Dodge Data & Analytics (https://www.construction.com/

“The U.S. construction industry has moved into a mature stage of expansion,” stated Robert Murray, chief economist for Dodge Data & Analytics. “After rising 11% to 13% per year from 2012 through 2015, total construction starts advanced a more subdued 5% in 2016. An important question entering 2017 was whether the construction industry had the potential for further expansion. Several project types, including multifamily housing and hotels, have pulled back from their 2016 levels, but the current year has seen continued growth by single family housing, office buildings, and warehouses. In addition, the institutional segment of nonresidential building has been quite strong, led especially by transportation terminal projects in combination with gains for schools and healthcare facilities. As for public works, the specifics of a $1 trillion infrastructure program by the Trump Administration have yet to materialize, so activity continues to hover around basically the plateau for construction starts reached a couple of years ago. Total construction starts in 2017 are estimated to climb 4% to $746 billion.”

“For 2018, there are several positive factors which suggest that the construction expansion has further room to proceed,” Murray continued. “The U.S. economy next year is anticipated to see moderate job growth. Long term interest rates may see some upward movement but not substantially. While market fundamentals for commercial real estate won’t be quite as strong as this year, funding support for construction will continue to come from state and local bond measures. Two areas of uncertainty relate to whether tax reform and a federal infrastructure program get passed, with their potential to lift investment. Overall, the year 2018 is likely to show some construction project types register gains while other project types settle back, with the end result being a 3% increase for total construction starts. By major sector, gains are predicted for residential building, up 4%; and nonresidential building, up 2%; while nonbuilding construction stabilizes after two years of decline.”

The pattern of construction starts by more specific segments is the following:

– Single family housing will rise 9% in dollars, corresponding to a 7% increase in units to 850,000 (Dodge basis). Continued employment growth has eased some of the caution shown by potential homebuyers, while older Millennials in their 30s are helping to lift demand for single family housing. A modest boost will also come from rebuilding efforts in Texas and Florida after Hurricanes Harvey and Irma.

– Multifamily housing will retreat 8% in dollars and 11% in units to 425,000 (Dodge basis). This project type appears to have peaked in 2016, helped by widespread growth across major metropolitan markets. That strength has begun to wane in 2017, given slight deterioration in market fundamentals (rent growth, occupancies) and a more cautious bank lending stance.

– Commercial building will increase 2%, following a 3% gain in 2017, and continuing to decelerate after the sharp 21% hike back in 2016. Office construction should see further growth in 2018, helped by broad development efforts in downtown markets, and warehouse construction is supported by greater demand arising from e-commerce. However, store construction will remain weak, and hotel construction will continue to pull back from its 2016 peak.

– Institutional building will advance 3%, maintaining its upward track after this year’s 14% jump. Educational facilities should see more substantial growth next year, lifted by the passage of recent school construction bond measures. The robust volume of transportation terminal projects in 2017 may not be repeated in 2018, but activity should stay at a high level.

– Manufacturing plant construction will recede 1% in dollar terms, after surging 27% this year due to the start of several massive petrochemical projects. Next year should still see moderate growth for manufacturing plants in square footage terms.

– Public works construction will improve 3%, slightly more than the 1% growth in 2017. Highways and bridges should be helped as federal funding rises to the levels called for by the FAST Act, while the environmental categories will partly reflect reconstruction efforts related to Hurricanes Harvey and Irma. Additional benefit may come from the infrastructure program proposed by the Trump Administration, should it achieve passage in some form.

– Electric utilities and gas plants will drop 13%, falling for the third year in a row after the exceptional amount reported in 2015. Power plant construction starts will ease back as new generating capacity comes on line.

The 2018 Dodge Construction Outlook was presented at the 79th annual Outlook Executive Conference held by Dodge Data & Analytics at the Swissotel in Chicago IL. Copies of the report with additional details by building sector can be ordered here.

Related Stories

High-rise Construction | Jan 23, 2017

Growth spurt: A record-breaking 128 buildings of 200 meters or taller were completed in 2016

This marks the third consecutive record-breaking year for building completions over 200 meters.

Market Data | Jan 18, 2017

Fraud and risk incidents on the rise for construction, engineering, and infrastructure businesses

Seven of the 10 executives in the sector surveyed in the report said their company fell victim to fraud in the past year.

Market Data | Jan 18, 2017

Architecture Billings Index ends year on positive note

Architecture firms close 2016 with the strongest performance of the year.

Market Data | Jan 12, 2017

73% of construction firms plan to expand their payrolls in 2017

However, many firms remain worried about the availability of qualified workers.

Market Data | Jan 9, 2017

Trump market impact prompts surge in optimism for U.S. engineering firm leaders

The boost in firm leader optimism extends across almost the entire engineering marketplace.

