Autodesk, Inc., in partnership with management consulting firm FMI Corporation, recently released findings from an industry study, "Trust Matters: The High Cost of Low Trust." The study measured the costs and benefits of different levels of trust within construction organizations and across construction project teams. The findings reveal organizations with "very high" levels of trust achieve better financial and organizational performance – yet 63% of survey respondents shared their organizations have less than "very high" trust. Compared to organizations with lower levels of trust, "very high" trust organizations generate more repeat business, retain more employees and drive a higher level of operational success.

"The performance advantages at 'very high' trust organizations can represent millions of dollars in profitability," said Jay Bowman, research and analytics lead at FMI. "With margins in the construction industry continuing to shrink, organizations should be aware of their trust ranking and how it can be improved to increase profitability. The 'very high' trust attributes uncovered in this report reflect approaches organizations can focus on to minimize uncertainties, simplify collaboration and ultimately improve trust."

FMI and Autodesk surveyed over 2,500 construction professionals worldwide who ranked trust within their organizations, ranging from "very low" to "very high" trust. The rankings were assessed against respondents' reports of their organizations' internal performance, culture and external relationships.

Key findings include:

1. "Very high" organizational trust can lead to millions of dollars in annual savings and new revenue.

Respondents from the highest trust organizations revealed performance advantages that can add up to millions of dollars of profitability each year, including:

-

More repeat business – The majority (57%) of "very high" trust organizations report working with repeat clients for more than 80% of their projects, whereas only 42% of "above average" trust organizations reported the same. The highest trust organizations working with repeat clients can expect gross margins two to seven percent higher than organizations of a similar size with only "above average" trust. Acquiring new clients is estimated to cost five to 25 times more than continuing work with repeat clients, particularly given new business onboarding processes such as aligning technology, managing payment systems and conducting background tests.

-

Lower voluntary turnover – The majority (56%) of construction professionals at "very high" trust organizations voluntarily choose to stay in their roles, versus just 32% at organizations where trust is "above average". Given the costs associated with recruiting new employees, "very high" trust organizations save as much as $750,000 annually by simply not having to onboard new employees. Retaining skilled labor amid the construction industry's global labor shortage is also particularly valuable for organizational success.

- Timely project delivery – Organizations with the highest levels of trust are twice as confident as those with "above average" trust about meeting their project schedules (43% versus 21%), suggesting a higher sense of reliability among their teams. Since delays require additional staffing, equipment and material costs, as well as opportunity costs of not being able to take on additional work, FMI estimates the highest trust organizations are saving as much as $4 million each year by meeting their deadlines.

2. Organizations with the highest trust generate more employee engagement.

Organizations that rank high on trust also rank high on employee engagement.

Seventy-four percent of respondents from "very high" trust organizations said they would recommend their companies as great places to work. Employee recommendations bolster recruiting efforts and can help attract skilled labor – another organizational benefit that is particularly valuable amid the construction industry's global labor shortage.

Respondents from "very high" trust organizations also disclosed they are twice as likely to go above and beyond what is asked of them (49%), compared to respondents from "above average" trust organizations (24%).

3. "Very high" trust organizations value collaboration and build stronger relationships externally.

Respondents from "very high" trust organizations were more than twice as likely to report that collaboration is central to the way they work (43%), compared to respondents from "above average" trust organizations (19%). The highest trust organizations are more likely to share information with external teams, receive prompt responses from team members and hear about project issues quickly. These findings suggest the collaboration found within "very high" trust organizations not only reduce project rework and schedule overruns, but also strengthens external industry relationships – between owners, architects, engineers, general contractors and specialty contractors – to expand opportunities for more work.

4. Trust can be increased.

The study uncovered common, measurable attributes that foster trust and positively impact performance across construction organizations, such as consistent internal processes, transparent communications, environments where employees feel safe and secure sharing their views, and a focus on employee development.

"Having worked as a project engineer, I know first-hand construction is a team sport and being able to trust the people you work with is essential to business success," said Dustin DeVan, construction strategist and evangelist at Autodesk Construction Solutions. "This study exposes a need for more transparency, accountability and collaboration in the industry. Organizations that effectively adopt processes and technologies that facilitate greater transparency, accountability and collaboration will be able to increase trust and improve their performance outcomes."

More details:

- Download the full report with country-specific insights, "Trust Matters: The High Cost of Low Trust," here

- Also check out the blog and infographic

- Sign up for our upcoming webinar on March 25, 2020 to learn how construction organizations can increase trust internally and across their project teams

About the study

In 2019, Autodesk Construction Solutions and FMI surveyed 2,527 construction professionals worldwide, asking them to rank the level of trust within their organizations and across project teams, and share financial and organizational performance. In the survey, respondents ranked the level of trust within their organization on a scale of 1 – 5 (very low = 1; very high = 5).

To evaluate the costs and benefits of the trust ratings, responses were then grouped in to one of three categories:

- "Very high": Trust extends through the organization and across all functions. Trust is core to how they work.

- "Above average": These firms may have pockets of strong trust, but individuals may still distrust or feel suspicious of others, even unconsciously. To some degree, trust must still be earned.

- "Average" to "below average": Employees of these firms are not consistently trustful, and internal groups may feel suspicious of others. Individual employees may also act in their own best interest rather than for the benefit of their organization or other team members.

Study participants include project owners (11%), architects and engineers (36%), contractors (31%) and specialty trades (22%) from the United States, Canada, United Kingdom, Ireland, Australia, New Zealand, Hong Kong and Singapore. Participants' tenure ranges from less than two years (21%), two to five years (26%), five to 10 years (26%), 10 to 20 years (19%), and more than 20 years (8%).

