Through September, spending on nonresidential construction was up 9.2%, to $883.9 billion, according to preliminary estimates by the Commerce Department’s Bureau of the Census. Sectors hard-hit by the coronavirus pandemic—including lodging, retail/commercial, and even office—were showing signs of life.

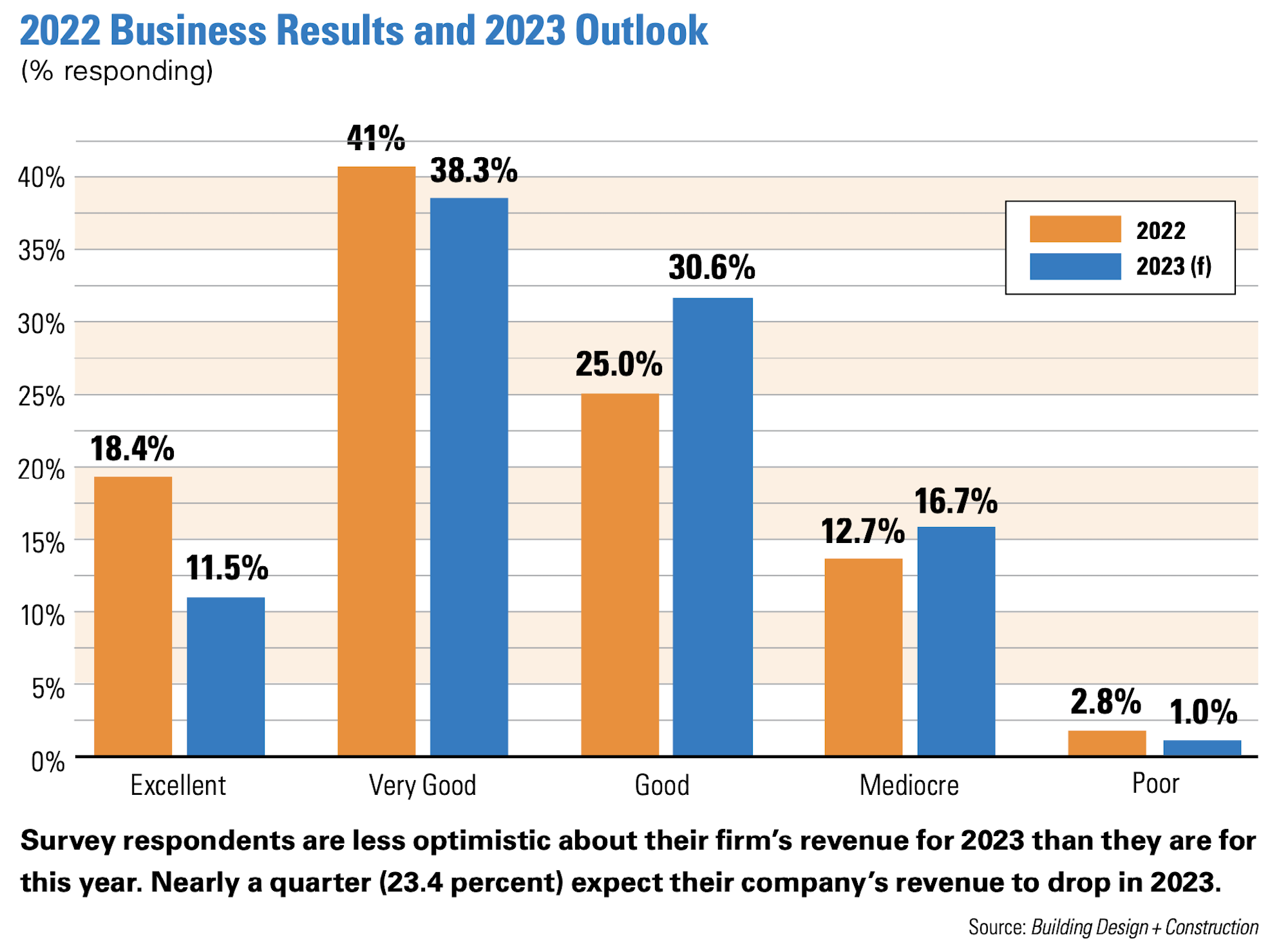

So it makes sense that a recent polling of 212 architects, engineers, contractors, and developer/owners found nearly three-fifths of respondents—59.4%—rating 2022 an “excellent” or “good” business year. Only 15.6% rated the year “mediocre” or “poor.”

