On Wednesday, the U.S. Treasury Department and the Internal Revenue Service released new regulations and guidelines for investments in the 8,700 distressed or lower-income census tracts that governors across the country have designated as Opportunity Zones (OZs).

The new regulations, which expand upon the initial round that came out last October, are meant to provide greater clarity for investors and developers about how funds raised for such investments might qualify for tax breaks.

“This round of regulations removes some of the most significant impediments keeping capital on the sidelines, especially as it relates to operating businesses,” John Lettieri, president of the Economic Innovation Group, a Washington research organization that developed and championed the Opportunity Zone concept, told the New York Times.

The new round of regs is timely, as the maximum tax benefit of the legislation requires an Opportunity Zone investment be completed by December 31.

While the federal government has projected $100 billion in Opportunity Zone investments, some developers so far have held back from jumping into this program—which was part of the tax overhaul that Congress approved in 2017—because of uncertainties about qualifications of both buildings and businesses to invest in.

The logic behind OZs is that wealth generated by capital gains could be better used for investments in neighborhoods that typically lack access to that money for redevelopment. The goal of OZs is to spur economic growth. But some skeptics had contended that the program’s regulatory structure was too lax, and that the government, through tax breaks, would end up subsidizing developments in areas that were already attractive to investors.

There are also concerns about gentrification, as the Opportunity Zone concept hasn’t always worked as intended, or at least to the direct benefit of low-income residents. Zillow Economic Research reported in March that prices for homes within Opportunity Zones rose by 25.3% last year, versus 8.4% for census tracts that were eligible but not selected as OZs, and 2.5% for tracts not eligible.

HUD’s Secretary Ben Carson told The Real Deal last month that his agency cannot mandate affordable housing in the zones. It will, however, give preference for developers who apply for certain federal grants to build affordable housing within Opportunity Zones.

Money flowing to Opportunity Zones has mostly gone toward real estate investments, particularly on both coasts. Treasury Secretary Steven Mnuchin has emphasized that the program is also geared toward other types of businesses as well.

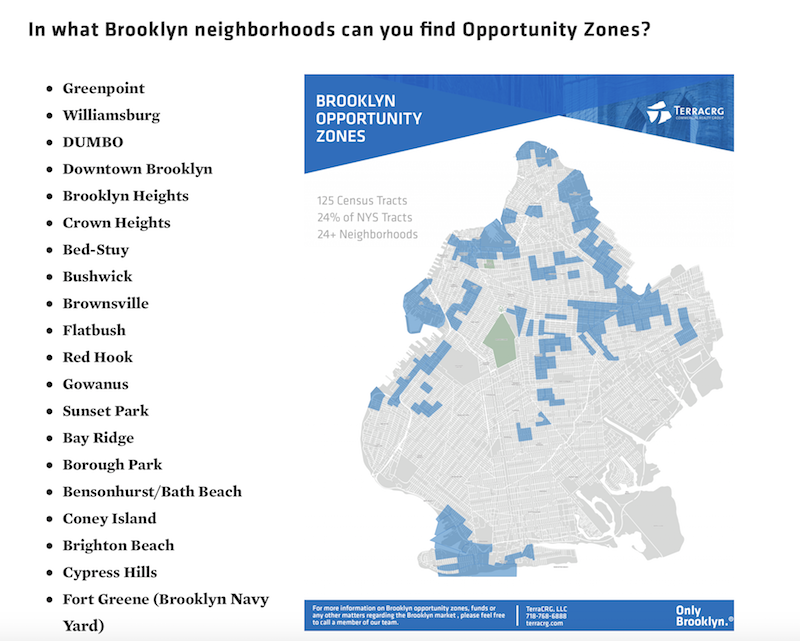

The New York City borough of Brooklyn is where New York State has designated 125 of its 514 Opportunity Zones. Nationwide, governors have designated 8,700 OZs. Image: TerraCRG

The new regulations spell out in greater detail the program’s investment and tax-break mechanism.

For one thing, new regulations create tax benefits for leased property, according to Law.com. Investors essentially can take their capital gains from any venture, real estate or otherwise, and put them into a qualified opportunity zone fund that then, likely through a fund manager, seeks eligible projects. The earlier version gave investors 180 days from the date they realized capital gains to put the money into an opportunity zone fund. If they keep their money in the fund for five years, 10% of their deferred gain is eliminated. An additional 5% of their capital gains would be untaxed if they keep their money in the fund for seven years.