Related Stories

Giants 400 | Sep 5, 2023

Top 80 Construction Management Firms for 2023

Alfa Tech, CBRE Group, Skyline Construction, Hill International, and JLL top the rankings of the nation's largest construction management (as agent) and program/project management firms for nonresidential buildings and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Sep 5, 2023

Top 150 Contractors for 2023

Turner Construction, STO Building Group, DPR Construction, Whiting-Turner Contracting Co., and Clark Group head the ranking of the nation's largest general contractors, CM at risk firms, and design-builders for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Market Data | Sep 5, 2023

Nonresidential construction spending increased 0.1% in July 2023

National nonresidential construction spending grew 0.1% in July, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.08 trillion and is up 16.5% year over year.

Giants 400 | Aug 31, 2023

Top 35 Engineering Architecture Firms for 2023

Jacobs, AECOM, Alfa Tech, Burns & McDonnell, and Ramboll top the rankings of the nation's largest engineering architecture (EA) firms for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

Top 115 Architecture Engineering Firms for 2023

Stantec, HDR, Page, HOK, and Arcadis North America top the rankings of the nation's largest architecture engineering (AE) firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

2023 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

A record 552 AEC firms submitted data for BD+C's 2023 Giants 400 Report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Aug 22, 2023

Top 175 Architecture Firms for 2023

Gensler, HKS, Perkins&Will, Corgan, and Perkins Eastman top the rankings of the nation's largest architecture firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

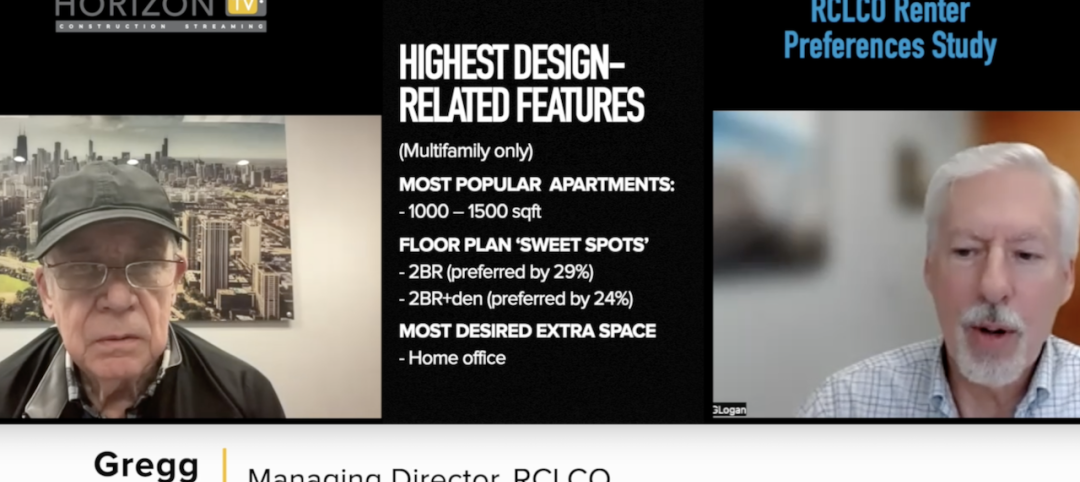

Apartments | Aug 22, 2023

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

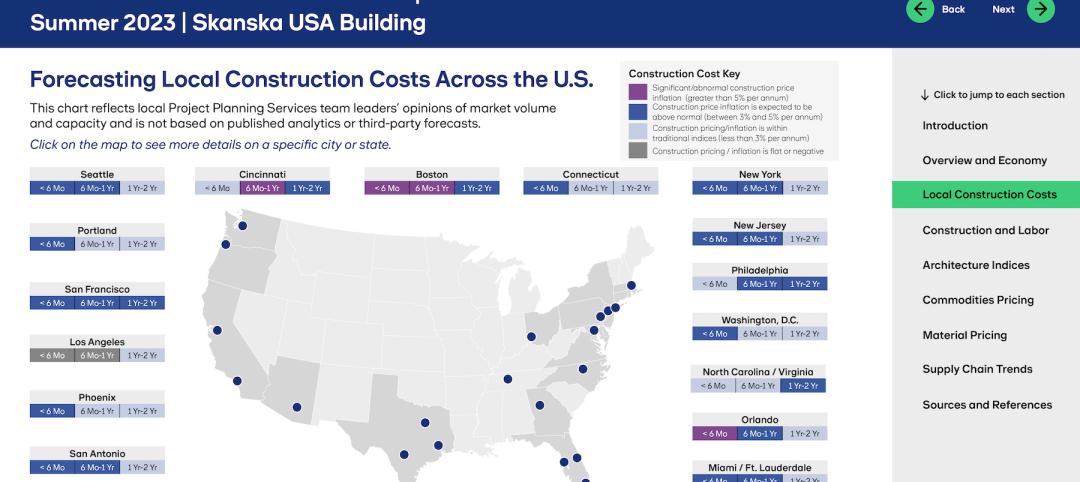

Market Data | Aug 18, 2023

Construction soldiers on, despite rising materials and labor costs

Quarterly analyses from Skanska, Mortenson, and Gordian show nonresidential building still subject to materials and labor volatility, and regional disparities.

Apartments | Aug 14, 2023

Yardi Matrix updates near-term multifamily supply forecast

The multifamily housing supply could increase by up to nearly 7% by the end of 2023, states the latest Multifamily Supply Forecast from Yardi Matrix.