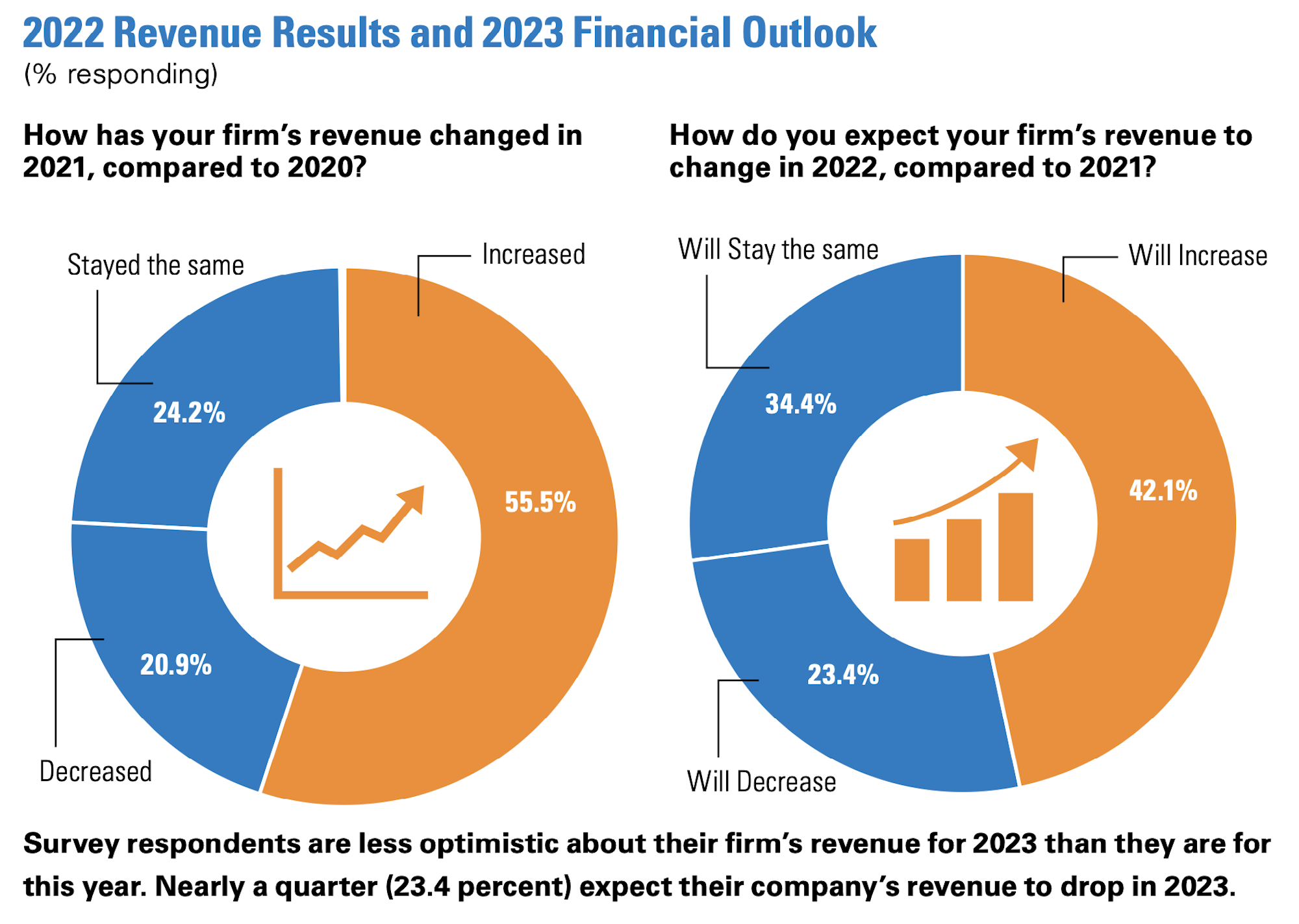

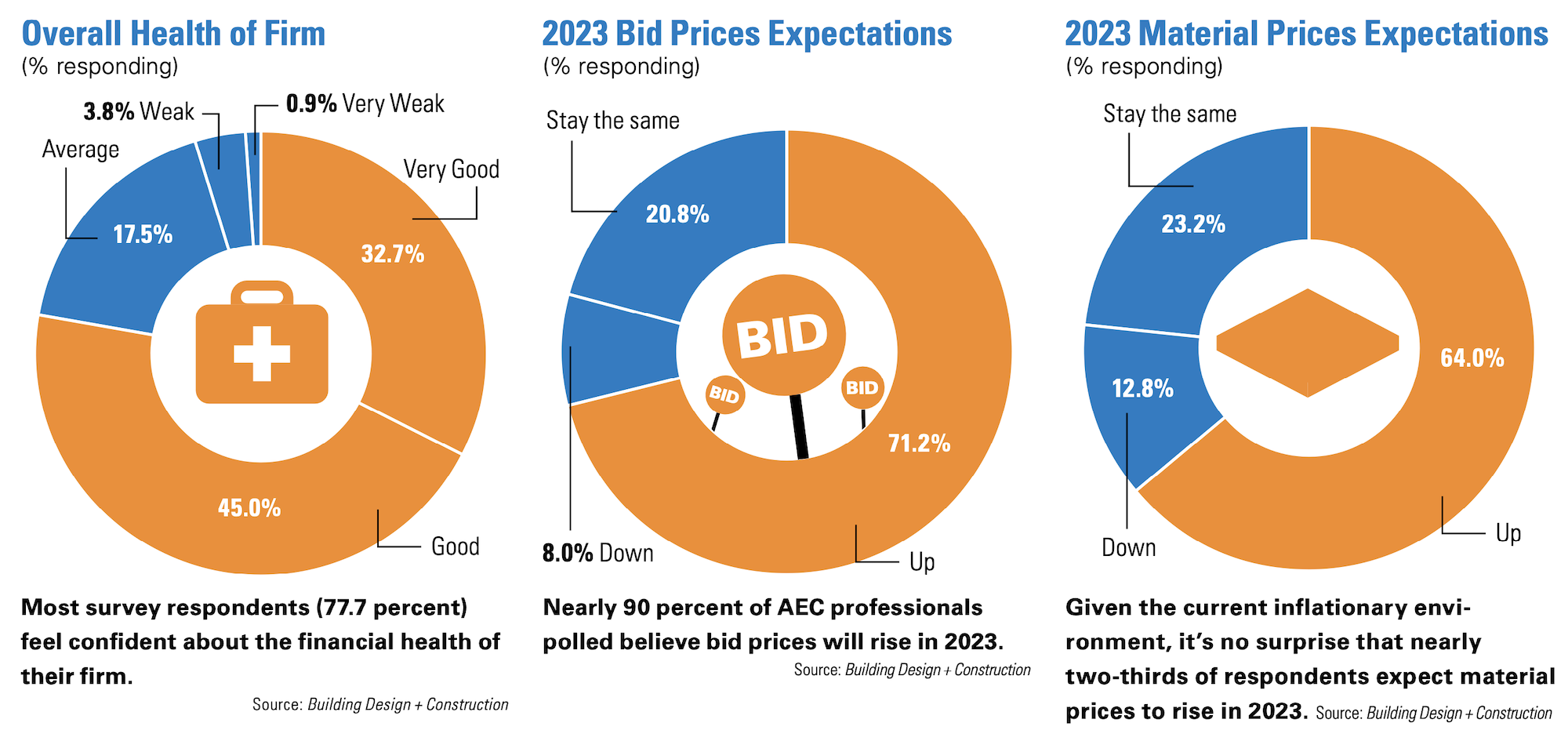

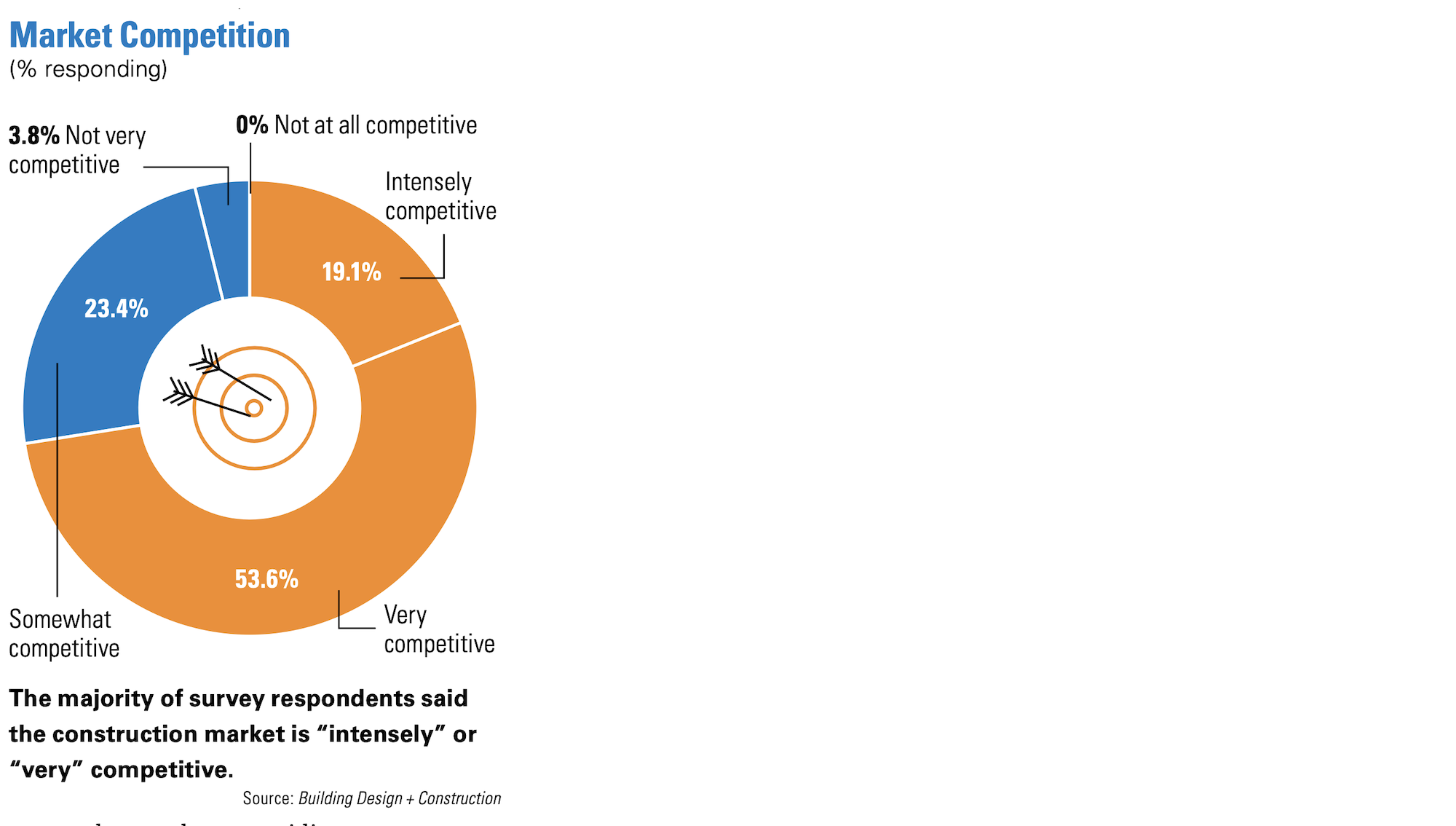

The vast majority of firms, 77.7%, rated their overall health “very good” or “good.” Conversely, only 4.7% saw their firms’ financial condition as either “weak” or “very weak.” Among the firms polled, 55% confirmed their revenue had increased, and another 20.9% said their revenue was level with last year’s. Gains were achieved despite nearly three-quarters of the firms surveyed characterizing the construction/materials market hobbled by supply-chain snags as “intensely” or “very” competitive.

Euphoria, though, might be short-lived, and firms are tempering their prognoses about the future. Nearly one-quarter—23.4%—expect their revenue to be down in 2023, and another 34.4% predict a flat year. Competition ranked third, behind