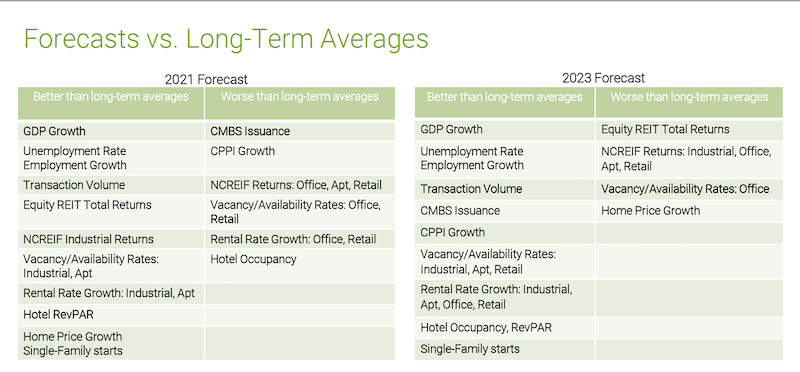

The GDP, which in 2020 contracted for the first time in 11 years, is expected to grow by 6.5% in 2021, and keep growing (albeit at a slower pace) in the proceeding two years. In 2021, the U.S. should recover about 60% of the 9.42 million jobs it lost last year, and pick up another 5.1 million jobs over the following two years. Consequently, the unemployment rate is expected to recede to 4% by the end of 2023, close to where it was pre-pandemic.

This economy and jobs picture, coupled with positive predictions about inflation, interest rates, and capitalization rates, sets the stage for the Urban Land Institute’s Real Estate Economic Forecast, released on May 19, which sees a sector poised to rebound, led by returns from single-family, hotel, and industrial assets. The biggest red flag is the office sector, whose national vacancy rates are expected to rise by a higher-than-usual three-year average, but to also recover starting in 2023.

The forecasts for 27 economic and real estate indicators, published in this report, ULI’s 19th, are derived from a survey this spring of 42 economists and analysts from 39 real estate organizations.

Commercial real estate should benefit from a strong economy through 2023. Graphic: ULI

Among the report’s notable findings are these:

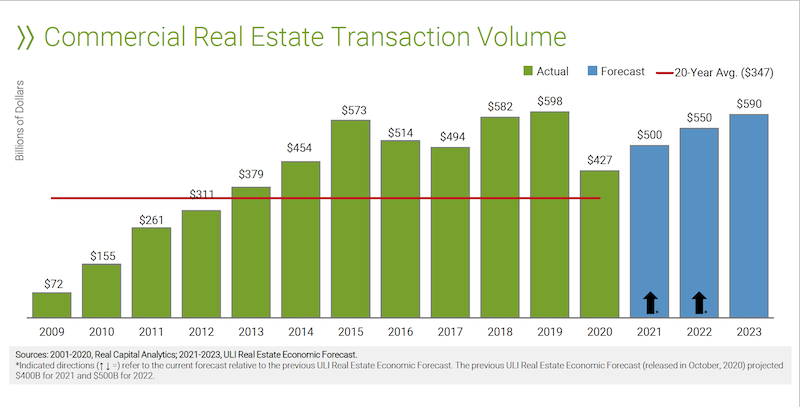

• Commercial real estate transaction volume should recover quickly. It is expected to hit $500 billion this year and $550 billion next year. (The latest peak was $598 billion in 2019.) Commercial mortgage-backed securities issuance is projected at $70 billion this year, and to rise to $90 billion in 2023, exceeding the 20-year $82 billion average.

Transaction volume from real estate is expected to approach pre-pandemic levels again by 2023. Chart: ULI

• Price growth, as measured by the RCA Commercial Property Price Index, should remain below the 2020 level during all three proceeding years. The good news is that ULI is forecasting 5% increases in each of the next two years.

