The U.S. Green Building Council (USGBC) has released two new Safety First pilot credits as part of the LEED for Cities and Communities rating system. The new credits are designed to help local governments and development authorities better prepare for and respond to future pandemic events. The guidance includes strategies for planning, risk assessment and training, as well as evaluating equity implications and impacts to vulnerable communities. Between the increasing risks associated with climate change and the current public health crisis, the new LEED credits provide additional ways to integrate public health and social equity into sustainability and resilience efforts.

The Safety First pilot credits are part of USGBC’s economic recovery strategy introduced in May that centers around a reimagined vision that healthy people in healthy places equals a healthy economy. The new LEED credits, called Safety First: Pandemic Planning and Safety First: Social Equity in Pandemic Planning, are available to LEED for Cities and Communities projects.

“The key to a better future lies in our ability to create places that support human and environmental health,” said Mahesh Ramanujam, president and CEO of USGBC. “LEED-certified cities and communities are already moving in that direction and they understand that effective planning is critical to tracking performance and making improvements. The current pandemic is revealing new lessons every day and LEED’s Safety First pilot credits provide a roadmap for taking action and bringing a more integrated and inclusive approach to rebuilding a healthier economy.”

The Safety First: Pandemic Planning credit is intended to help cities and communities prepare for, control and mitigate the spread of disease during a pandemic that poses a high risk to people. The plan must include a task force representing diverse backgrounds that is responsible for evaluating possible impacts and advising decision makers on short- and long-term challenges. It must also identify risks and vulnerabilities to health by outlining historical, geographical, epidemiological and other factors, and assess preparedness. The plan evaluates healthcare system readiness, domestic response, incident management and other existing policies and procedures. Education and training for community partners and other stakeholders must also be included.

The Safety First: Social Equity in Pandemic Planning credit systematically considers equity implications across all phases of the pandemic preparedness, planning and response process. The local government or development authority must have a local equity officer in place and responsible for building equity into the structure of the emergency command and response system. The plan must also convene a Pandemic Community Advisory Group to gather input on an on-going basis and the group must reflect the demographic and socio-economic diversity of the city or community. Public communications, outreach and educational campaigns must also be included in order to share relevant information about the pandemic, public health and health care facilities available. Project teams are also encouraged to demonstrate how policy, procedures, infrastructure and facilities impact low income, vulnerable or at-risk groups.

In the U.S., the coronavirus is expected to reduce GDP by nearly $8 trillion through 2030 putting tremendous strain on local economies, businesses and people. Those losses will be even more acute when coupled with mounting costs associated with climate events. Last year, just 14 weather and climate disasters cost the U.S. more than $45 billion. LEED has long supported resilience planning and the new Safety First pilot credits expand those efforts to ensure local governments and development authorities are also planning for and considering public health threats and social equity challenges. As projects pursue the new credits, USGBC will collect feedback and refine the guidance.

These and other new LEED credits will be discussed during USGBC’s Healthy Economy Forum August 4-5. The forum will address a wide range of building sectors and examine how green building plays a role in ensuring people feel safe and healthy returning to buildings and spaces. The presentations and discussions will identify changes that may be needed in the short term and those that may be permanent while helping to rebuild the economy and replace unprecedented job losses. Registration for the virtual forum is currently open.

For more than 20 years, USGBC has defined global best practices for designing, constructing and operating sustainable, resilient and healthy buildings, cities and communities through LEED. LEED, or Leadership in Energy and Environmental Design, is the world’s most widely used green building rating system and promotes strategies that reduce environmental harm, enhance human health and support economic development. Third party verification systems like LEED encourage transparency and confirm that a project has met the highest sustainability standards. Nearly 200 cities and communities, and over 103,000 buildings and spaces are currently participating across nearly 180 countries and territories.

Related Stories

Contractors | Oct 19, 2023

Crane Index indicates slowing private-sector construction

Private-sector construction in major North American cities is slowing, according to the latest RLB Crane Index. The number of tower cranes in use declined 10% since the first quarter of 2023. The index, compiled by consulting firm Rider Levett Bucknall (RLB), found that only two of 14 cities—Boston and Toronto—saw increased crane counts.

Market Data | Oct 2, 2023

Nonresidential construction spending rises 0.4% in August 2023, led by manufacturing and public works sectors

National nonresidential construction spending increased 0.4% in August, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.09 trillion.

