A business-financed marketing campaign that began more than seven years ago may have contributed to the surge in construction and development that is transforming Greater Fort Lauderdale in Florida.

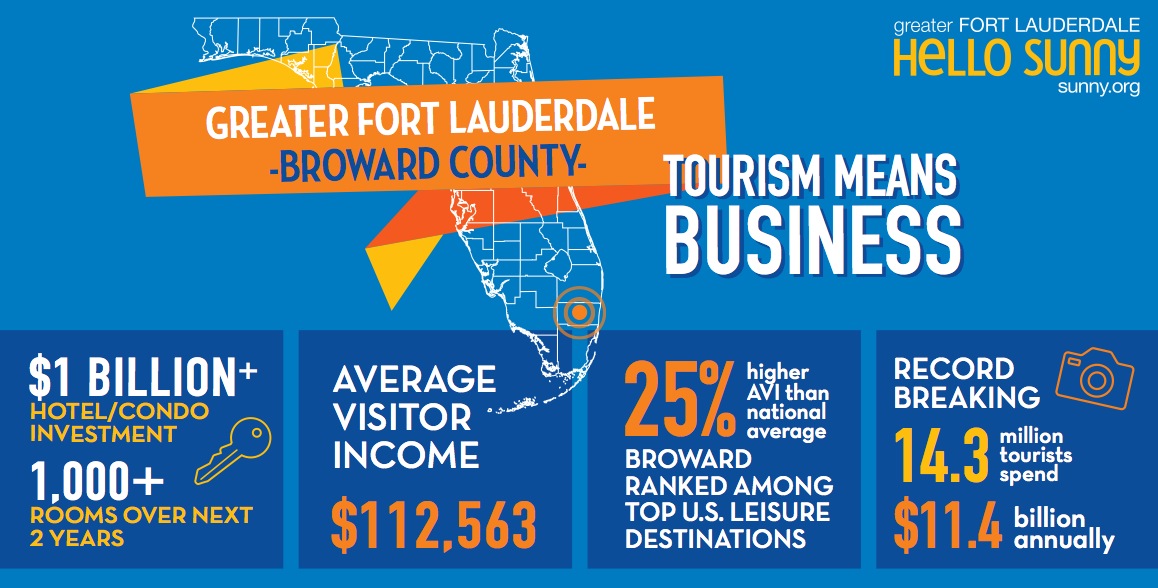

More than $1 billion is being invested in new hotel and condo development alone there, with more than $704 million of that development already underway, which will add in excess of 1,000 new rooms and apartments to this market over the next two years. Another $222 million in expenditures for renovations and improvements are earmarked for several hotel properties.

This activity is creating a new landscape of high-rise residential and commercial buildings that is attracting visitors from Washington D.C., Boston, Dallas, and South America.

“By 2030, there are expected to be seven million more Floridians, and South Florida will make up a large part of that growth,” says Bob Swindell, President and CEO of the Greater Fort Lauderdale Alliance, an economic development organization that promotes and markets the advantages of Broward County’s 31 municipalities for business, residential, and tourist interests.

Swindell notes that 2015 was the first year during which the Florida legislature approved funding—$10 million—to market businesses in that county. About one-third of the companies and investors that have projects underway in Broward benefit from publicly funded tax incentives.

New hotel projects include the $200 million Four Seasons Hotel and Private Residences, which is scheduled to open in 2018; the $500 million Auberge Beach Residences & Spa, slated to open in 2017; the $120 million Gale Boutique Hotel & Residences, opening in 2017; and the $40 million Conrad Fort Lauderdale Beach Resort, opening this year.

Also in the works is the $1 billion Metropica mixed-use development in nearby Sunrise, Fla., which when completed within the next seven years will include more than 1,900 condos, 345 apartments, a hotel, 400,000 sf of retail (including 12 restaurants), and 150,000 sf of offices. Construction on the first condos began last October, and is scheduled to begin on the commercial component in the first quarter of 2016.

Plans are underway for a $2.3 billion expansion of the Fort-Lauderdale-Hollywood International Airport. Funding is in place, says Swindell, for a $600 million expansion of the Broward County Convention Center, which would include a new hotel with between 700 and 1,000 rooms by 2019. He adds that this market could soon have sufficient density to support a light-rail system.

“We made a move to buy the building for the Conrad two years ago,” says Andreas Ioannou, a former executive with Hilton Hotels and now CEO of Orchestra Hotels & Resorts, which he formed in 2014. The 24-story Ocean Resort Residences Conrad Fort Lauderdale Beach Resort will have 290 for-sale condos and residences, including 20 oceanfront villas and three penthouses. It has 178 studio apartments that average 640 sf and start in the low $400s.

