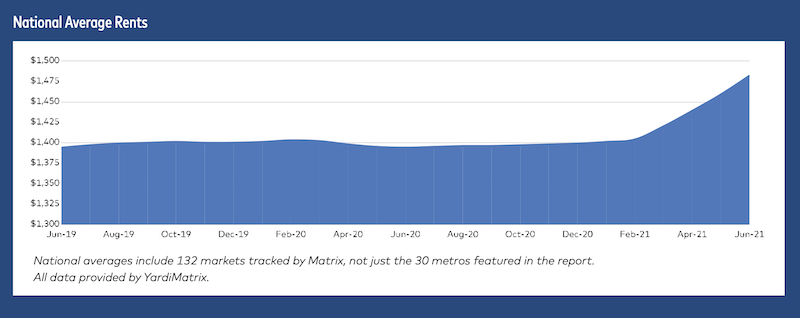

Multifamily asking rents jumped an average of 6.3% year-over-year in June, the largest leap ever recorded by Yardi Matrix, a leading industry data tracker. The national average apartment rent increased $23 last month to $1,482, another record, and single-family home rents were up 11% year-over-year.

“These are the largest year-over-year and monthly increases in the history of our data set,” said Jeff Adler, vice president of Yardi Matrix. Analysts point to increased household savings and government stimulus funding as factors that have kept the multifamily industry stable during the pandemic period, and now able to rebound as the economy improves.

The newly released data is an economic indicator of post-pandemic recovery across the U.S. The largest increases were documented in the lifestyle apartment sector. Renters are also now returning to many gateway markets that saw outbound migration for most of the last year. A supercharged housing market is also pricing out some potential buyers, leading residents to remain in apartments.

“Rent growth will not be able to continue at these levels indefinitely, but conditions for above-average growth are likely to persist for months,” Adler said. The increases reflect growth in what landlords are asking for unleased apartments. Renters renewing leases may also be seeing increased rents, but at lower levels.

Migration is pushing up rents in Southwest and Southeast metros like Phoenix (17.0%), Tampa and California’s Inland Empire (both 15.1%), Las Vegas (14.6%) and Atlanta (13.3%). These metros were lower cost compared to larger gateway metros.

Some takeaways from the Yardi Matrix report:

• Multifamily asking rents increased by 6.3% on a year-over-year basis in June, the largest YoY increase in the history of our data set. Out of our top 30 markets, 27 had positive YoY rent growth.

• Rents grew an astonishing $23 in June to $1,482—another record-breaking increase. Lifestyle rents are growing at a faster pace than Renter-by-Necessity rents, something we have not seen since 2011 and another sign of a hot market.

• Phoenix (17.0%), Tampa and the Inland Empire (both 15.1%) topped the list with unprecedented year-over-year rent growth. Nine of the top 30 markets had double-digit YoY rent growth in June, driven by strong migration to these metros.

• Year-over-year Lifestyle rents (7.2%) grew faster than Renter-by-Necessity rents (5.8%) in June for the first time since 2011. Renters have benefited from increased government support, strong wage growth and increased

• Single-family (Built-to-Rent) rents grew even faster, at an 11% year-over-year pace

• Rents increased nationally by 1.6% in June on a month-over-month basis. For the third month in a row, all 30 metros had positive month-over-month rent growth.

• Tampa, Phoenix (both 2.5%), Austin (2.4%), and Miami (2.3%) had the strongest MoM gains.

Related Stories

Modular Building | Feb 16, 2020

On the West Coast, prefab gains ground for speedier construction

Gensler has been working with component supplier Clark Pacific on several projects.

AEC Tech | Feb 13, 2020

Exclusive research: Download the final report for BD+C's Giants 300 Technology and Innovation Study

This survey of 130 of the nation's largest architecture, engineering, and construction firms tracks the state of AEC technology adoption and innovation initiatives at the AEC Giants.

Office Buildings | Feb 11, 2020

Forget Class A: The opportunity is with Class B and C office properties

There’s money to be made in rehabbing Class B and Class C office buildings, according to a new ULI report.

Architects | Feb 6, 2020

NBBJ acquires immersive technology design studio ESI Design

NBBJ has acquired experience design studio ESI Design. The acquisition signals a new era where buildings will be transformed into immersive and interactive digital experiences that engage and delight.

Sponsored | HVAC | Feb 3, 2020

Reliable Building Systems Increase Net Operating Income by Retaining Tenants

Tenants increasingly expect a well-crafted property that feels unique, authentic, and comfortable—with technologically advanced systems and spaces that optimize performance and encourage collaboration and engagement. The following guidance will help owners and property managers keep tenants happy.

Architects | Jan 29, 2020

Frank Lloyd Wright’s architecture school is closing

The school was established in 1932.

Libraries | Jan 23, 2020

Information or community center: The next generation of libraries must be both

Are libraries still relevant in a digital world?

Green | Jan 10, 2020

How the new EC3 tool raises the bar on collective action

Nearly 50 AEC industry organizations partnered to develop the groundbreaking Embodied Carbon in Construction Calculator.

Architects | Jan 9, 2020

AIA selects recipients for the 2020 Regional & Urban Design Awards

The 2020 Regional & Urban Design program recognizes the best in urban design, regional and city planning and community development.

Building Technology | Jan 7, 2020

Tariff whiplash for bifacial solar modules

Bifacial solar systems offer many advantages over traditional systems.