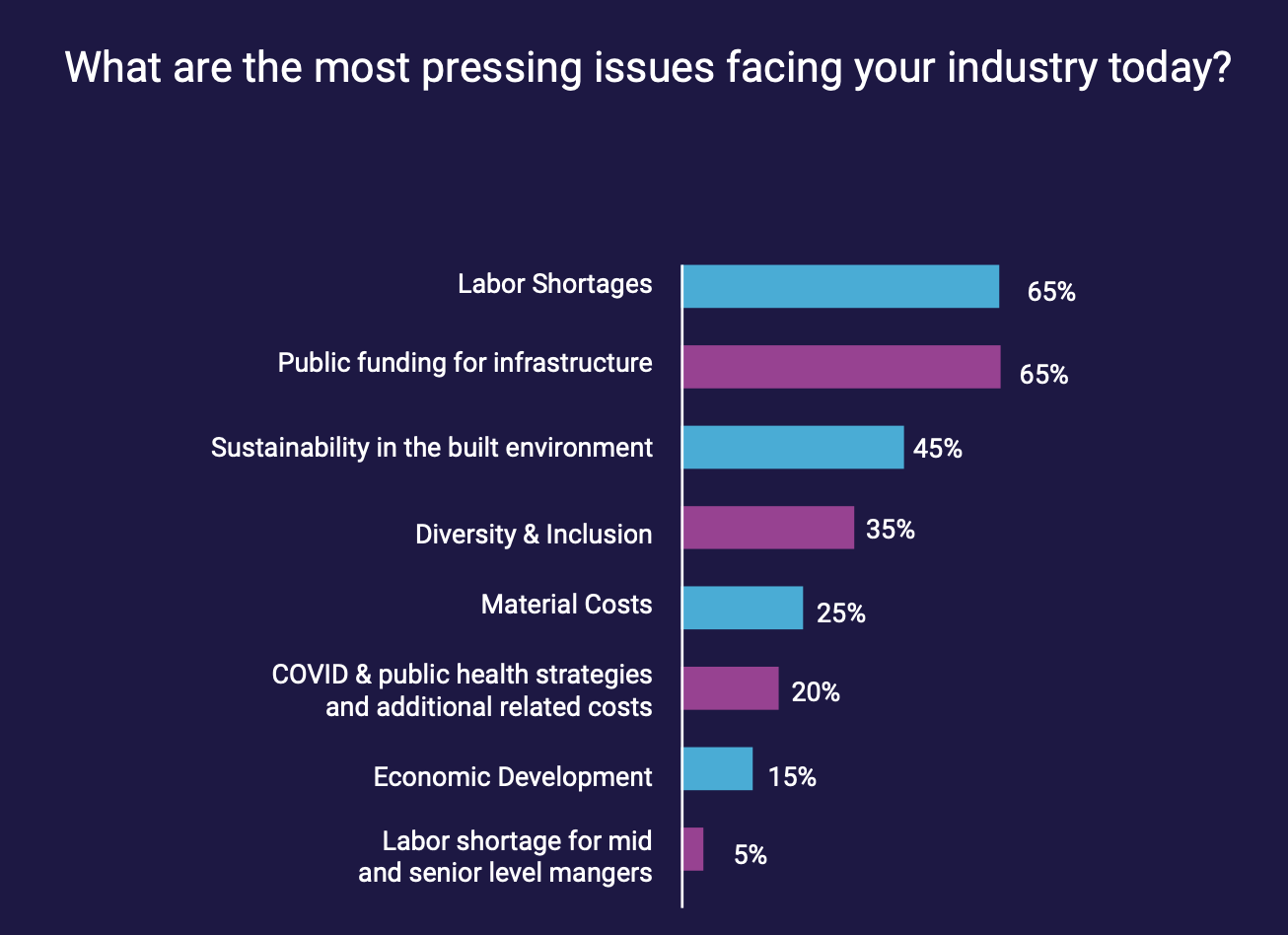

The report found a New York market that is at once resilient and facing “unprecedented challenges.” Its “most pressing” issues, as stated by nearly two-thirds of the firms polled, are labor shortages and public funding for infrastructure projects. Retaining talent is critical to these companies, and has led AEC firms toward greater flexibility about allowing remote or hybrid work, and increasing worker salaries. Thirty percent of the firms polled are focusing on management training and career development.

