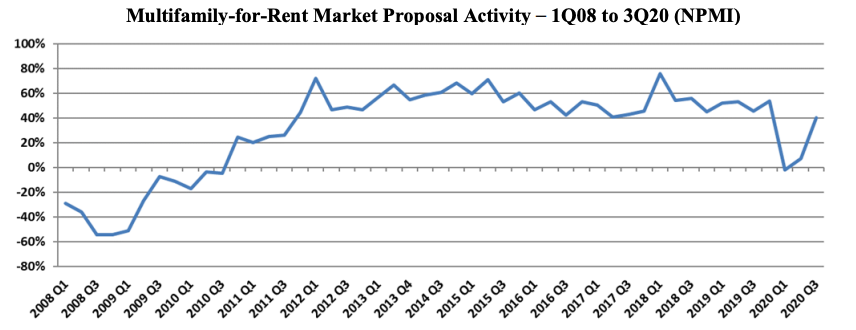

After dipping in the previous two quarters to levels unseen in nearly a decade, the Multifamily-for-Rent outlook for design and construction firms returned to pre-COVID levels in the 3rd Quarter, according to the PSMJ Resources’ Quarterly Market Forecast (QMF). The market’s net plus/minus index (NPMI) reached 40% for the 3rd Quarter, following quarters of -2% and +7%, respectively, in the first half of 2020. The negative index in the 1st Quarter was the first for the Multifamily market since 2010.

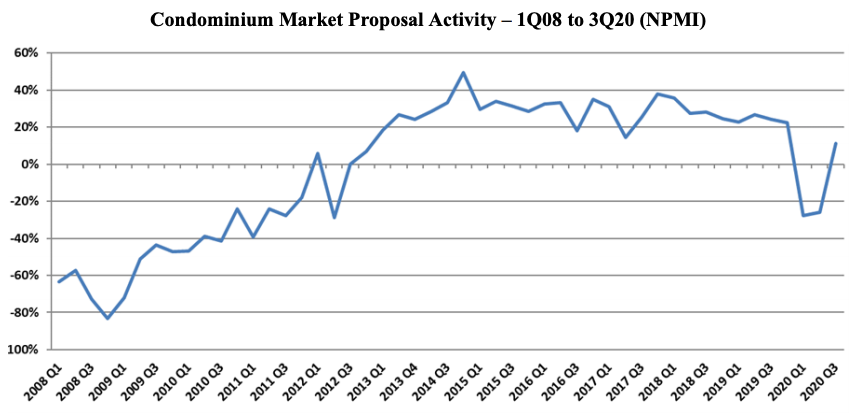

"The entire Housing market is showing impressive growth potential based on A/E proposal activity,” said PSMJ Senior Principal David Burstein, PE, AECPM. “This view is reinforced by government statistics for housing permits and new home starts. Multifamily housing (apartment buildings) took a brief pause from its 10-year growth surge when the COVID-19 crisis first hit in March, but has since recovered quite nicely. The condominium market actually saw a significant dip this spring, but more recently is showing signs of recovery, albeit not to the same levels as Multifamily-for-Rent.”

PSMJ’s NPMI expresses the difference between the percentage of firms reporting an increase in proposal activity and those reporting a decrease. The QMF has proven to be a solid predictor of market health for the architecture and engineering (A/E) industry since its inception in 2003. A consistent group of over 300 A/E firm leaders participate regularly, with 162 contributing to the most recent survey.

Multifamily-for-Rent Market Proposal Activity – 1Q08 to 3Q20 (NPMI)

The Multifamily market returned to positive territory out of the Great Recession in the 4th Quarter of 2010 with an NPMI of 24%, then jumped to 44% in the 4th Quarter of 2011. It never dropped below 41% again until it plummeted from 54% in the 4th Quarter of 2019 to -2% in the 1st Quarter of 2020.

“Many of the factors that drove Multifamily's growth pre-COVID remain in place,” adds Burstein. “Plus, there is now a new factor – the potential flight of many people from cities to suburbs – which is shifting the location of the demand. So we believe the Multifamily market will continue to be strong into the foreseeable future.”

