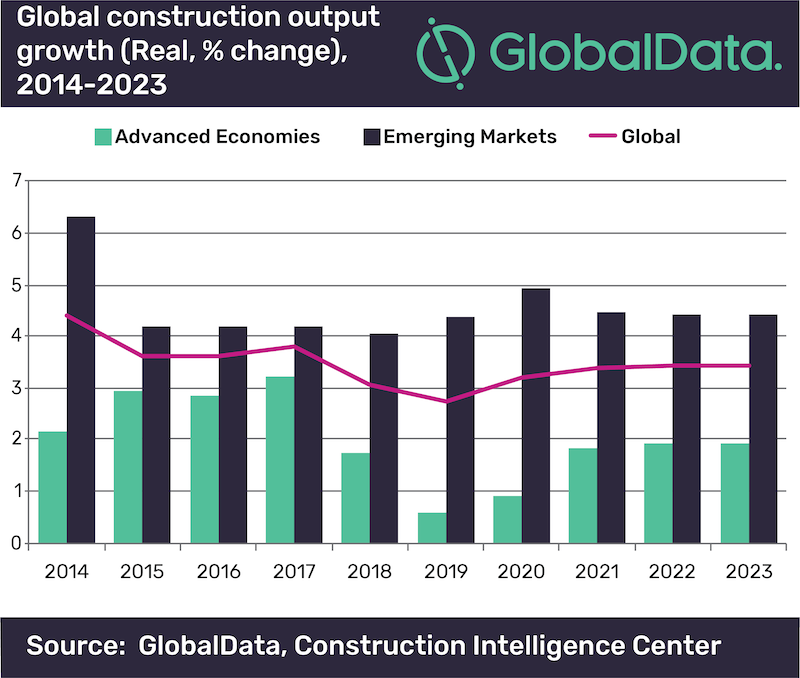

The deterioration in construction output growth across emerging markets has been worse than previously expected, particularly in the US and the Middle East. Therefore, the forecast for global construction output growth in 2019 has been revised down to 2.7%, which will be the slowest pace of growth in a decade, according to GlobalData, a leading data and analytics company.

GlobalData’s central forecast sees global construction output growth increase to 3.2% in 2020 and then stabilize at 3.4% over the remainder of the forecast period, which runs to 2023. According to the company’s latest report, ‘Global Construction Outlook to 2023 – Q3 2019 Update’, this is partly driven by a projected improvement in the global economy in 2020, which in turn relies on improvements in financial market sentiment and stabilization in some of the larger currently-troubled emerging markets.

Danny Richards, Lead Economist at GlobalData, comments: “Some major advanced economies have struggled to generate growth momentum, including the US, the UK and Australia. In China, where the authorities are stepping up investment in infrastructure to prevent a continued slowdown, growth will remain positive, contributing to a slight acceleration in growth in total output in the emerging markets.”

Richards continues: “Geopolitical risks are intensifying, which could potentially undermine investor confidence and disrupt capital flows in the early part of the forecast period. Risks to the overall forecast stem primarily from a possible escalation in the trade war between the US and China, as well as inflamed tensions between the US and Iran following the recent drone strikes on Saudi Arabia’s largest oil processing center, which were blamed on Iran.

“The emerging markets of South-East Asia will invest heavily in new infrastructure projects, supported by private investment, and this region will be the fastest growing, expanding by 6.4% between 2019 and 2023.”

Information based on GlobalData’s report: ‘Global Construction Outlook to 2023 – Q3 2019 Update.

Related Stories

Codes and Standards | Oct 26, 2022

‘Landmark study’ offers key recommendations for design-build delivery

The ACEC Research Institute and the University of Colorado Boulder released what the White House called a “landmark study” on the design-build delivery method.

Building Team | Oct 26, 2022

The U.S. hotel construction pipeline shows positive growth year-over-year at Q3 2022 close

According to the third quarter Construction Pipeline Trend Report for the United States from Lodging Econometrics (LE), the U.S. construction pipeline stands at 5,317 projects/629,489 rooms, up 10% by projects and 6% rooms Year-Over-Year (YOY).

Designers | Oct 19, 2022

Architecture Billings Index moderates but remains healthy

For the twentieth consecutive month architecture firms reported increasing demand for design services in September, according to a new report today from The American Institute of Architects (AIA).

Market Data | Oct 17, 2022

Calling all AEC professionals! BD+C editors need your expertise for our 2023 market forecast survey

The BD+C editorial team needs your help with an important research project. We are conducting research to understand the current state of the U.S. design and construction industry.

Market Data | Oct 14, 2022

ABC’s Construction Backlog Indicator Jumps in September; Contractor Confidence Remains Steady

Associated Builders and Contractors reports today that its Construction Backlog Indicator increased to 9.0 months in September, according to an ABC member survey conducted Sept. 20 to Oct. 5.

Market Data | Oct 12, 2022

ABC: Construction Input Prices Inched Down in September; Up 41% Since February 2020

Construction input prices dipped 0.1% in September compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Laboratories | Oct 5, 2022

Bigger is better for a maturing life sciences sector

CRB's latest report predicts more diversification and vertical integration in research and production.

Market Data | Aug 25, 2022

‘Disruptions’ will moderate construction spending through next year

JLL’s latest outlook predicts continued pricing volatility due to shortages in materials and labor

Market Data | Aug 2, 2022

Nonresidential construction spending falls 0.5% in June, says ABC

National nonresidential construction spending was down by 0.5% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Jul 28, 2022

The latest Beck Group report sees earlier project collaboration as one way out of the inflation/supply chain malaise

In the first six months of 2022, quarter-to-quarter inflation for construction materials showed signs of easing, but only slightly.