A small increase in total construction spending in September masked a widening gap between declines in most nonresidential segments and robust gains in residential construction, according to an analysis by the Associated General Contractors of America of government data released today. Association officials warned nonresidential construction is headed for an even steeper slump unless officials in Washington enact relief promptly, noting that their latest industry survey found three out of four respondents had experienced a postponed or cancelled project since the start of the pandemic.

“The September spending report shows the gulf between housing and nonresidential markets is growing steadily wider,” said Ken Simonson, the association’s chief economist. “In our October survey, 75% of respondents reported a postponed or cancelled project, up from 60% in August and 32% in June.”

Construction spending in September totaled $1.41 trillion at a seasonally adjusted annual rate, an increase of 0.3% from the pace in August and 1.5% higher than in September 2019. Private and public nonresidential spending slumped by a combined 1.6% since August and 4.4% from a year earlier, while private residential spending climbed by 2.8% for the month and 9.9% year-over-year.

Private nonresidential construction spending declined for the third consecutive month, falling 1.5% from August to September, with decreases in nine out of 11 categories. The largest private nonresidential segment, power construction, declined 2.2% for the month. Among the other large private nonresidential project types, commercial construction—comprising retail, warehouse and farm structures—slid 1.9%, manufacturing construction declined 2.1%, and office construction rose 0.3%. Simonson noted that the office figure was likely inflated by inclusion of data centers, a segment that appears to have held up well.

Public construction spending fell 1.7% in September, the fourth monthly decline in a row. The largest public category, highway and street construction, tumbled 5.4% for the month. Among other large public segments, educational construction increased 2.0% for the month, while transportation construction dipped 0.3%.

Private residential construction spending increased for the fourth-straight month, rising 2.8% in September. Single-family homebuilding soared 5.7% for the month, while multifamily construction spending rose 1.2% and residential improvements declined 0.4%.

Association officials noted that the coronavirus was having a significant, negative impact on most commercial construction firms. In addition to widespread project delays and cancellations, the association’s recent survey found most contractors do not expect to expand their headcount during the next 12 months because of the pandemic. Many contractors report they are looking to Washington to enact new infrastructure investments and liability reforms to offset the ongoing impacts of the coronavirus.

“The pandemic is suppressing demand for new office buildings, hotels and shopping centers even while it inspires many people to build bigger homes,” said Stephen E. Sandherr, the association’s chief executive officer. “Without new federal investments in infrastructure and other needed relief measures, commercial firms will have a hard time retaining staff or investing in new equipment and supplies.”

Related Stories

Contractors | Feb 14, 2023

The average U.S. contractor has nine months worth of construction work in the pipeline

Associated Builders and Contractors reports today that its Construction Backlog Indicator declined 0.2 months to 9.0 in January, according to an ABC member survey conducted Jan. 20 to Feb. 3. The reading is 1.0 month higher than in January 2022.

Office Buildings | Feb 9, 2023

Post-Covid Manhattan office market rebound gaining momentum

Office workers in Manhattan continue to return to their workplaces in sufficient numbers for many of their employers to maintain or expand their footprint in the city, according to a survey of more than 140 major Manhattan office employers conducted in January by The Partnership for New York City.

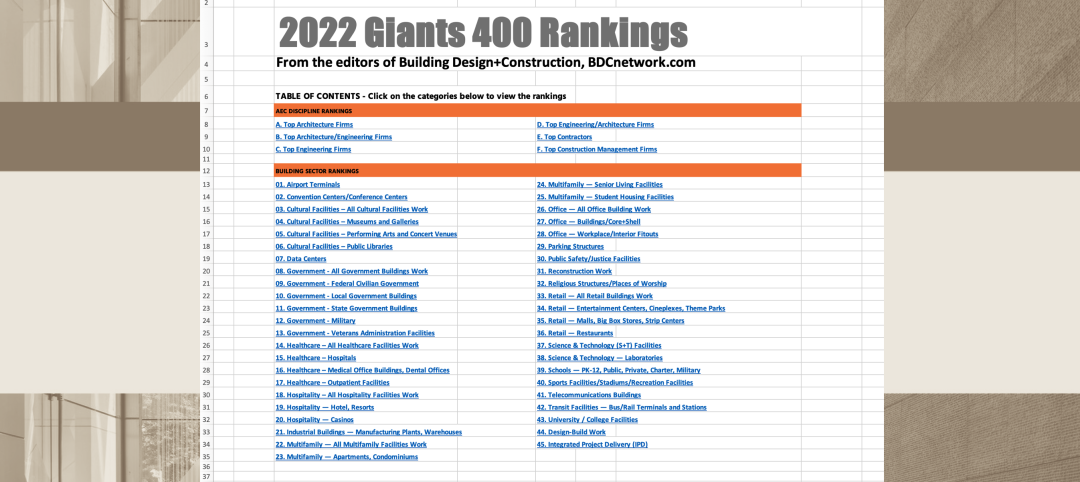

Giants 400 | Feb 9, 2023

New Giants 400 download: Get the complete at-a-glance 2022 Giants 400 rankings in Excel

See how your architecture, engineering, or construction firm stacks up against the nation's AEC Giants. For more than 45 years, the editors of Building Design+Construction have surveyed the largest AEC firms in the U.S./Canada to create the annual Giants 400 report. This year, a record 519 firms participated in the Giants 400 report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Multifamily Housing | Feb 7, 2023

Multifamily housing rents flat in January, developers remain optimistic

Multifamily rents were flat in January 2023 as a strong jobs report indicated that fears of a significant economic recession may be overblown. U.S. asking rents averaged $1,701, unchanged from the prior month, according to the latest Yardi Matrix National Multifamily Report.

Market Data | Feb 6, 2023

Nonresidential construction spending dips 0.5% in December 2022

National nonresidential construction spending decreased by 0.5% in December, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $943.5 billion for the month.

Architects | Jan 23, 2023

PSMJ report: The fed’s wrecking ball is hitting the private construction sector

Inflation may be starting to show some signs of cooling, but the Fed isn’t backing down anytime soon and the impact is becoming more noticeable in the architecture, engineering, and construction (A/E/C) space. The overall A/E/C outlook continues a downward trend and this is driven largely by the freefall happening in key private-sector markets.

Hotel Facilities | Jan 23, 2023

U.S. hotel construction pipeline up 14% to close out 2022

At the end of 2022’s fourth quarter, the U.S. construction pipeline was up 14% by projects and 12% by rooms year-over-year, according to Lodging Econometrics.

Products and Materials | Jan 18, 2023

Is inflation easing? Construction input prices drop 2.7% in December 2022

Softwood lumber and steel mill products saw the biggest decline among building construction materials, according to the latest U.S. Bureau of Labor Statistics’ Producer Price Index.

Market Data | Jan 10, 2023

Construction backlogs at highest level since Q2 2019, says ABC

Associated Builders and Contractors reports today that its Construction Backlog Indicator remained unchanged at 9.2 months in December 2022, according to an ABC member survey conducted Dec. 20, 2022, to Jan. 5, 2023. The reading is one month higher than in December 2021.

Market Data | Jan 6, 2023

Nonresidential construction spending rises in November 2022

Spending on nonresidential construction work in the U.S. was up 0.9% in November versus the previous month, and 11.8% versus the previous year, according to the U.S. Census Bureau.