LIFE SCIENCES AND INDUSTRIAL SEEN AS GROWTH SECTORS

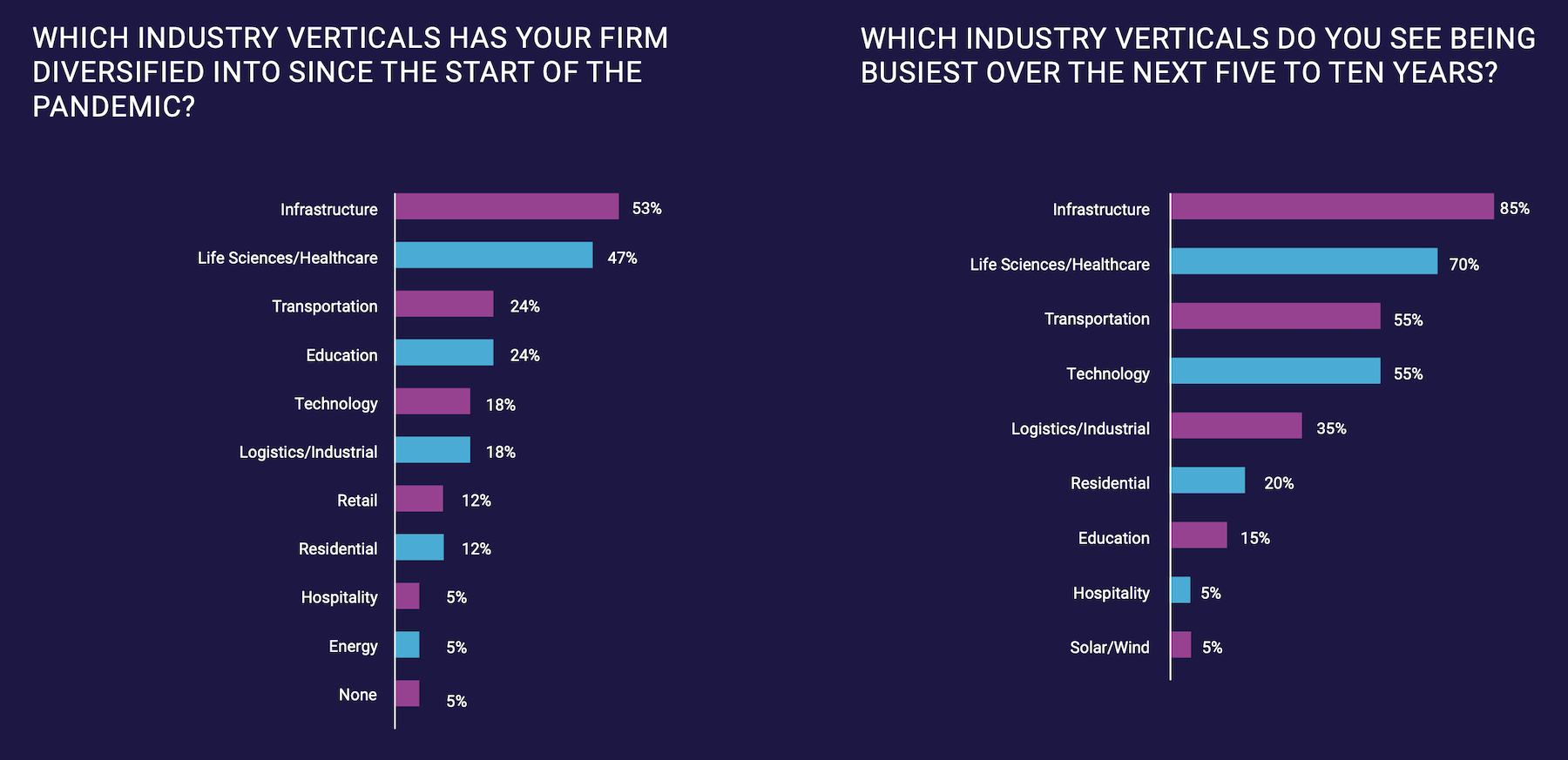

Since the coronavirus pandemic was declared in March 2020, more than half of the firms surveyed have diversified into the infrastructure sector, no doubt in anticipation of the $1.2 trillion federal infrastructure bill that President Biden signed into law last November. Eighty-five percent of the AEC firms polled expect infrastructure to be their market’s “busiest” sector over the next five to 10 years, followed by the life sciences/healthcare sector (into which nearly half of the firms polled diversified over the past 18 months}.