Market Data | Jan 5, 2017

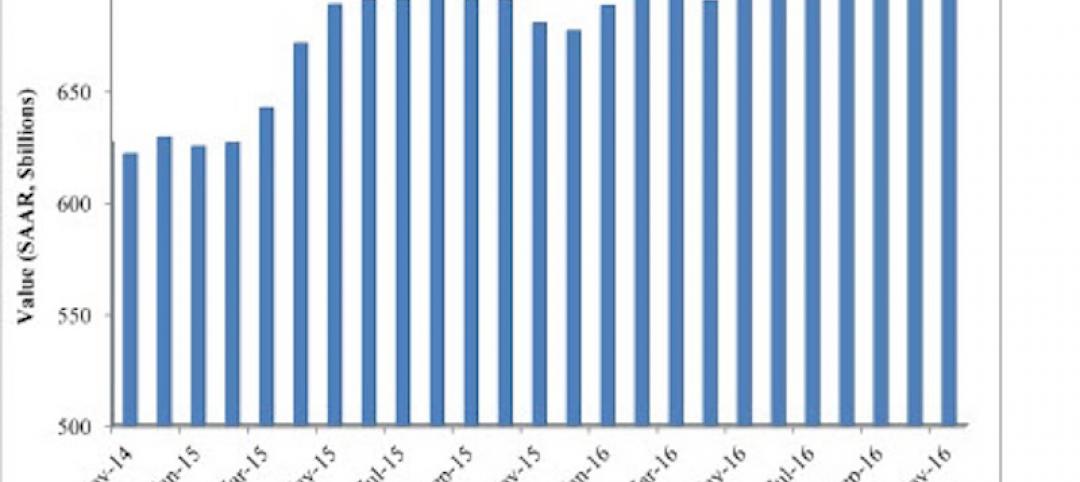

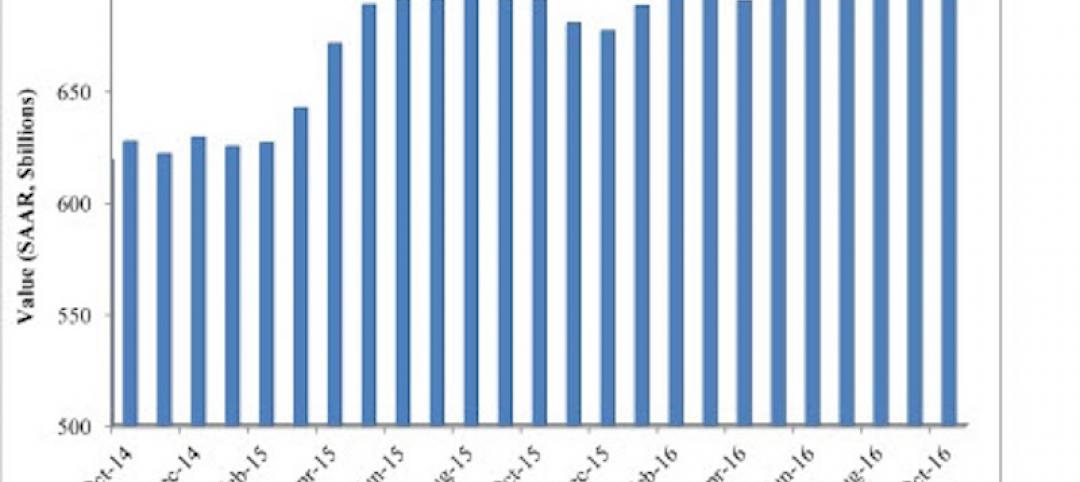

Nonresidential spending thrives in strong November spending report

Many construction firms have reported that they remain busy but have become concerned that work could dry up in certain markets in 2017 or 2018, says Anirban Basu, ABC Chief Economist.

Market Data | Dec 21, 2016

Architecture Billings Index up slightly in November

New design contracts also return to positive levels, signifying future growth in construction activity.

Market Data | Dec 21, 2016

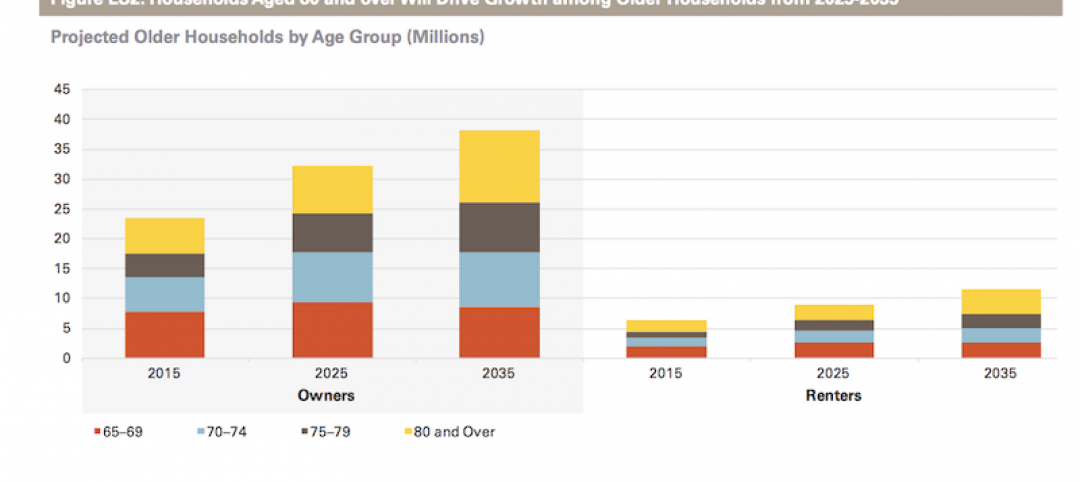

Will housing adjust to an aging population?

New Joint Center report projects 66% increase in senior heads of households by 2035.

Market Data | Dec 13, 2016

ABC predicts modest growth for 2017 nonresidential construction sector; warns of vulnerability for contractor

“The U.S. economy continues to expand amid a weak global economy and, despite risks to the construction industry, nonresidential spending should expand 3.5 percent in 2017,” says ABC Chief Economist Anirban Basu.

Market Data | Dec 2, 2016

Nonresidential construction spending gains momentum

Nonresidential spending is now 2.6 percent higher than at the same time one year ago.