Since the beginning of the pandemic, rents have only varied by a few dollars each month – contrary to what many experts initially feared. However, there are significant rent variations at the metro level, and given a lack of government stimulus and continuing layoffs, the fall and winter months will be telling, says the latest Yardi Matrix® National Multifamily Report.

“With the extreme uncertainty surrounding the country today, the multifamily industry has held up better so far than many predicted. Since the beginning of the pandemic, overall rents have only been up or down by a few dollars each month. Many initially feared that the decline would be much steeper than the $8 overall national rent decline we have seen since February,” states the report.

According to the National Multifamily Housing Council’s Rent Payment Tracker, 92.2% of apartment households made a full or partial rent payment by September 27—a 1.5 percentage point decline from September 2019 and a 0.1 percentage point increase from August 2020.

Rents decreased 0.3% in September on a year-over-year basis, continuing a trend since the onset of the pandemic: Metros with the highest rents have suffered the most, while less expensive metros have fared better than expected. San Jose (-6.6%) and San Francisco (-5.8%) led with the sharpest year-over-year declines yet again. Austin (-2.9%) moved up to tie with Boston (-2.9%) for third place in largest YoY declines.

Dive deeper into the full September National Multifamily Report.

Related Stories

Multifamily Housing | Aug 12, 2016

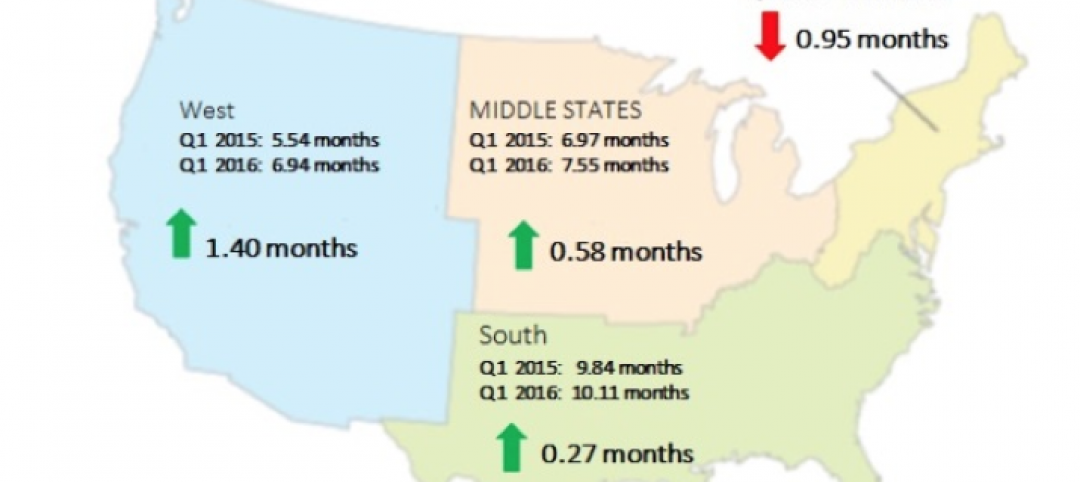

Apartment completions in largest metros on pace to increase by 50% in 2016

Texas is leading this multifamily construction boom, according to latest RENTCafé estimates.

Market Data | Jul 29, 2016

ABC: Output expands, but nonresidential fixed investment falters

Nonresidential fixed investment fell for a third consecutive quarter, as indicated by Bureau of Economic Analysis data.

Industry Research | Jul 26, 2016

AIA consensus forecast sees construction spending on rise through next year

But several factors could make the industry downshift.

Architects | Jul 20, 2016

AIA: Architecture Billings Index remains on solid footing

The June ABI score was down from May, but the figure was positive for the fifth consecutive month.

Market Data | Jul 7, 2016

Airbnb alleged to worsen housing crunch in New York City

Allegedly removing thousands of housing units from market, driving up rents.

Market Data | Jul 6, 2016

Construction spending falls 0.8% from April to May

The private and public sectors have a combined estimated seasonally adjusted annual rate of $1.14 trillion.

Market Data | Jul 6, 2016

A thriving economy and influx of businesses spur construction in downtown Seattle

Development investment is twice what it was five years ago.

Multifamily Housing | Jul 5, 2016

Apartments continue to shrink, rents continue to rise

Latest survey by RENTCafé tracks size changes in 95 metros.

Multifamily Housing | Jun 22, 2016

Can multifamily construction keep up with projected demand?

The Joint Center for Housing Studies’ latest disection of America’s housing market finds moderate- and low-priced rentals in short supply.

Contractors | Jun 21, 2016

Bigness counts when it comes to construction backlogs

Large companies that can attract talent are better able to commit to more work, according to a national trade group for builders and contractors.