The survey’s authors also point to the industrial sector’s “growing momentum” as an in-demand asset driven by e-commerce.

However, AEC firms lamented the pressures being exerted on their companies’ cashflows from, most prominently, slower client payments, labor and materials cost inflation, insurance costs, and project delays.

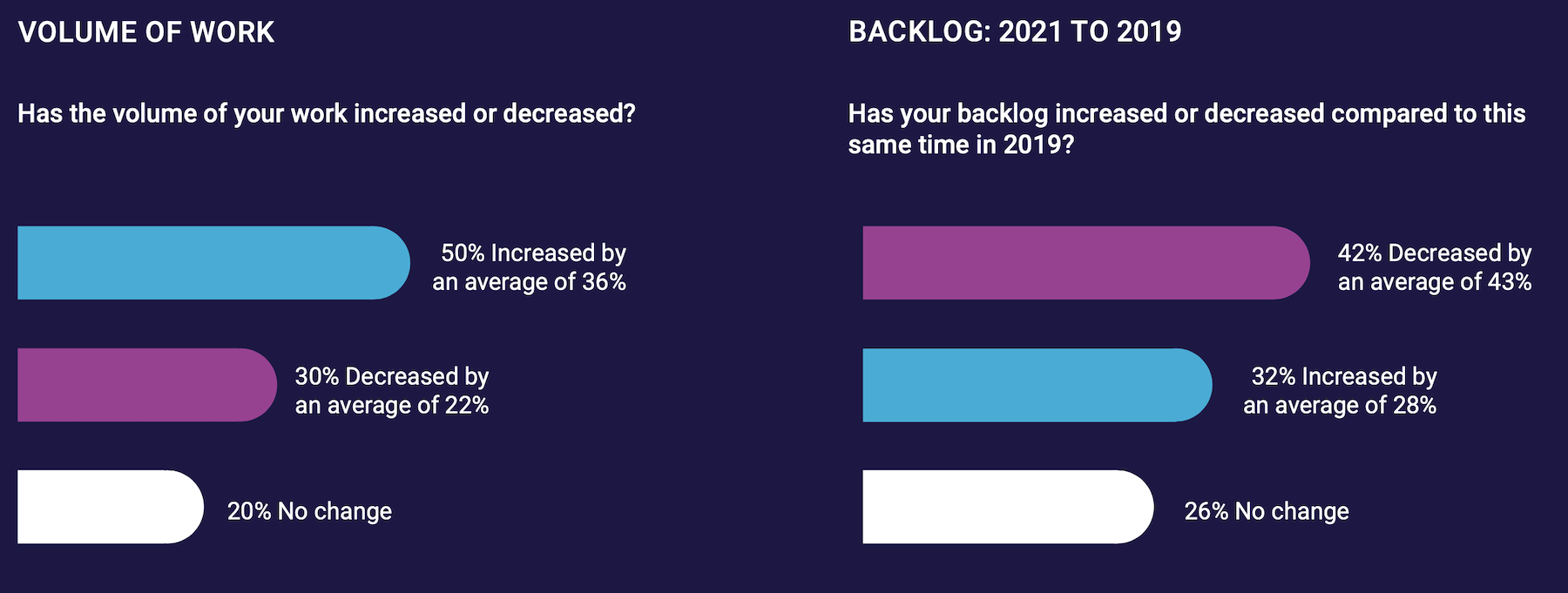

Half of the survey’s respondents said that their volume of work has increased during the pandemic, by an average of 36 percent. But 30 percent reported decreases in their companies’ work volumes, by an average of 22 percent. And 42 percent of those polled said their backlogs were down from 2019, by an average of 43 percent.