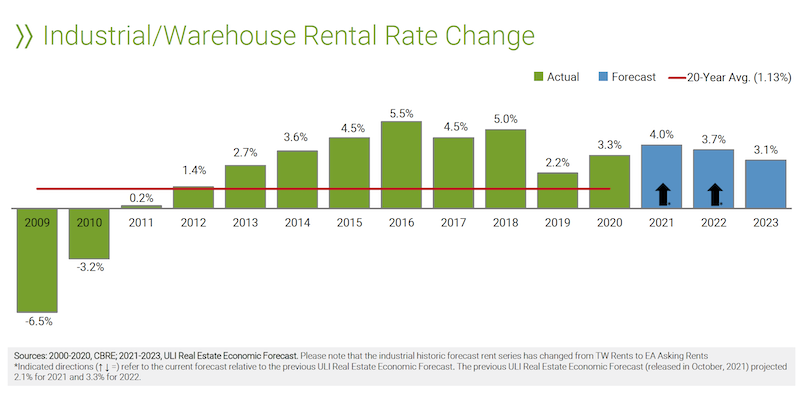

• Rent growth will be similarly volatile. Industrial rents will lead the pack with an average of 3.6% growth between 2021-2023. Multifamily rents will also rise, but office and retail rents are expected to stay in the negative column for a while.

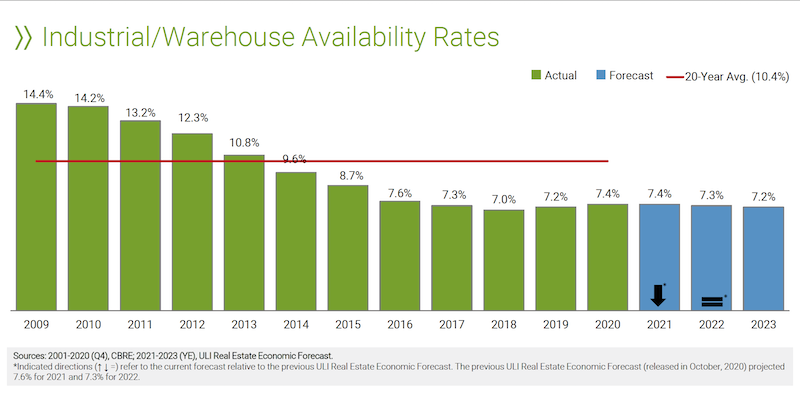

As demand for industrial space increases, so will its rental rates. Charts: ULI

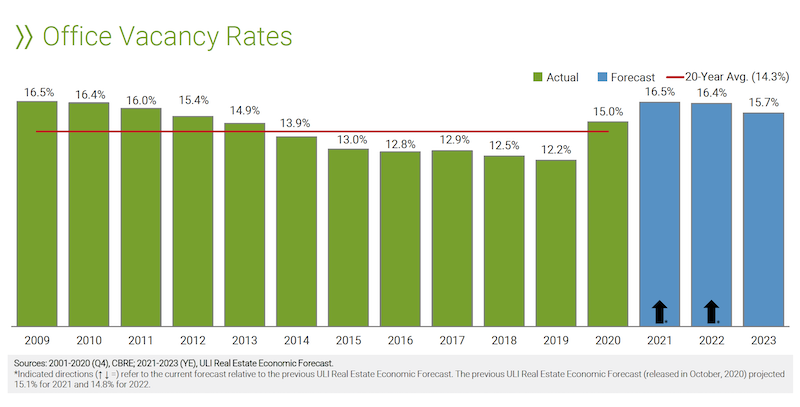

• The report looks at potential vacancy rates for five property types. Availability of warehouses and apartments is expected to remain below their 20-year averages over the next three years. Offices, on the other hand, will see vacancy rates rise to a three-year average of 16.2%, substantively above the sector’s 14.3% 20-year average. Retail vacancy rates, somewhat surprisingly, are projected to average 9.8%, below the sector’s 9.9% 20-year average.

The office sector will have high vacancy rates for at least the next two years. Chart: ULI

• Last year, housing starts exceeded their 20-year average for the first time since the 2008-10 financial crisis. They are expected to hit 1.1 million units this year, and 1.2 million in 2022 and 2023.

• Real estate returns, as measured by the National Council of Real Estate Investment Fiduciaries, are forecast at 4.5%, 5.9%, and 6.5%, respectively, for 2021-2023. Industrial should lead all property types, but even office and retail are projected to generate positive returns.

Related Stories

Market Data | Apr 6, 2023

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.

Multifamily Housing | Apr 4, 2023

Acing your multifamily housing amenities for the modern renter

Eighty-seven percent of residents consider amenities when signing or renewing a lease. Here are three essential amenity areas to focus on, according to market research and trends.

