The Federal Aviation Administration’s latest report to Congress projects $32.5 billion in airport construction and renovation projects from 2017 to 2021. That would be a decrease of $1 billion, or 3%, from the FAA’s 2015 report. Since that last report, construction costs have increased 1.9%, according to the U.S. Army Corps of Engineers.

Reconstruction is expected to be the largest spending category, accounting for 35% of funding needs over the next five years. Standards development is next, projected to account for 33% of funding needs, followed by spending to expand existing airport capacity (11%), and terminal building (8%).

The 70-page National Plan of Integrated Airport Systems (NPIAS) report, based on 3,340 public-use airports tracked, identifies projects that are eligible for federal funding under the Airport Improvement Program.

Despite multibillion-dollar renovations and expansions underway at major hubs such as Los Angeles International, LaGuardia Airport in New York and Hartsdale-Jackson Atlanta International, FAA’s latest report states that large and medium hubs would be decreasing their spending, while development at small hubs is expected to increase.

FAA anticipates that airlines will continue to concentrate their schedules at their primary hubs where large numbers of flights converge in short periods of time to maximize the opportunity for passenger transfers. No new airline hubs are expected to arise within the next five years. Conversely, FAA observes that secondary airports are becoming a focus where a major hub airport is nearing capacity and is served by low-cost carriers.

At the airports tracked by NPIAS, capacity-related development continues to decrease while development to reconstruct pavement, bring airports up to design standards, and expand or rehabilitate terminal buildings are projected to increase. The national initiative to improve nonstandard surface geometry is beginning, and is anticipated that increased development costs will be captured in the next NPIAS report.

FAA concludes that the country’s airport system “is safe, convenient, well maintained.” The majority of airport capital improvements is funded by nonfederal sources, such as rents, fees, taxes paid by users, and Passenger Facility Charges (FAA’s report does not capture the costs of airport development funded primarily PFCs). Almost 98% of NPIAS airports are owned by public entities.

There are 382 primary airports in the U.S. receiving scheduled air carrier service with 10,000 or more enplaned passengers per year. Of these, FAA designates 89 as National airports, with at least 250 aircraft (including at least 30 jets) based at these ports. Within the primary total, 530 are regional airports with at least 100 based aircraft.

Non-primary airports, of which there are 2,950, handle at least 2,500 to 9,999 passengers annually, depending on their sizes.

FAA identifies eight proposed airports (two primary and six nonprimary) that are anticipated to be developed over the next five years. One of these, in the Chicago area, is still in the planning stages, A second will replace the existing site-constrained airport at Williston, N.D., a market that has been revitalized by hydraulic fracturing from oil shale.

Total enplanements in the U.S. hit an all-time high last year, 785 million passengers, with domestic enplanements representing 87% of U.S. passenger traffic at commercial service airports. However, given the turbulence among carriers over the past 15 years, air carrier operations were actually down 9% last year, based on data from 517 airport traffic control towers. Some of this is the result of better operational efficiencies, the retirement of older and less efficient aircraft, the shifting of larger aircraft to international services, and the growing use of 70- to 90-seat regional jet aircraft in place of smaller 50-seat regional jets.

FAA quotes Department of Transportation estimates that 18.9% of all flights were delayed (i.e., departed from their gates 15 minutes or later from their scheduled time) in 2015. In its Future Airport Capacity Task series, FAA identifies those airports at risk for significant delays and congestion through 2020 and 2030. These include most of the usual suspects with extraordinary capacities, such as the New York City airports, and those serving Philadelphia, Atlanta, and San Francisco.

“It remains crucial for these airports to continue their efforts to devise long-term planning solutions to address capacity constraints,” the FAA report states. “Going forward, both new runways and NextGen improvements are needed to improve efficiency at capacity-constrained airports.

The new report touches on unmanned aircraft systems (UAS), whose professional and recreational uses are growing. “The FAA’s goal is to safely integrate the UAS into the NAS [National Airspace System],” the report states. On August 29, FAA issued new rules for non-hobbyist small UAS operations, covering a broad spectrum of commercial uses for drones weighing less than 55 pounds.

FAA sees several factors affecting airports in the future, including the new generations of larger aircraft, which more airports are gearing up to receive.

Related Stories

Airports | Apr 18, 2023

India's mammoth new airport terminal takes ‘back to nature’ seriously

On January 15, 2023, Phase 1 of the Kempegowda International Airport’s Terminal 2, in Bengaluru, India, began domestic operations. The 2.75 million-sf building, designed by Skidmore, Owings & Merrill (SOM), is projected to process 25 million passengers annually, while providing its travelers with a healthier environment, thanks to extensive indoor-outdoor landscaping that offers serenity to what is normally a frenzied experience.

Architects | Apr 6, 2023

Design for belonging: An introduction to inclusive design

The foundation of modern, formalized inclusive design can be traced back to the Americans with Disabilities Act (ADA) in 1990. The movement has developed beyond the simple rules outlined by ADA regulations resulting in features like mothers’ rooms, prayer rooms, and inclusive restrooms.