RESILIENCE AND SUSTAINABILITY ARE CENTRAL

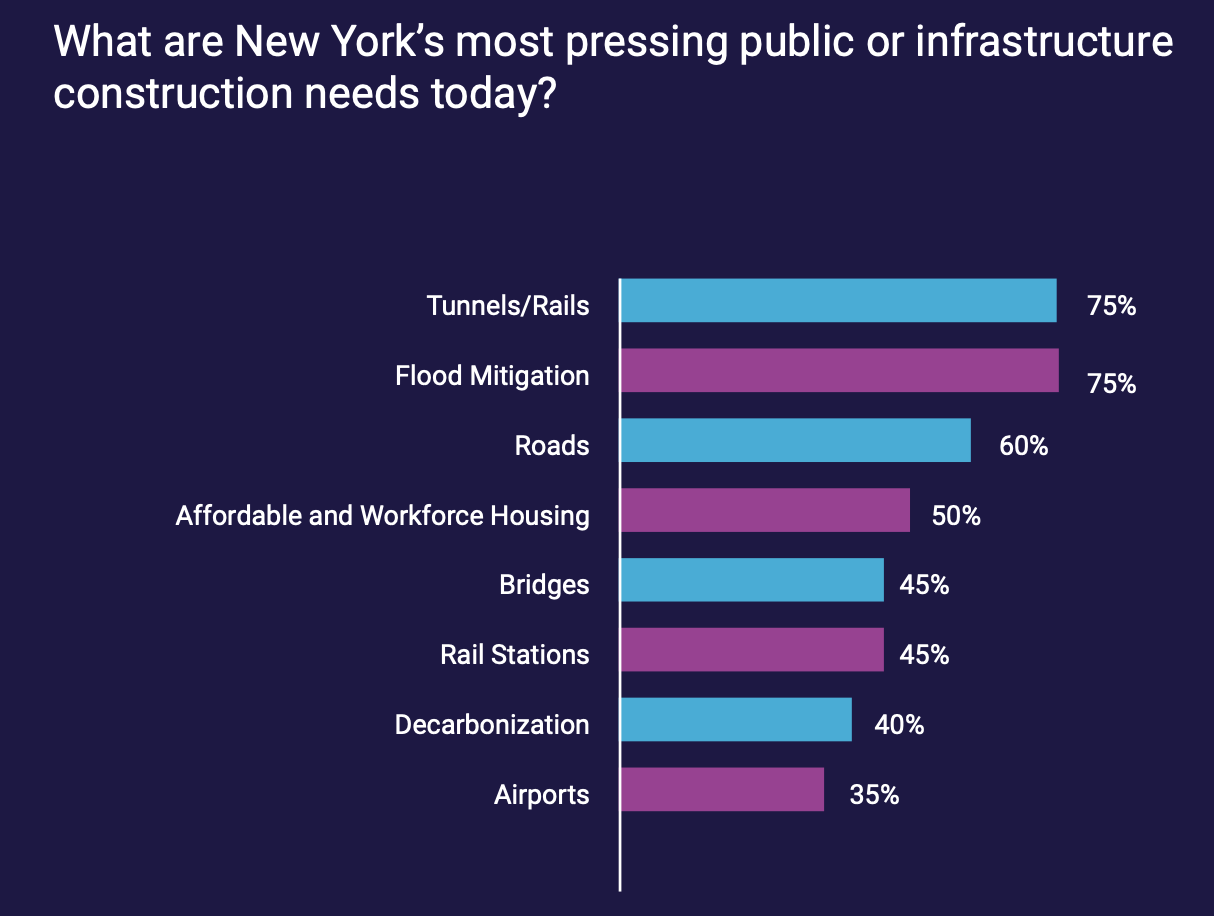

The usual suspects—tunnels, roads, bridges, rail stations—were cited by the survey’s respondents as being among the structures desperate for repair or replacement. A surprising 40 percent of the firms polled also identified “decarbonization” as a need, most probably because of New York’s Local Law 97, which passed in 2019, and creates carbon emissions limits for most commercial buildings over 25,000 sf, as well as alternative paths for the law’s two compliance periods: 2024-2029, and 2030-2034. Building owners must submit emission intensity reports, stamped by a registered design professional, every year starting in 2025 or face substantial fines.