Even with so much new construction going on, Ioannou isn’t worried about the market overheating. “Exactly the opposite. Fort Lauderdale has very controlled growth at the ocean.” And he’s confident that Greater Fort Lauderdale will continue to be a magnet for homebuyers and businesses from the Northeast, Midwest, Canada, and other parts of Florida, too. “Miami Beach prices are more than double those in Fort Lauderdale,” he says about the cost of apartments in both metros.

Fort Lauderdale’s growth spurt coincides with a nearly 7% increase in this area’s population over the past decade, according to Census Bureau estimates. The University of Florida’s Bureau of Economic and Business Research has estimated that Broward County could expand to 2.46 million people by 2040, from 1.9 million in 2015.

Some 15 million tourists are expected to visit Greater Fort Lauderdale in 2016, including a significant number from South America. “As long as those countries remain OK, they will keep coming to South Florida,” predicts Ioannou.

Swindell believes his organization has played a role in this market’s development boom, starting with a “perception survey” the Alliance conducted in the mid 2000s. That pool revealed that Broward County “did not have much name recognition” and that referring to this market as Greater Fort Lauderdale had more brand equity.

So the Alliance convinced local businesses to invest in a rebranding campaign that played up the market’s plusses, which include its Triple-A bond rating and its low business taxes. The Alliance directed that campaign toward the New York metropolitan area, as well as Chicago and Boston. Since 2008, the Alliance and its business partners have spent more than $6 million on this effort.

On its website, the Alliance identifies the industries that it is tries attract to Greater Fort Lauderdale: Advanced Materials & High Tech Manufacturing, Creative Economy and Film, Global Logistics, Information and Communications Technologies, Life Sciences, and Marine. Last year, the Alliance hired a consultant to make sure it was going after the right sectors (it was, says Swindell). The market has also seen promising growth in the aviation sector, particularly on the maintenance and repair sides.

Other Florida cities, including Orlando and Miami, have their own strategies to get their share of the ongoing influx of people and businesses into the Sunshine State. But Swindell doesn’t see Florida metros as competition with Fort Lauderdale as much as places like Atlanta, Charlotte, and even Panama City.

He makes his pitch to the AEC community by pointing out that a lot of what’s going up in Greater Fort Lauderdale is “architecturally interesting,” and that projects there aren’t just being planned but are also being financed and getting built.

Related Stories

Giants 400 | Aug 21, 2022

Top 110 Architecture/Engineering Firms for 2022

Stantec, HDR, HOK, and Skidmore, Owings & Merrill top the rankings of the nation's largest architecture engineering (AE) firms for nonresidential and multifamily buildings work, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Aug 20, 2022

Top 180 Architecture Firms for 2022

Gensler, Perkins and Will, HKS, and Perkins Eastman top the rankings of the nation's largest architecture firms for nonresidential and multifamily buildings work, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Aug 19, 2022

2022 Giants 400 Report: Tracking the nation's largest architecture, engineering, and construction firms

Now 46 years running, Building Design+Construction's 2022 Giants 400 Report rankings the largest architecture, engineering, and construction firms in the U.S. This year a record 519 AEC firms participated in BD+C's Giants 400 report. The final report includes more than 130 rankings across 25 building sectors and specialty categories.

Hotel Facilities | Aug 12, 2022

Denver builds the nation’s first carbon-positive hotel

Touted as the nation’s first carbon-positive hotel, Populus recently broke ground in downtown Denver.

Hotel Facilities | Jul 28, 2022

As travel returns, U.S. hotel construction pipeline growth follows

According to the recently released United States Construction Pipeline Trend Report from Lodging Econometrics (LE), the total U.S. construction pipeline stands at 5,220 projects/621,268 rooms at the close of 2022’s second quarter, up 9% Year-Over-Year (YOY) by projects and 4% YOY by rooms.

Hotel Facilities | May 31, 2022

Checking out: Tips for converting hotels to housing

Many building owners are considering repositioning their hotels into another property type, such as senior living communities and rental apartments. Here's advice for getting started.

Sponsored | Multifamily Housing | May 8, 2022

Choosing the right paver system for rooftop amenity spaces

This AIA course by Hoffmann Architects offers best practices for choosing the right paver system for rooftop amenity spaces in multifamily buildings.

Sponsored | BD+C University Course | May 3, 2022

For glass openings, how big is too big?

Advances in glazing materials and glass building systems offer a seemingly unlimited horizon for not only glass performance, but also for the size and extent of these light, transparent forms. Both for enclosures and for indoor environments, novel products and assemblies allow for more glass and less opaque structure—often in places that previously limited their use.

Hotel Facilities | Apr 25, 2022

U.S. hotel construction pipeline up 2%, with 5,090 projects in the works

The total U.S. hotel construction pipeline stands at 5,090 projects and 606,302 rooms at the end of the first quarter of 2022, up 2% by projects, but down 3% by rooms, according to the Q1 2022 Construction Pipeline Trend Report for the United States from Lodging Econometrics (LE).

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.