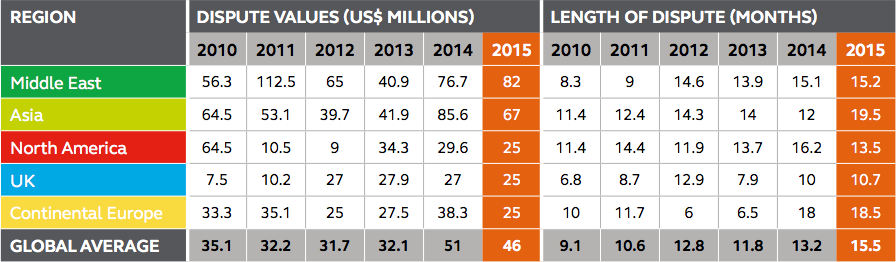

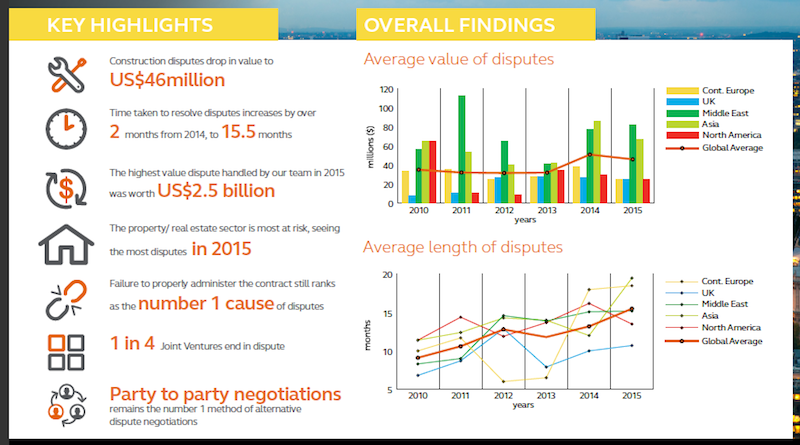

Most construction disputes are settled before they erupt into migraine-inducing litigation. But global asset volatility, currency turbulence, and the loss of economic momentum globally, have made dispute resolution tougher to reach amicably. And, in fact, for the third consecutive year, the length of disputes rose in 2015, according to a new report by Arcadis, the international design and consultancy firm, based on an in-depth review of projects that the firm’s Contract Solutions team handled last year.

Arcadis, which is active in 70 countries, defines a dispute as a “situation where two parties typically differ in the assertion of a contractual right.” Last year, the value of disputes fell by nearly 11% to an average of $46 million. However, the length of time it took to resolve these conflicts increased to a record average of 15.2 months, compared to 13.2 months in 2014 and 11.8 months in 2013.

The highest value dispute that Arcadis handled last year was worth a whopping $2.5 billion. (The firm did not state where that dispute arose.)

Contractual disputes took longer to mediate for the third consecutive year in 2015. The No. 1 cause for disputes continues to be faulty contract administration. Image: Arcadis “Global Construction Dispute Report 2016.”

Contractual disputes took longer to mediate for the third consecutive year in 2015. The No. 1 cause for disputes continues to be faulty contract administration. Image: Arcadis “Global Construction Dispute Report 2016.”

“The increased length of disputes will have multiple effects for both parties and are likely to, ultimately, have a negative impact on the construction industry,” Arcadis cautions in its report.

The No. 1 cause for disputes was failure to properly administer a contract, followed by a poorly written draft and unsubstantiated claims. The property/real estate sector had the most disputes, followed by the social infrastructure/public sector. Arcadis notes, ruefully, that more than one-quarter of joint ventures end in disputes.

Party-to-party negotiation is still the most common form of resolving disputes. And the best ways to avoid disputes in the first place is to make sure the contract is administered properly, the documents are accurate, and the contract has fair and appropriate risk and balances.

While the number of disputes in North America was up last year, their average values and lengths dipped. The value of disputes last year averaged $25 million, a 15.5% drop from the previous year. And the length of disputes in North America was down by nearly three months, to an average of 13.5 months compared to 16.2 in 2014.

Arcadis notes that the U.S. was the only global region to achieve both a decrease in construction dispute values and length of time to resolve disputes last year. “But there is one downside,” notes Roy Cooper, a Vice President for Arcadis North America. “Even though more disputes are being settled early, the ones that remain grow into complicated, emotional affairs, with large damages at stake. These also take longer to resolve, since U.S. courts hate to try construction cases due to their large volumes of documents and greater complexity.”

In North America, errors and omissions in contracts documents are the most common reasons for disputes.

“We expect that the decline in duration and value will continue into 2016 as the industry [in North America] continues to recognize the importance of addressing disputes early in their lifecycle, and contracts are written with provisions giving strict instruction on how and when to address disputes,” writes Arcadis.

Conversely, the Middle East now surpasses Asia as Dispute Central when it comes to contractual disagreements. The average dispute value in that region jumped by 6.9% last year to $82 million, and the length of disputes rose marginally to an average of 15.2 months.

Disputes drag out even longer in Continental Europe, which averaged 18.5 months last year. “Conflicting party interests” was cited by Arcadis as the No. 1 cause for disputes.

Joint ventures are most vulnerable to contract disputes. And the Middle East far exceeds global averages in the value and lenght of its construction disputes. Image: Arcadis “Global Construction Dispute Report 2016.”