Condominium proposal activity soared to a positive NPMI of 11% in the 3rd Quarter, up from -26% in the 2nd Quarter. The Condo market took longer to recover from the last recession than Multifamily-for-Rent did, not rebounding to positive numbers until late 2012. Its NPMI generally stayed in the 20% and 30% range for the next seven years running, until plummeting from 22% in the 4th Quarter of 2019 to a nine-year low of -28% in the 1st Quarter of 2020.

Condominium Market Proposal Activity – 1Q08 to 3Q20 (NPMI)

The Multifamily rebound was part of overall improving conditions for the Housing market, which paced all 12 of the major markets assessed in the QMF with an overall NPMI of 38%. Among other Housing submarkets, Single-Family Property (individual houses) also recorded a 40% NPMI (up from 9%), with Single-Family Development (Subdivisions) at 27%, up from -12%, and Senior & Assisted Living (Independent Living) at 26%, up from -1%,.

Among the 12 major markets surveyed, Water/Wastewater was a close second to Housing at 37%, followed by Healthcare (30%), Energy/Utilities (28%) and Light Industry (27%). Overall proposal activity across all markets and submarkets returned to growth mode in the 3rd Quarter with an NPMI of 22%, up from -10% in the 2nd Quarter. The three worst-performing major markets in the 3rd Quarter were Education (-36%), Commercial Users (-31%) and Commercial Developers (-21%).

PSMJ Resources, a consulting and publishing company dedicated to the A/E industry, has conducted its Quarterly Market Forecast for more than 17 years. It includes data on 12 major markets and 58 submarkets served by A/E firms. For more information, go to https://www.psmj.com/surveys/quarterly-market-forecast-2.

Related Stories

Codes and Standards | Oct 26, 2022

‘Landmark study’ offers key recommendations for design-build delivery

The ACEC Research Institute and the University of Colorado Boulder released what the White House called a “landmark study” on the design-build delivery method.

Building Team | Oct 26, 2022

The U.S. hotel construction pipeline shows positive growth year-over-year at Q3 2022 close

According to the third quarter Construction Pipeline Trend Report for the United States from Lodging Econometrics (LE), the U.S. construction pipeline stands at 5,317 projects/629,489 rooms, up 10% by projects and 6% rooms Year-Over-Year (YOY).

Designers | Oct 19, 2022

Architecture Billings Index moderates but remains healthy

For the twentieth consecutive month architecture firms reported increasing demand for design services in September, according to a new report today from The American Institute of Architects (AIA).

Market Data | Oct 17, 2022

Calling all AEC professionals! BD+C editors need your expertise for our 2023 market forecast survey

The BD+C editorial team needs your help with an important research project. We are conducting research to understand the current state of the U.S. design and construction industry.

Market Data | Oct 14, 2022

ABC’s Construction Backlog Indicator Jumps in September; Contractor Confidence Remains Steady

Associated Builders and Contractors reports today that its Construction Backlog Indicator increased to 9.0 months in September, according to an ABC member survey conducted Sept. 20 to Oct. 5.

Market Data | Oct 12, 2022

ABC: Construction Input Prices Inched Down in September; Up 41% Since February 2020

Construction input prices dipped 0.1% in September compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Laboratories | Oct 5, 2022

Bigger is better for a maturing life sciences sector

CRB's latest report predicts more diversification and vertical integration in research and production.

Market Data | Aug 25, 2022

‘Disruptions’ will moderate construction spending through next year

JLL’s latest outlook predicts continued pricing volatility due to shortages in materials and labor

Market Data | Aug 2, 2022

Nonresidential construction spending falls 0.5% in June, says ABC

National nonresidential construction spending was down by 0.5% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Jul 28, 2022

The latest Beck Group report sees earlier project collaboration as one way out of the inflation/supply chain malaise

In the first six months of 2022, quarter-to-quarter inflation for construction materials showed signs of easing, but only slightly.