Despite predictions about an impending softening in multifamily construction, builders and developers continue to expand their market reach and portfolios. Here are some of the more prominent projects and deals announced within the past few weeks:

Crescent Communities is developing a 5.3-acre, 374-unit luxury apartment community called Crescent Westshore in Tampa, Fla. This is the fifth multifamily community that Crescent has started in Florida in the past few years, and the third in Tampa. Crescent Warehouse is expected to open in the summer of 2016.

Boston-based Intercontinental Real Estate Corporation and San Diego-based MG Properties Group have jointly acquired the 768-unit Madison Park Apartments in West Anaheim, Calif. This is the largest property, by units, to be purchased in Southern California since 2013. The seller was Institutional Property Advisors. The price was not disclosed.

The Picerne Group has joined forces with Rockwood Capital and The Muller Company to build ELEVEN10 West, a five-story, 260-unit rental community on 2.76 acres in Orange, Calif. TCA Architects designed the building, which will include 43 studios, 117 one-bedroom apartments and 224,293 rentable sf. ELEVEN10 West is being designed to coincide with the City of Orange’s general plan’s mixed-use vision created in 2010. It will open for leasing in the summer of 2017.

Asset Plus Cos., the nation’s largest privately owned apartment and student housing developer, on March 17 opened Arrabella, a 232-unit luxury rental townhouse community in west Houston. Arrabella features six one- to three-bedroom floor plans. As of early April the building was 15% preleased. However, this could be Asset’s last Houston project for a while: its CEO and chairman, Michael McGrath, told the Houston Business Journal that his company would postpone building new multifamily projects in Houston until oil prices recover.

SWBC Real Estate is developing a 304-unit garden style community in Dallas called Timberview Ranch, which should be completed by the end of next year. Galaxy Builders is the designated GC on this project. Earlier this year, SWBC broke ground on a 300-unit apartment complex within Twin Creeks at Alamo Ranch in Far West San Antonio.

Asbury Park, N.J.-based developer J.G. Petrucci Co. plans to break ground this summer on a 68-unit apartment building at the Chalfont train station in Bucks County, Pa. The developer will raze what had been an institution that housed people with brain injuries. The architect on this project is Minno & Wasko, based in Lambertville, N.J.

Kushner Companies last month closed on a portfolio of 16 buildings scattered throughout Manhattan and Brooklyn, N.Y., for which it paid $131.5 million. The sellers, Stone Street Properties and HIG Realty Partners, paid $73 million for that portfolio in 2012, according to the Real Deal. The deal was brokered by Marcus & Millichap.

Downtown Detroit is about to get its first new apartment development in a generation. Village Green, a luxury apartment owner and operation, has received approval to construct Statler City Apartments, for which it plans to break ground in the second quarter of next year and complete by the fourth quarter of 2017. Statler City Apartments will be a mid-rise, mixed-use community with 235 apartments and penthouses. It will be located on Detroit’s Grand Circus Park, near the People Mover line and M1 Rail.

Related Stories

MFPRO+ News | Nov 15, 2023

Average U.S multifamily rents drop $3 to $1,718 in October 2023: Yardi Matrix

Multifamily fundamentals continued to soften and impact rents last month, according to the latest Yardi Matrix National Multifamily Report. The average U.S. asking rent dropped $3 to $1,718 in October, with year-over-year growth moderating to 0.4%, down 40 basis points from September. Occupancy slid to 94.9%, marking the first decline in four months.

Industrial Facilities | Nov 14, 2023

Some AEC firms are plugging into EV charging market

Decentralized electrical distribution is broadening recharger installation to several building types.

MFPRO+ Special Reports | Nov 14, 2023

Register today! Key trends in the multifamily housing market for 2024 - BD+C Live Webinar

Join the BD+C and Multifamily Pro+ editorial team for this live webinar on key trends and innovations in the $110 billion U.S. multifamily housing market. A trio of multifamily design and construction experts will present their latest projects, trends, innovations, and data/research on the three primary multifamily sub-sectors: rental housing, senior living, and student housing.

