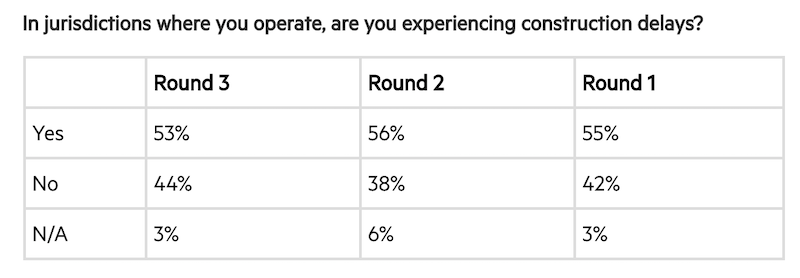

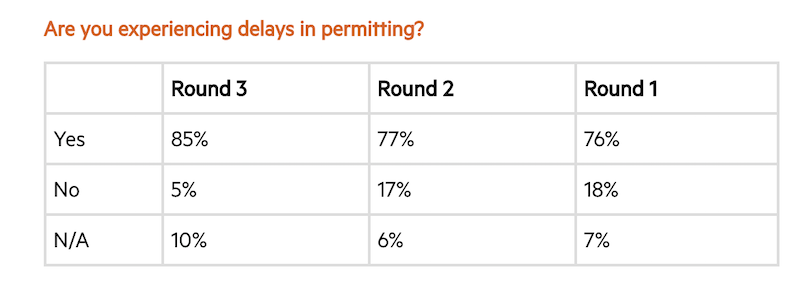

More than half (53%) of multifamily developer respondents reported construction delays in the jurisdictions where they operate, according to the third edition of the National Multifamily Housing Council (NMHC) COVID-19 Construction Survey. Of this group, 85% reported delays in permitting due to COVID-19, up from 77% in round two (conducted April 9-14) and 76% in the initial survey (conducted March 27-April 1).

Getting permits is a major problem for multifamily developers and construction firms, says the NMHC in its latest survey.

Getting permits is a major problem for multifamily developers and construction firms, says the NMHC in its latest survey.

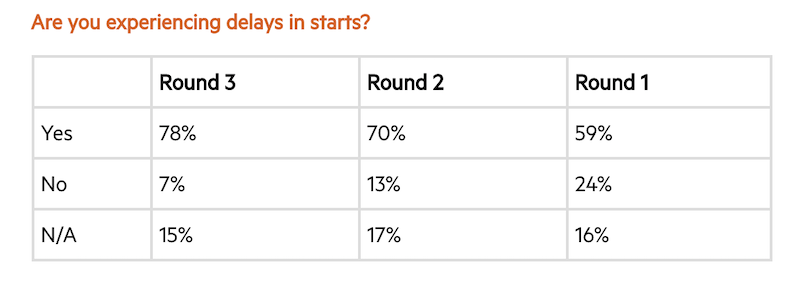

Survey respondents reporting construction delays also indicated a significant pause in starts, with 78% reporting delays, up 8 percentage points from the end of last month, and 19 percentage points from the first round.

More than three-quarters of multifamily developers said continue to face delays in starts, says the latest NMHC survey.

More than three-quarters of multifamily developers said continue to face delays in starts, says the latest NMHC survey.

The NMHC Construction Survey is intended to gauge the magnitude of the disruption caused by the COVID-19 outbreak on multifamily construction. Additional findings include:

• 53% of developers reported a delay in construction. Of those developers, the percentage experiencing a delay in construction because of construction moratorium dropped from 62% in round one to 37% in round three, indicating that construction activity is resuming as states relax pandemic-related restrictions.

• Only 29% of respondents reported being impacted by a lack of materials, but the percentage of respondents experiencing price increases in materials jumped to 17%, from 5% in round one and 4% in round two. Despite this jump, 78% still report no price impact, and 24% of those implementing new strategies report they are sourcing alternative building materials, up 8 percentage points from the first survey.

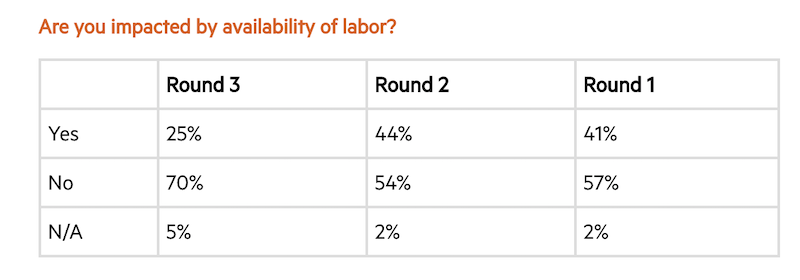

Labor availability seems to be less of a problem for multifamily construction firms, says the NMHC survey.

Labor availability seems to be less of a problem for multifamily construction firms, says the NMHC survey.

• Labor availability has also improved over the course of the three surveys. Seventy percent of respondents said they were not impacted by labor shortages, up from 54% in round one and 57% in round two. This may be due in part to the fact that 24% of those implementing new strategies said they were offering workforce incentives or other benefits, up from 16% in round two.

Firms continue to innovate in the face of challenges posed by the outbreak. Fifty-nine percent of respondents indicated they have implemented new strategies to deal with the hurdles established by the virus’s continued presence. This is down from 75% in the last round and 73% in the first round. Many firms said they have implemented more than one strategy.

View the full survey results here and a comprehensive overview of the results here.

Additional resources, data, and materials from NMHC can be found here.

Related Stories

Coronavirus | Aug 25, 2020

Co-living firm Common issues RFP for the future home office and work hub

Common, the U.S.’s largest co-living company, recently released an RFP for a “Remote Work Hub” to blend work and life from the ground up.

Coronavirus | Aug 25, 2020

Video: 5 building sectors to watch amid COVID-19

RCLCO's Brad Hunter reveals the winners and non-winners of the U.S. real estate market during the coronavirus pandemic.

Coronavirus | Aug 25, 2020

6 must reads for the AEC industry today: August 26, 2020

Big-box retailers’ profits surge, and rent payment tracker finds 90% of apartment households paying rent.

Coronavirus | Aug 25, 2020

7 must reads for the AEC industry today: August 25, 2020

Medical office buildings get a boost by demand and capital, and why the COVID-19 pandemic is increasing the need for telemedicine.

University Buildings | Aug 20, 2020

Student housing in the COVID-19 era

Student housing remains a vital part of the student and campus experience.

Coronavirus | Aug 17, 2020

Covid-19 and campus life: Where do we go from here?

Campus communities include international, intergenerational, and varied health-risk populations.

Coronavirus | Aug 10, 2020

Reimagining multifamily spaces in the COVID era

Multifamily developments pose unique challenges and opportunities.

Coronavirus | Aug 3, 2020

Exploring the airborne transmission of the coronavirus and strategies for mitigating risk

Health authorities say it’s important to understand the dangers of microdroplets. How might indoor ventilation need to change?

Coronavirus | Jul 31, 2020

The Weekly show: Microhospitals, mass timber, and the outlook for 5 key building sectors

The July 30 episode of BD+C's "The Weekly" is available for viewing on demand.