Related Stories

Market Data | Jan 31, 2017

AIA foresees nonres building spending increasing, but at a slower pace than in 2016

Expects another double-digit growth year for office construction, but a more modest uptick for health-related building.

High-rise Construction | Jan 23, 2017

Growth spurt: A record-breaking 128 buildings of 200 meters or taller were completed in 2016

This marks the third consecutive record-breaking year for building completions over 200 meters.

Market Data | Jan 18, 2017

Fraud and risk incidents on the rise for construction, engineering, and infrastructure businesses

Seven of the 10 executives in the sector surveyed in the report said their company fell victim to fraud in the past year.

Market Data | Jan 18, 2017

Architecture Billings Index ends year on positive note

Architecture firms close 2016 with the strongest performance of the year.

Market Data | Jan 12, 2017

73% of construction firms plan to expand their payrolls in 2017

However, many firms remain worried about the availability of qualified workers.

Market Data | Jan 9, 2017

Trump market impact prompts surge in optimism for U.S. engineering firm leaders

The boost in firm leader optimism extends across almost the entire engineering marketplace.

Market Data | Jan 5, 2017

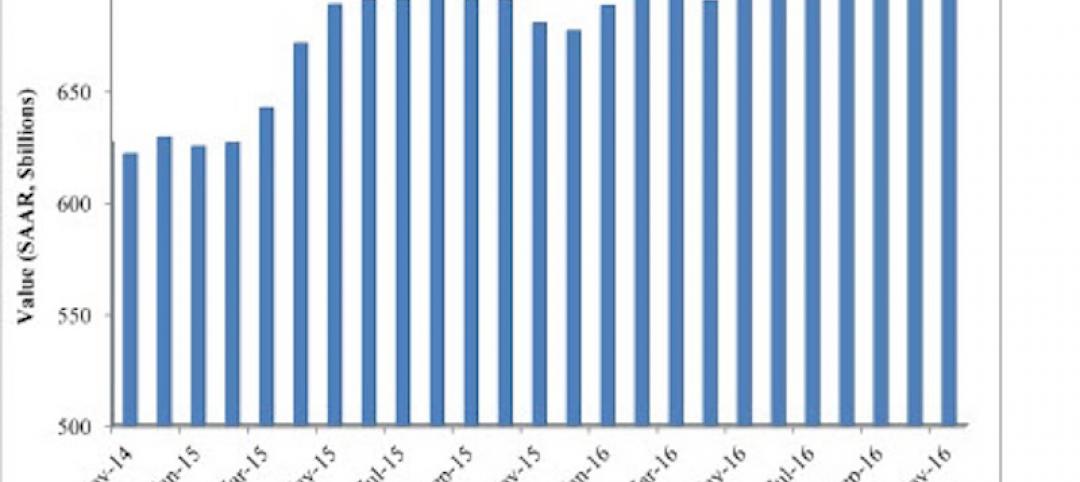

Nonresidential spending thrives in strong November spending report

Many construction firms have reported that they remain busy but have become concerned that work could dry up in certain markets in 2017 or 2018, says Anirban Basu, ABC Chief Economist.

Market Data | Dec 21, 2016

Architecture Billings Index up slightly in November

New design contracts also return to positive levels, signifying future growth in construction activity.

Market Data | Dec 21, 2016

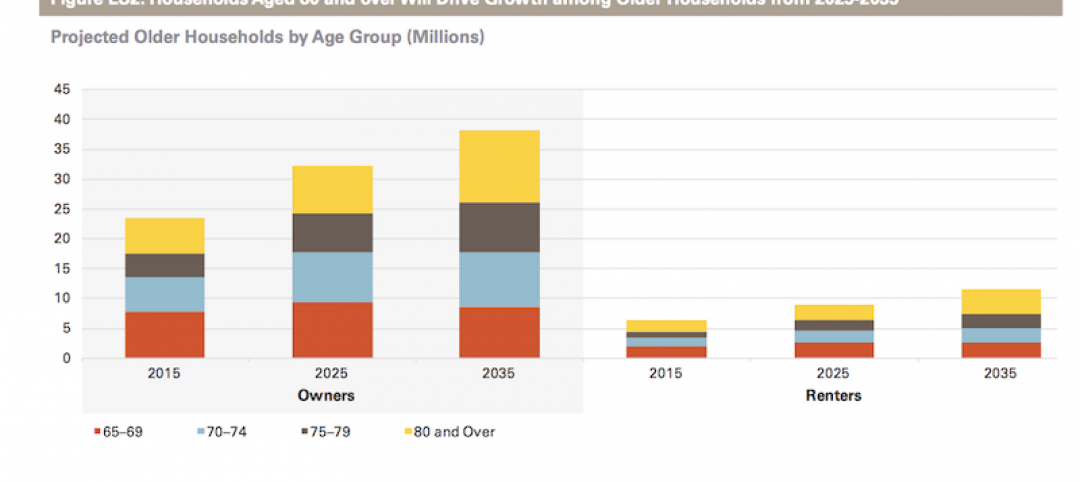

Will housing adjust to an aging population?

New Joint Center report projects 66% increase in senior heads of households by 2035.

Market Data | Dec 13, 2016

ABC predicts modest growth for 2017 nonresidential construction sector; warns of vulnerability for contractor

“The U.S. economy continues to expand amid a weak global economy and, despite risks to the construction industry, nonresidential spending should expand 3.5 percent in 2017,” says ABC Chief Economist Anirban Basu.