Airports | Feb 28, 2023

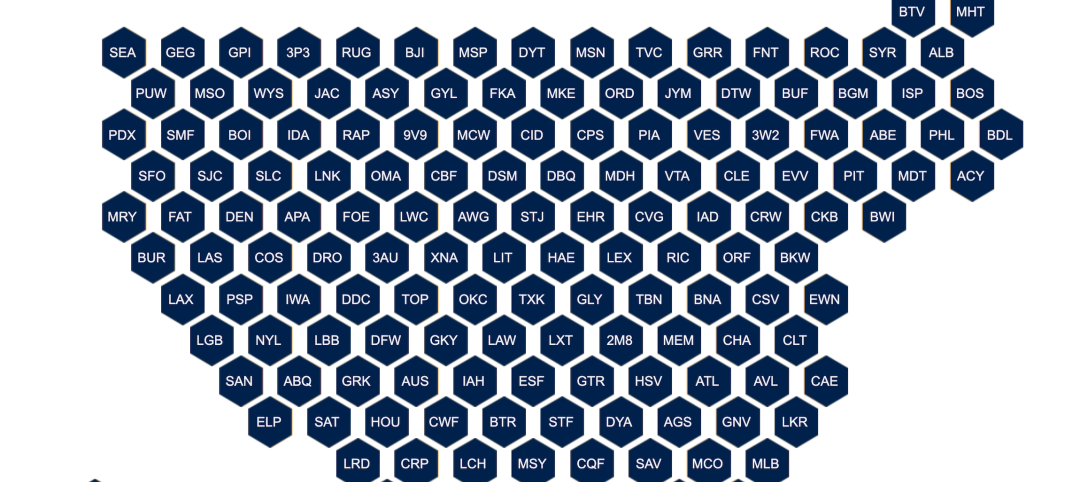

Data visualization: $1 billion earmarked for 2023 airport construction projects

Ninety-nine airports across 47 states and two territories are set to share nearly $1 billion in funding in 2023 from the Federal Aviation Administration. The funding is aimed at help airports of all sizes meet growing air travel demand, with upgrades like larger security checkpoints and more reliable and faster baggage systems.

Intelligent Lighting | Feb 13, 2023

Exploring intelligent lighting usage in healthcare, commercial facilities

SSR's Todd Herrmann, PE, LEEP AP, explains intelligent lighting's potential use cases in healthcare facilities and more.

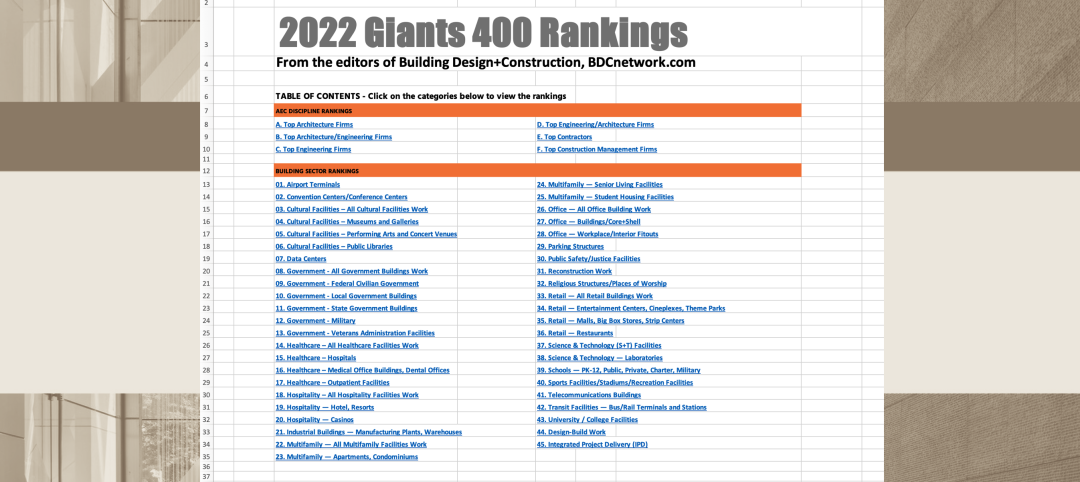

Giants 400 | Feb 9, 2023

New Giants 400 download: Get the complete at-a-glance 2022 Giants 400 rankings in Excel

See how your architecture, engineering, or construction firm stacks up against the nation's AEC Giants. For more than 45 years, the editors of Building Design+Construction have surveyed the largest AEC firms in the U.S./Canada to create the annual Giants 400 report. This year, a record 519 firms participated in the Giants 400 report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Feb 6, 2023

2022 Reconstruction Sector Giants: Top architecture, engineering, and construction firms in the U.S. building reconstruction and renovation sector

Gensler, Stantec, IPS, Alfa Tech, STO Building Group, and Turner Construction top BD+C's rankings of the nation's largest reconstruction sector architecture, engineering, and construction firms, as reported in the 2022 Giants 400 Report.

Cladding and Facade Systems | Dec 20, 2022

Acoustic design considerations at the building envelope

Acentech's Ben Markham identifies the primary concerns with acoustic performance at the building envelope and offers proven solutions for mitigating acoustic issues.

Digital Twin | Nov 21, 2022

An inside look at the airport industry's plan to develop a digital twin guidebook

Zoë Fisher, AIA explores how design strategies are changing the way we deliver and design projects in the post-pandemic world.

Giants 400 | Nov 14, 2022

Top 65 Airport Terminal Engineering + EA Firms for 2022

AECOM, Jacobs, Arup, and Burns & McDonnell head the ranking of the nation's largest airport terminal engineering and engineering/architecture (EA) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Nov 14, 2022

Top 60 Airport Terminal Contractors + CM Firms for 2022

Hensel Phelps, Turner Construction, Walsh Group, and Holder Construction top the ranking of the nation's largest airport terminal contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.