The biggest tax benefit from this program accrues to investors and developers who hold their money in an Opportunity Zone for at least a decade. By doing so, they forgo paying tax on capital gains from those investments altogether.

Opportunity Funds raised by investors get a 12-month grace period to sell assets in Opportunity Zones and then reinvest those proceeds in the Zone. There was some concern previously that this reinvestment had to be made immediately.

The Times reports that investors will be allowed to share their stakes in funds that invest in the zones, and to sell, say, a start-up in an Opportunity Zone as long as the money is reinvested in another qualifying business or asset. Real estate investors will be allowed to lease and refinance their properties.

However, the proposal also allows Treasury officials to revoke a tax break for any Opportunity Zone project “if a significant purpose of a transaction is to achieve a tax result that is inconsistent with the purposes” of the program.

Investors have been concerned about earlier guidance that stated a business that wanted to qualify for the Opportunity Zone program had to derive at least half of its gross income from the Zone itself. Joshua Pollard, a contributing writer for Forbes, points out that the new guidance assuages those concerns by creating four distinct tests for businesses to qualify:

•Total hours worked by employees or independent contractors in a Zone must equal at least 50% of the company’s total hours worked;

•Half of total dollars paid to those employees or contractors must be for services performed in the Zone. The Times reports that provisions in the new regulations allow investors to qualify for tax breaks even if the businesses they fund export goods or services, or if the domestic market for those goods is outside of the zone.

•A business’s management and operational staff, and the tangible property of the business, that are in the Opportunity Zone must be essential to at least half of the business’s gross income; and

•A fourth, intentionally ambiguous, category, “Facts and circumstances,” leaves a lot of wriggle room for businesses to make their case to the IRS, says Pollard.

Pollard notes that outside of the 169-page guidance document, the White House Opportunity and Revitalization Council, made up of nearly 20 federal agencies, has added so-called “preference points,” or tie-breaker considerations, for projects and applicants in Opportunity Zones this year, with the explicit goal of eliminating federal bureaucracy. Ultimately this could give a leg up to as many as 150 programs.

Related Stories

Codes and Standards | Jun 8, 2022

Florida Legislature passes bill requiring stricter condominium inspection

The Florida Legislature recently passed a bill to beef up building inspection requirements for many of the state’s condominiums.

Codes and Standards | Jun 7, 2022

FEMA launches National Initiative to Advance Building Codes

The U.S. Federal Emergency Management Agency (FEMA) has launched a new government-wide effort to boost national resiliency and reduce energy costs.

Codes and Standards | Jun 2, 2022

Guide helps schools find funding for buildings from federal, state government

New Buildings Institute (NBI) recently released a guide to help schools identify funding programs for facilities improvements available from federal and state government programs.

Codes and Standards | Jun 2, 2022

New design guide for hybrid steel-mass timber frames released

The American Institute of Steel Construction (AISC) has released the first-ever set of U.S. recommendations for hybrid steel frames with mass timber floors, according to a news release.

Codes and Standards | Jun 1, 2022

HKS, U. of Texas Dallas partner on brain health study

HKS and The University of Texas at Dallas’ Center for BrainHealth are conducting a six-month study to improve the way the firm’s employees work, collaborate, and innovate, both individually and as an organization, according to a news release.

Mass Timber | May 31, 2022

Tall mass timber buildings number 139 worldwide

An audit of tall mass timber buildings turned up 139 such structures around the world either complete, under construction, or proposed.

Legislation | May 20, 2022

Arlington County, Virginia may legalize multifamily housing countywide

Arlington County, Va., a Washington, D.C.-area community, is considering proposed legislation that would remove zoning restrictions on multifamily housing up to eight units in size.

Codes and Standards | May 20, 2022

Wildfire threat score now available for all U.S. homes

The non-profit First Street Foundation has made publicly available a database that assesses the wildfire risk of all U.S. homes.

Coronavirus | May 20, 2022

Center for Green Schools says U.S. schools need more support to fight COVID-19

The Center for Green Schools at the U.S. Green Building Council released a new report detailing how school districts around the country have managed air quality within their buildings during the second year of the COVID-19 pandemic.

Regulations | May 20, 2022

Biden’s Clean Air in Buildings Challenge aims to reduce COVID-19 spread

The Biden Administration recently launched the Clean Air in Buildings Challenge that calls on all building owners and operators, schools, colleges and universities, and organizations to adopt strategies to improve indoor air quality in their buildings and reduce the spread of COVID-19.