Multifamily Housing | Nov 9, 2023

Multifamily project completions forecast to slow starting 2026

Yardi Matrix has released its Q4 2023 Multifamily Supply Forecast, emphasizing a short-term spike and plateau of new construction.

MFPRO+ News | Nov 1, 2023

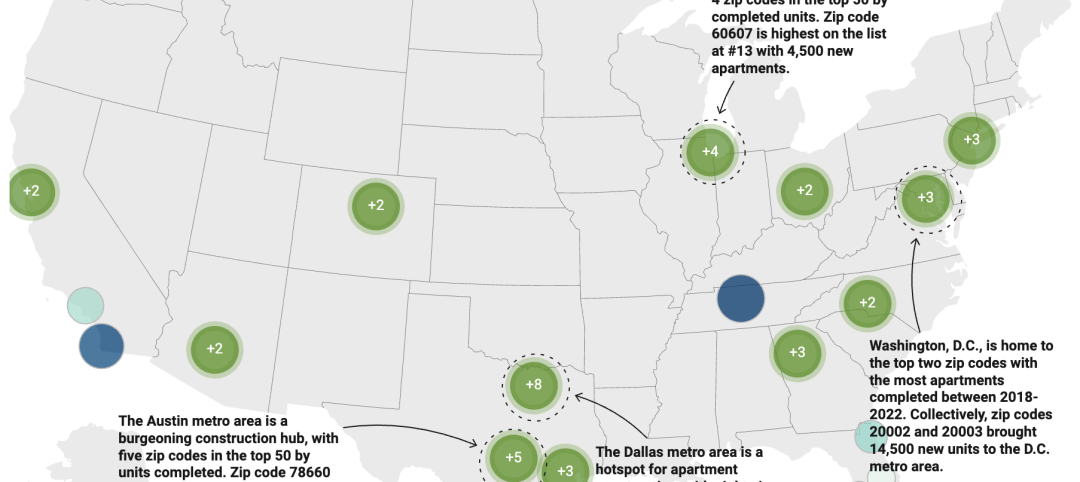

Washington, D.C., Queens, N.Y., lead nation in number of new apartments by zip code

A study of new apartment construction by zip code showed Washington D.C., and the Queens borough of New York City are the hottest multifamily markets since 2018, according to RentCafe.

Adaptive Reuse | Nov 1, 2023

Biden Administration reveals plan to spur more office-to-residential conversions

The Biden Administration recently announced plans to encourage more office buildings to be converted to residential use. The plan includes using federal money to lend to developers for conversion projects and selling government property that is suitable for conversions.

Sponsored | MFPRO+ Course | Oct 30, 2023

For the Multifamily Sector, Product Innovations Boost Design and Construction Success

This course covers emerging trends in exterior design and products/systems selection in the low- and mid-rise market-rate and luxury multifamily rental market. Topics include facade design, cladding material trends, fenestration trends/innovations, indoor/outdoor connection, and rooftop spaces.

MFPRO+ Special Reports | Oct 27, 2023

Download the 2023 Multifamily Annual Report

Welcome to Building Design+Construction and Multifamily Pro+’s first Multifamily Annual Report. This 76-page special report is our first-ever “state of the state” update on the $110 billion multifamily housing construction sector.

Mass Timber | Oct 27, 2023

Five winners selected for $2 million Mass Timber Competition

Five winners were selected to share a $2 million prize in the 2023 Mass Timber Competition: Building to Net-Zero Carbon. The competition was co-sponsored by the Softwood Lumber Board and USDA Forest Service (USDA) with the intent “to demonstrate mass timber’s applications in architectural design and highlight its significant role in reducing the carbon footprint of the built environment.”

Sponsored | MFPRO+ Blog | Oct 26, 2023

Unlock New Potential—Can Multifamily Pop-Up Hotel Concepts Transform Lease-Ups?

Dive into the new trend of multifamily pop-up hotels! Learn how they're changing the game in lease-ups, creating vibrant communities, and offering property managers a lucrative new revenue stream. Join the conversation on the future of multifamily living spaces.