“The overwhelming trend relates to resilience, particularly in the face of a growing urban population; and sustainability/climate change needs, which are being felt acutely,” the report states.

Related Stories

Market Data | May 2, 2023

Nonresidential construction spending up 0.7% in March 2023 versus previous month

National nonresidential construction spending increased by 0.7% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $997.1 billion for the month.

Hotel Facilities | May 2, 2023

U.S. hotel construction up 9% in the first quarter of 2023, led by Marriott and Hilton

In the latest United States Construction Pipeline Trend Report from Lodging Econometrics (LE), analysts report that construction pipeline projects in the U.S. continue to increase, standing at 5,545 projects/658,207 rooms at the close of Q1 2023. Up 9% by both projects and rooms year-over-year (YOY); project totals at Q1 ‘23 are just 338 projects, or 5.7%, behind the all-time high of 5,883 projects recorded in Q2 2008.

Market Data | May 1, 2023

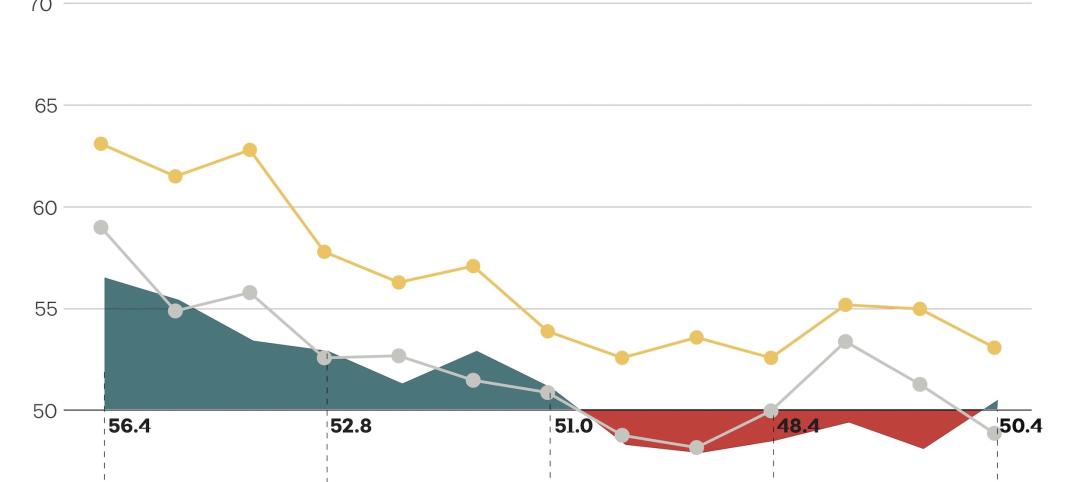

AEC firm proposal activity rebounds in the first quarter of 2023: PSMJ report

Proposal activity for architecture, engineering and construction (A/E/C) firms increased significantly in the 1st Quarter of 2023, according to PSMJ’s Quarterly Market Forecast (QMF) survey. The predictive measure of the industry’s health rebounded to a net plus/minus index (NPMI) of 32.8 in the first three months of the year.

