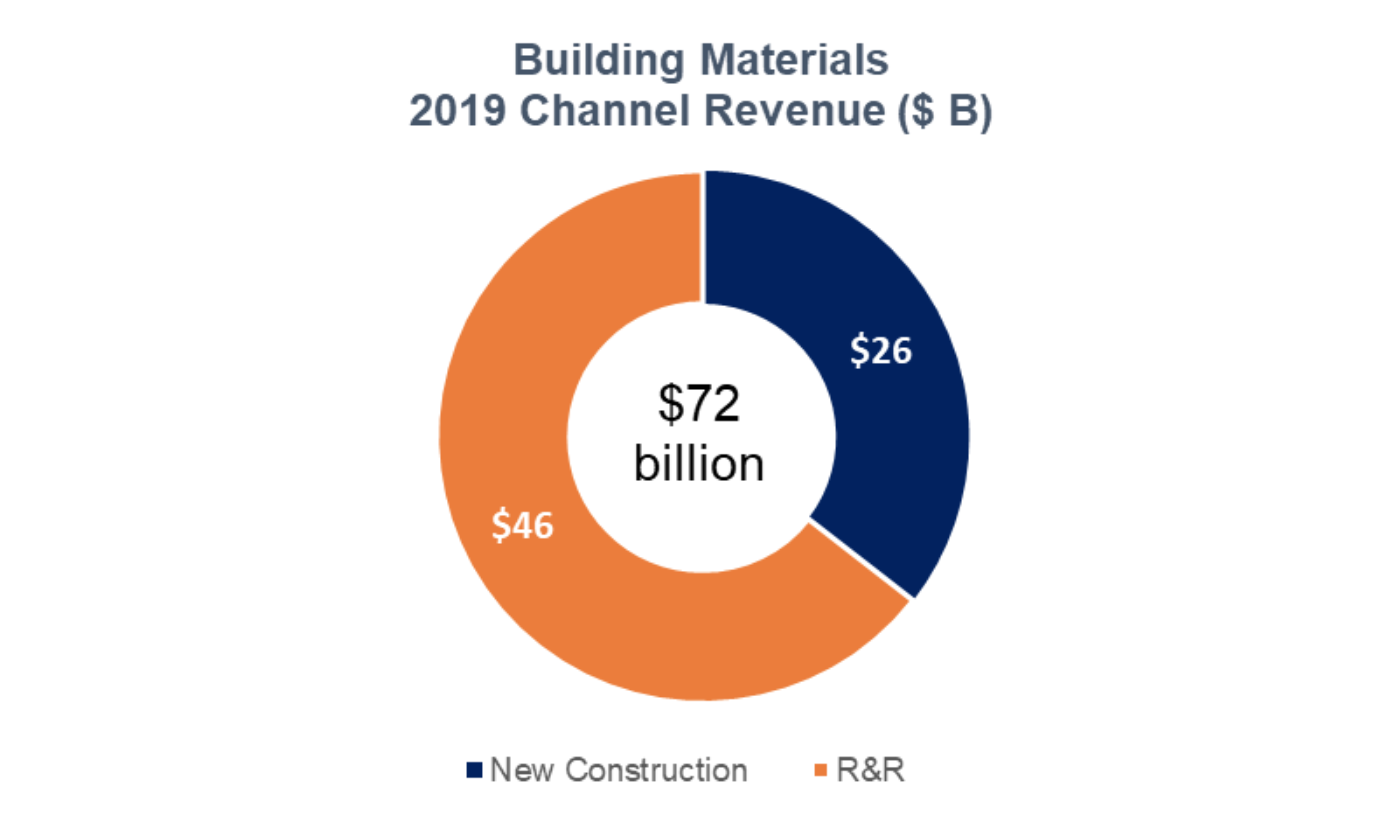

Principia, a provider of business insights to the building materials and business construction industry, tracks $72 billion of residential revenue sold in selected building product categories (roofing, siding, exterior trim, windows, doors, decking, railing, and insulation) through the lumber and building materials (LBM) channel in 2019. Remodeling and repair represented $46 billion (over 64%) of channel revenues, with new construction accounting for $26 billion.

Principia's has issued a bulletin on COVID-19 impact on LBM distribution.

MOST LBM DISTRIBUTORS ARE STILL OPEN FOR BUSINESS

Distributors are open for business, with most states also deeming them essential.

- Most distributors are not experiencing material shortages, except in areas like personal protection equipment and some stuff from China.

