In the third quarter of 2021, analysts at Lodging Econometrics (LE) report that the top five markets with the largest total hotel construction pipelines by projects are: Dallas with 147 projects/17,711 rooms, Atlanta with 139 projects/18,659 rooms, Los Angeles with 133 projects/22,145 rooms, New York City with 130 projects/22,417 rooms, and Houston, with 90 projects/9,225 rooms. These top five markets account for 13% of the projects and 15% of rooms in the total U.S. pipeline.

The top 25 U.S. markets account for 33% of all pipeline projects and 37% of all rooms in the U.S. hotel construction pipeline. There are currently nine markets in the United States that have 20 or more projects under construction in their pipelines. Markets with the greatest number of projects already in the ground are New York with 95 projects/16,516 rooms, Atlanta with 33 projects/5,311 rooms, Dallas with 31 projects/4,399 rooms, Los Angeles with 30 projects/4,954 rooms, and Austin with 28 projects/3,577 rooms. Atlanta has the greatest number of projects scheduled to start construction in the next 12 months, with 54 projects/7,529 rooms. Dallas follows with 48 projects/5,643 rooms, and then Los Angeles with 47 projects/7,343 rooms, Phoenix with 44 projects/4,834 rooms, and Houston with 42 projects/3,748 rooms. The top five markets with the greatest number of projects in the early planning stage at the end of the third quarter are Dallas with 68 projects/7,669 rooms, Los Angeles with 56 projects/9,848 rooms, Atlanta with 52 projects/5,819, Orlando with 41 projects/7,754 rooms, and Washington D.C. with 40 projects/7,310 rooms.

The increased demand for building materials and shortages in supply, in the wake of the COVID-19 pandemic, has led to higher prices and continues to be major hurdles for contractors, developers, and investors. Nevertheless, in the third quarter, Dallas has the highest number of new projects announced into the pipeline with 18 projects/1,756 rooms. Atlanta follows with 17 projects/1,777 rooms, Phoenix with 10 projects/1,819 rooms, and then Houston with 9 projects/946 rooms.

The renovation and conversion pipeline shows no sign of decline. Presently, there are 1,253 hotels/176,305 rooms under renovation or conversion across the U.S., and twenty-four of the top 50 markets in the U.S. currently have 10 or more hotels undergoing renovation or conversion activity at the end of Q3‘21.

In the first three quarters of 2021, the U.S. opened 665 new hotels with 85,306 rooms. The markets with the highest number of new openings throughout the first three quarters are New York City with 21 hotels/3,554 rooms, Atlanta with 21 hotels/2,925 rooms, Orlando with 19 hotels/2,908 rooms, Houston with 16 hotels/2,166 rooms and Nashville with 16 hotels/2,116 rooms. In Q3, alone, the top 50 markets in the U.S. saw 98 hotels /15,454 rooms open. The U.S. had 189 hotels/25,995 rooms total open in the third quarter.

In 2021, New York City is forecasted to open 51 new hotels and 7,074 rooms, Atlanta follows with 25 hotels/3,499 rooms, then Nashville with 23 hotels/3,011 rooms, Houston with 23 hotels/2,787 rooms, and Orlando with 21 hotels/3,393 rooms. U.S. supply growth is forecasted to be 2.0% in 2021 and is expected to remain the same into 2022.

Related Stories

Market Data | Sep 19, 2018

August architecture firm billings rebound as building investment spurt continues

Southern region, multifamily residential sector lead growth.

Market Data | Sep 18, 2018

Altus Group report reveals shifts in trade policy, technology, and financing are disrupting global real estate development industry

International trade uncertainty, widespread construction skills shortage creating perfect storm for escalating project costs; property development leaders split on potential impact of emerging technologies.

Market Data | Sep 17, 2018

ABC’s Construction Backlog Indicator hits a new high in second quarter of 2018

Backlog is up 12.2% from the first quarter and 14% compared to the same time last year.

Market Data | Sep 12, 2018

Construction material prices fall in August

Softwood lumber prices plummeted 9.6% in August yet are up 5% on a yearly basis (down from a 19.5% increase year-over-year in July).

Market Data | Sep 7, 2018

Safety risks in commercial construction industry exacerbated by workforce shortages

The report revealed 88% of contractors expect to feel at least a moderate impact from the workforce shortages in the next three years.

Market Data | Sep 5, 2018

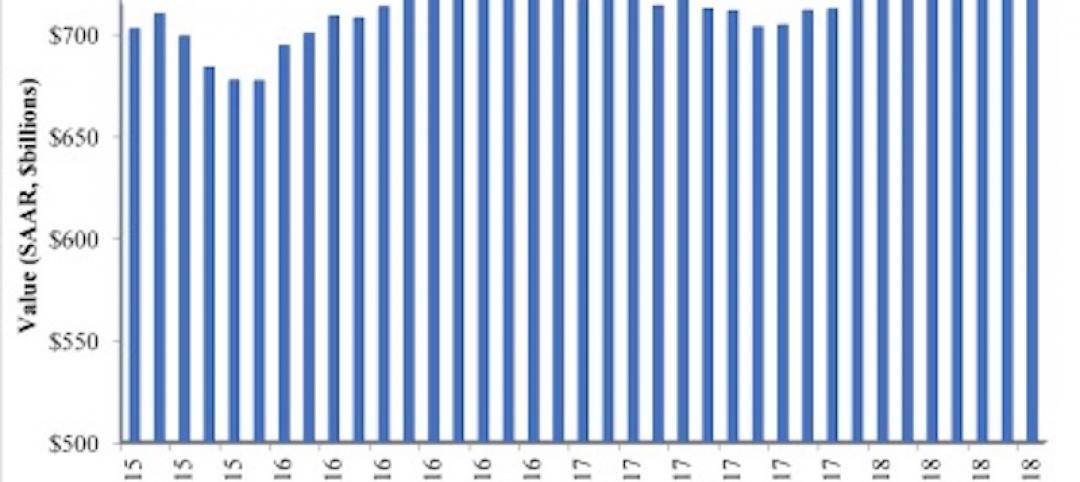

Public nonresidential construction up in July

Private nonresidential spending fell 1% in July, while public nonresidential spending expanded 0.7%.

Market Data | Aug 30, 2018

Construction in ASEAN region to grow by over 6% annually over next five years

Although there are disparities in the pace of growth in construction output among the ASEAN member states, the region’s construction industry as a whole will grow by 6.1% on an annual average basis in the next five years.

Market Data | Aug 22, 2018

July architecture firm billings remain positive despite growth slowing

Architecture firms located in the South remain especially strong.

Market Data | Aug 15, 2018

National asking rents for office space rise again

The rise in rental rates marks the 21st consecutive quarterly increase.