Industry Research | Apr 25, 2023

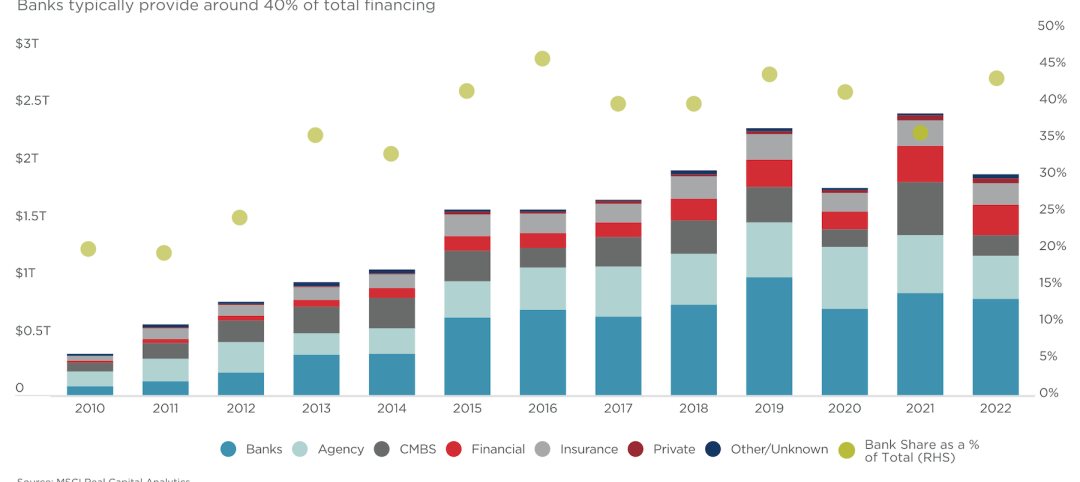

The commercial real estate sector shouldn’t panic (yet) about recent bank failures

A new Cushman & Wakefield report depicts a “well capitalized” banking industry that is responding assertively to isolated weaknesses, but is also tightening its lending.

Architects | Apr 21, 2023

Architecture billings improve slightly in March

Architecture firms reported a modest increase in March billings. This positive news was tempered by a slight decrease in new design contracts according to a new report released today from The American Institute of Architects (AIA). March was the first time since last September in which billings improved.

Contractors | Apr 19, 2023

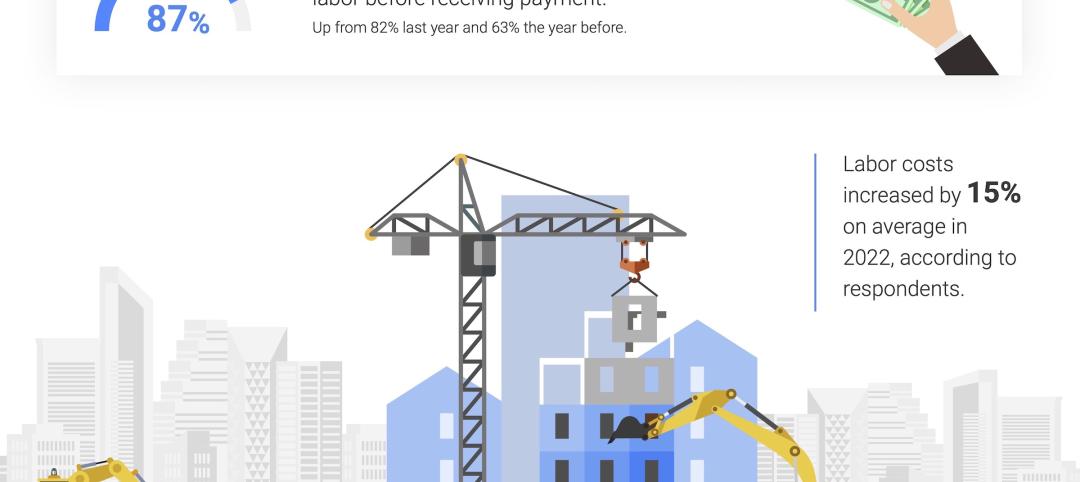

Rising labor, material prices cost subcontractors $97 billion in unplanned expenses

Subcontractors continue to bear the brunt of rising input costs for materials and labor, according to a survey of nearly 900 commercial construction professionals.

Data Centers | Apr 14, 2023

JLL's data center outlook: Cloud computing, AI driving exponential growth for data center industry

According to JLL’s new Global Data Center Outlook, the mass adoption of cloud computing and artificial intelligence (AI) is driving exponential growth for the data center industry, with hyperscale and edge computing leading investor demand.

Healthcare Facilities | Apr 13, 2023

Healthcare construction costs for 2023

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

Higher Education | Apr 13, 2023

Higher education construction costs for 2023

Fresh data from Gordian breaks down the average cost per square foot for a two-story college classroom building across 10 U.S. cities.

Market Data | Apr 13, 2023

Construction input prices down year-over-year for first time since August 2020

Construction input prices increased 0.2% in March, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices rose 0.4% for the month.