Sustainability | Apr 4, 2023

NIBS report: Decarbonizing the U.S. building sector will require massive, coordinated effort

Decarbonizing the building sector will require a massive, strategic, and coordinated effort by the public and private sectors, according to a report by the National Institute of Building Sciences (NIBS).

Multifamily Housing | Mar 24, 2023

Average size of new apartments dropped sharply in 2022

The average size of new apartments in 2022 dropped sharply in 2022, as tracked by RentCafe. Across the U.S., the average new apartment size was 887 sf, down 30 sf from 2021, which was the largest year-over-year decrease.

Multifamily Housing | Mar 14, 2023

Multifamily housing rent rates remain flat in February 2023

Multifamily housing asking rents remained the same for a second straight month in February 2023, at a national average rate of $1,702, according to the new National Multifamily Report from Yardi Matrix. As the economy continues to adjust in the post-pandemic period, year-over-year growth continued its ongoing decline.

AEC Tech | Mar 14, 2023

Skanska tests robots to keep construction sites clean

What if we could increase consistency and efficiency with housekeeping by automating this process with a robot? Introducing: Spot.

Industry Research | Mar 9, 2023

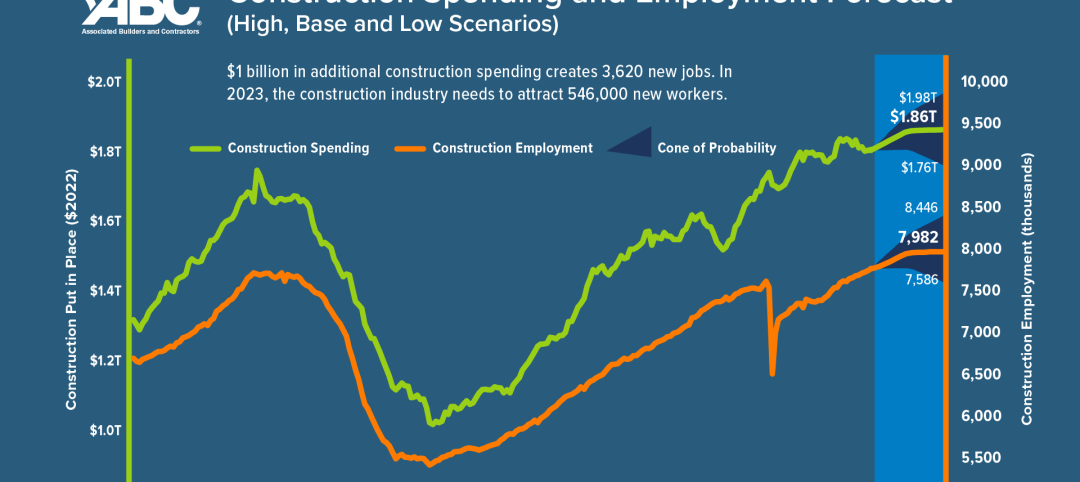

Construction labor gap worsens amid more funding for new infrastructure, commercial projects

The U.S. construction industry needs to attract an estimated 546,000 additional workers on top of the normal pace of hiring in 2023 to meet demand for labor, according to a model developed by Associated Builders and Contractors. The construction industry averaged more than 390,000 job openings per month in 2022.

Industry Research | Mar 2, 2023

Watch: Findings from Gensler's latest workplace survey of 2,000 office workers

Gensler's Janet Pogue McLaurin discusses the findings in the firm's 2022 Workplace Survey, based on responses from more than 2,000 workers in 10 industry sectors.

Architects | Feb 24, 2023

7 takeaways from HKS’s yearlong study on brain health in the workplace

Managing distractions, avoiding multitasking, and cognitive training are key to staff wellbeing and productivity, according to a yearlong study of HKS employees in partnership with the University of Texas at Dallas’ Center for BrainHealth.

Office Buildings | Feb 9, 2023

Post-Covid Manhattan office market rebound gaining momentum

Office workers in Manhattan continue to return to their workplaces in sufficient numbers for many of their employers to maintain or expand their footprint in the city, according to a survey of more than 140 major Manhattan office employers conducted in January by The Partnership for New York City.