general economic conditions and inflation, as the most important concern AEC firms believe they will face next year. Nearly two-thirds—64%—anticipate that materials prices will continue to rise in 2023. An even higher number, 71.2%, said they were girding for increases in bid prices for projects.

Our poll also found at least one-fifth of firms are concerned about the availability of capital funding for projects, regulations, cashflow management, and keeping their staffs motivated.

When asked about what business development strategies they planned to deploy next year, more than half—53.4%—said they would hire selectively to burnish their firms’ competitiveness, and 47.1% were planning to step up their staff training and education to enhance competitiveness.

Other business strategies these firms are plotting include increasing their marketing and public relations (25.3% of firms polled currently don’t use social media, and among that do LinkedIn is their preferred platform), investing more in technology, and creating new service or business opportunity.

U.S. design and construction firms pick their battles, sector by sector

Our survey asked AEC firms to assess their prospects in 18 construction sectors. Sizable percentages (at least 30%) were hopeful about business for airports, data centers, government/military buildings, healthcare, industrial/warehouse, multifamily and senior living residential, science + technology, and university. At least 20% of respondents saw their prospects as “average” for performing arts centers, hospitality, K-12 education, and sports and recreations. AEC firms placed offices and interior fitouts, religious, and retail/commercial in the “weak” or “very weak” categories.