Giants 400 | Sep 28, 2023

Top 100 University Building Construction Firms for 2023

Turner Construction, Whiting-Turner Contracting Co., STO Building Group, Suffolk Construction, and Skanska USA top BD+C's ranking of the nation's largest university sector contractors and construction management firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue for all university/college-related buildings except student residence halls, sports/recreation facilities, laboratories, S+T-related buildings, parking facilities, and performing arts centers (revenue for those buildings are reported in their respective Giants 400 ranking).

Construction Costs | Sep 28, 2023

U.S. construction market moves toward building material price stabilization

The newly released Quarterly Construction Cost Insights Report for Q3 2023 from Gordian reveals material costs remain high compared to prior years, but there is a move towards price stabilization for building and construction materials after years of significant fluctuations. In this report, top industry experts from Gordian, as well as from Gilbane, McCarthy Building Companies, and DPR Construction weigh in on the overall trends seen for construction material costs, and offer innovative solutions to navigate this terrain.

Data Centers | Sep 21, 2023

North American data center construction rises 25% to record high in first half of 2023, driven by growth of artificial intelligence

CBRE’s latest North American Data Center Trends Report found there is 2,287.6 megawatts (MW) of data center supply currently under construction in primary markets, reaching a new all-time high with more than 70% already preleased.

Contractors | Sep 12, 2023

The average U.S. contractor has 9.2 months worth of construction work in the pipeline, as of August 2023

Associated Builders and Contractors' Construction Backlog Indicator declined to 9.2 months in August, down 0.1 month, according to an ABC member survey conducted from Aug. 21 to Sept. 6. The reading is 0.5 months above the August 2022 level.

Contractors | Sep 11, 2023

Construction industry skills shortage is contributing to project delays

Relatively few candidates looking for work in the construction industry have the necessary skills to do the job well, according to a survey of construction industry managers by the Associated General Contractors of America (AGC) and Autodesk.

Market Data | Sep 6, 2023

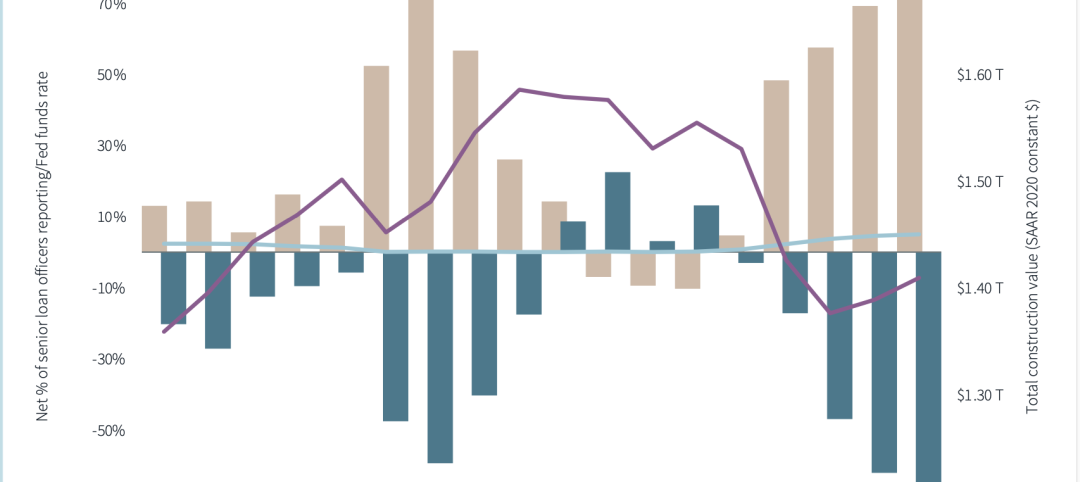

Far slower construction activity forecast in JLL’s Midyear update

The good news is that market data indicate total construction costs are leveling off.

Giants 400 | Sep 5, 2023

Top 80 Construction Management Firms for 2023

Alfa Tech, CBRE Group, Skyline Construction, Hill International, and JLL top the rankings of the nation's largest construction management (as agent) and program/project management firms for nonresidential buildings and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Sep 5, 2023

Top 150 Contractors for 2023

Turner Construction, STO Building Group, DPR Construction, Whiting-Turner Contracting Co., and Clark Group head the ranking of the nation's largest general contractors, CM at risk firms, and design-builders for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.