- Deliveries from suppliers are proceeding apace. Some distributors have heard from dealers that they would like to push April deliveries to May. If this activity is widespread, distributor inventory levels will start rising, leading to a pullback on orders from suppliers.Focusing on inventories and receivables. Distributors are staying in touch with their dealer customers and watching their accounts receivables and destocking efforts at the same time they are watching their own accounts receivables and inventory levels.

- Distributors are staying in touch with their dealer customers and watching their accounts receivables and destocking efforts.

- Areas with higher concentrations of COVID-19 cases are reporting more disruptions. Distributors overexposed to a state where construction has not been exempted are faring less well than their counterparts.

MOST STATES DEEM LBM DEALERS 'ESSENTIAL BUSINESSES'

Most states have deemed building materials dealerships essential, so most dealers are open for business.

Most have made changes to operate safely—reduced store hours, limitation on the number of people entering the building at one time, more reliance on curbside pickup and online orders with store pickup.

Small dealers in states where construction has not been exempted from stay-at-home restrictions are faring worse than those in other states. Dealers are watching inventory levels and are slowing restocking of slow-moving products.

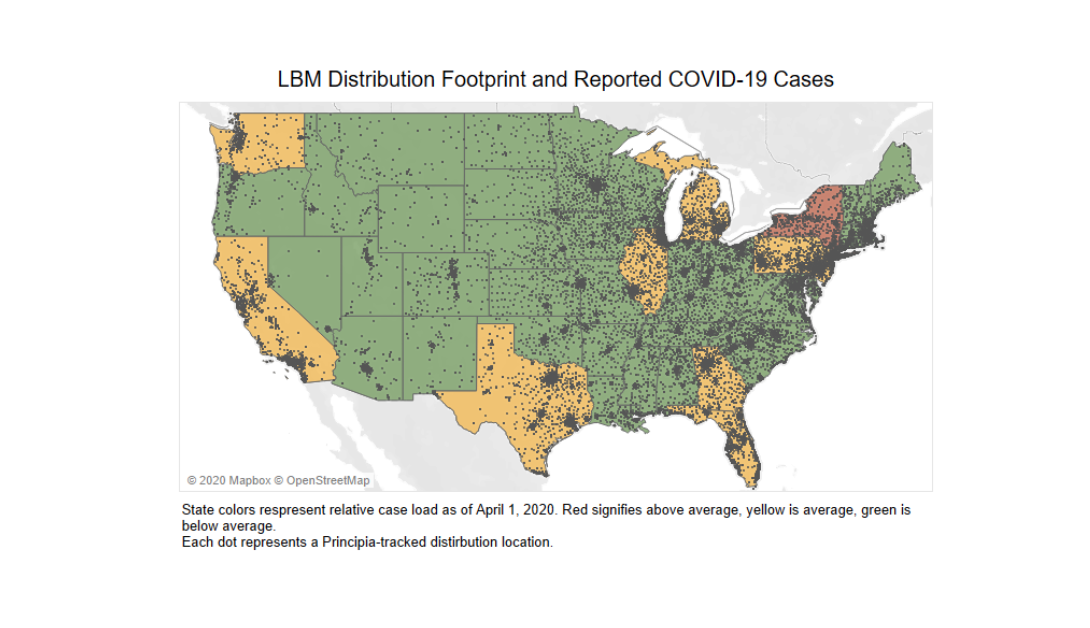

This map correlates COVID-19 intensity with LBM distribution tracked by Principia:

State colors indicate relative COVID-19 case load as of 04-02-01: red, above average; yellow, average; green, below average. Dots represent Principia-tracked locations. Map © 2020 Mapbox © OpenStreetMap Source: Principia