Here's a closer look at their responses. Keep in mind that these firms aren’t active in every sector, so the numbers providing ratings were smaller than the total in each category. It’s also worth noting that nearly one-third of the AEC firms polled generate between 25% and 74% of their annual business from reconstruction projects:

• Healthcare appears to hold out the greatest opportunities for next year. More than 45% of respondents rated their prospects in this sector as excellent or good. Multifamily received those ratings from 43.1% or AEC firms polled, industrial/warehouse from 39.7%, and data centers from 37.8%.

• Through September, construction spending in the office sector was up only 0.7%, according to Census Bureau estimates. The AEC firms that responded to our survey aren’t anticipating a rebound in this sector any time soon: 41.3% rated their prospects weak or very week. Another 23.5% gave the same ratings to office interiors and fitouts.

Even though Census estimates that the commercial sector (which encompasses retail) was up 22.4% through September, our survey’s respondents are still taking a wait-and-see approach, as 33.3% saw their prospects in retail next year as weak or very weak.

• 29% of respondents said their firms don’t build in the retail sector. And even with the uptick in firms that have expanded their practices and services, only around 10% of our survey’s respondents see mergers or acquisitions in their immediate futures. Our survey reveals an industry whose firms, in many cases, focus on a limited array of typologies and clients, and leave other sectors to specialists.

It was not surprising that 53.2% of respondent firms aren’t building airports and 41.2% aren’t active in the religious sector. Only about half of respondent firms—46.2%—engage performing arts center projects, and 44.3% keep their distances from data centers. But even some of the broader sectors, notably education, find between 30% and 33% of respondent firms absent. Nearly two-fifths aren’t active in science + technology construction, either, and more than two-fifths don’t build in the multifamily sector.

Related Stories

Market Data | Nov 27, 2023

Number of employees returning to the office varies significantly by city

While the return-to-the-office trend is felt across the country, the percentage of employees moving back to their offices varies significantly according to geography, according to Eptura’s Q3 Workplace Index.

MFPRO+ News | Nov 21, 2023

Renters value amenities that support a mobile, connected lifestyle

Multifamily renters prioritize features and amenities that reflect a mobile, connected lifestyle, according to the National Multifamily Housing Council (NMHC) and Grace Hill 2024 Renter Preferences Survey.

Industry Research | Nov 17, 2023

Air conditioning amenity sees largest growth in Pacific Northwest region

The 2024 Renter Preferences Survey Report sheds light on the demographics, lifestyle, connectivity needs, and more for the renters of today. At the top of this list—the feature that respondents are “interested in” or “won't rent without”—is air conditioning.

Multifamily Housing | Nov 9, 2023

Multifamily project completions forecast to slow starting 2026

Yardi Matrix has released its Q4 2023 Multifamily Supply Forecast, emphasizing a short-term spike and plateau of new construction.

MFPRO+ Special Reports | Oct 27, 2023

Download the 2023 Multifamily Annual Report

Welcome to Building Design+Construction and Multifamily Pro+’s first Multifamily Annual Report. This 76-page special report is our first-ever “state of the state” update on the $110 billion multifamily housing construction sector.

Market Data | Oct 23, 2023

New data finds that the majority of renters are cost-burdened

The most recent data derived from the 2022 Census American Community Survey reveals that the proportion of American renters facing housing cost burdens has reached its highest point since 2012, undoing the progress made in the ten years leading up to the pandemic.

Giants 400 | Oct 23, 2023

Top 115 Multifamily Construction Firms for 2023

Clark Group, Suffolk Construction, Summit Contracting Group, Whiting-Turner Contracting, and McShane Companies top the ranking of the nation's largest multifamily housing sector contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue for all multifamily buildings work, including apartments, condominiums, student housing facilities, and senior living facilities.

Giants 400 | Oct 23, 2023

Top 75 Multifamily Engineering Firms for 2023

Kimley-Horn, WSP, Tetra Tech, Olsson, and Langan head the ranking of the nation's largest multifamily housing sector engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue for all multifamily buildings work, including apartments, condominiums, student housing facilities, and senior living facilities.

Giants 400 | Oct 23, 2023

Top 190 Multifamily Architecture Firms for 2023

Humphreys and Partners, Gensler, Solomon Cordwell Buenz, Niles Bolton Associates, and AO top the ranking of the nation's largest multifamily housing sector architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue for all multifamily buildings work, including apartments, condominiums, student housing facilities, and senior living facilities.

Senior Living Design | Oct 19, 2023

Senior living construction poised for steady recovery

Senior housing demand, as measured by the change in occupied units, continued to outpace new supply in the third quarter, according to NIC MAP Vision. It was the ninth consecutive quarter of growth with a net absorption gain. On the supply side, construction starts continued to be limited compared with pre-pandemic levels.