Related Stories

Coronavirus | Apr 2, 2020

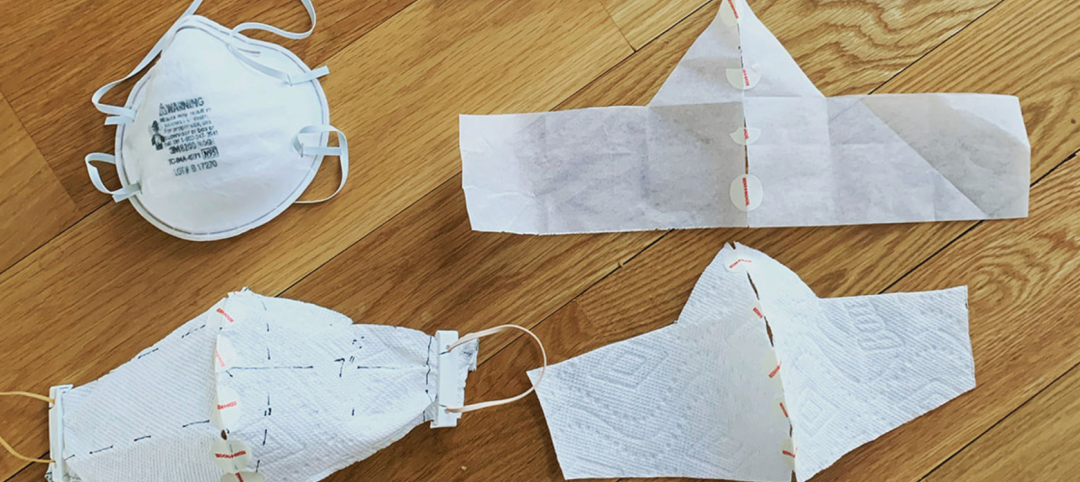

COVID-19: CannonDesign initiates industry coalition to make masks for healthcare providers

Coalition formed to make DIY face masks for healthcare workers in COVID-19 settings.

Coronavirus | Apr 2, 2020

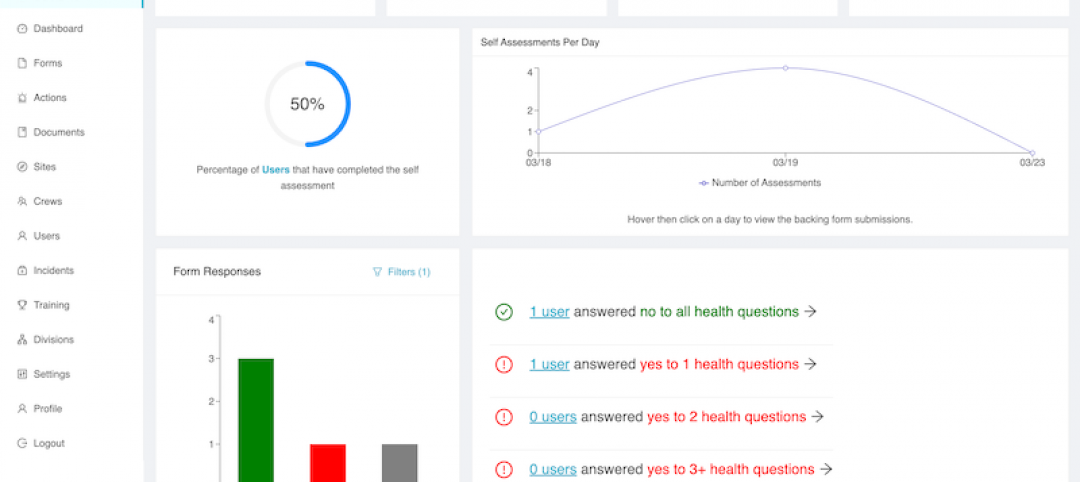

As virus spreads across North America, software providers step up with cost-free offerings

The goal is to keep construction projects moving forward at a time when jobs are being postponed or canceled.

Coronavirus | Apr 2, 2020

SBA and Treasury begin effort to distribute $349 billion in emergency small business capital

The new loan program will help small businesses with their payroll and other business operating expenses.

Coronavirus | Apr 2, 2020

New webinar explains how AIA Contract Documents can address business disruptions due to Covid-19

The webinar was recorded March 27.

Coronavirus | Apr 2, 2020

Informed by its latest Crane Index, Rider Levett Bucknall anticipates the effect of coronavirus on the construction industry

While total crane count holds steady, turbulent economic conditions indicate a recession-based drop in construction costs.

Coronavirus | Apr 1, 2020

How is the coronavirus outbreak impacting your firm's projects?

Please take BD+C's three-minute poll on the AEC business impacts from the coronavirus outbreak.

Coronavirus | Apr 1, 2020

Opinion: What can we learn from the coronavirus pandemic?

The coronavirus pandemic will soon end, soon be in the rear-view mirror, but we can still take lessons learned as directions for going forward.

Coronavirus | Apr 1, 2020

Three reasons you should keep sewing face masks (as long as you follow simple best practices)

Here are three reasons to encourage sewists coast to coast to keep their foot on the pedal.

Coronavirus | Apr 1, 2020

TLC’s Michael Sheerin offers guidance on ventilation in COVID-19 healthcare settings

Ventilation engineering guidance for COVID-19 patient rooms

Coronavirus | Apr 1, 2020

February rise in construction outlays contrasts with pandemic-driven collapse in March as owners, government orders shut down projects

Survey finds contractors face shortages of materials and workers, delivery delays and cancellations.