Construction spending increased in December compared to both November and a year ago thanks to growing demand for residential construction, according to an analysis of federal spending data the Associated General Contractors of America released today. Association officials noted, however, that spending on private nonresidential construction was flat for the month and down compared to a year ago while public sector construction spending fell for both the month and the year.

“Demand for new housing remains strong, while demand for nonresidential projects has been variable and most types of public sector investments in construction are declining,” said Ken Simonson, the association’s chief economist. “Contractors coping with rising materials prices and labor shortages are also dealing with the consequences of a nonresidential market that is, at best, uneven.”

Construction spending in December totaled $1.64 trillion at a seasonally adjusted annual rate, 0.2% above the November rate and 9.0% higher than in December 2020. Full-year spending for 2021 increased 8.2% compared to 2020.

Private residential construction spending rose 0.7% in December from a month prior and 12.7% from December 2020. For 2021 as a whole, residential construction spending jumped 23.2% from 2020, with gains of 32.8% for single-family spending and 15.6% for multifamily spending.

Private nonresidential construction spending was nearly unchanged from November to December but increased 9.1% from December 2020. For all of 2021, private nonresidential spending slipped 2.3% from 2020. The largest private nonresidential segment, power construction, rose 0.1% for the month and 4.9% year-over-year. Among other large segments, commercial construction--comprising warehouse, retail, and farm structures--inched up 0.1% in December and jumped 18.4% year-over-year, driven by surging demand for distribution facilities. Manufacturing construction spending fell by 1.9% in December, after 11 consecutive months of growth, but posted a 30.4% gain above its year-earlier level.

Public construction declined 1.6% in December, with decreases in 11 of the 12 categories, and 2.9% year-over-year. For 2021 as a whole, public construction fell 4.2% from 2020. Highway and street construction increased 0.1% from November and rose 0.9% compared to December 2020. Educational construction slipped 1.4% for the month and skidded 8.5% year-over-year. Transportation construction spending fell 3.0% in December and 6.3% year-over year.

Association officials said one reason for the declines in public sector construction spending is that Congress has yet to appropriate most of the additional funds authorized in the Bipartisan Infrastructure Bill signed by President Biden last year. They urged Congress to quickly make those new funds available so state and local officials can make the investments needed to improve the nation’s aging infrastructure.

“The Bipartisan Infrastructure Package’s immediate promise is not being met because Congress has yet to appropriate much of the increased funding,” said Stephen E. Sandherr, the association’s chief executive officer. “It is time to improve our infrastructure and protect those who rely on it.”

Related Stories

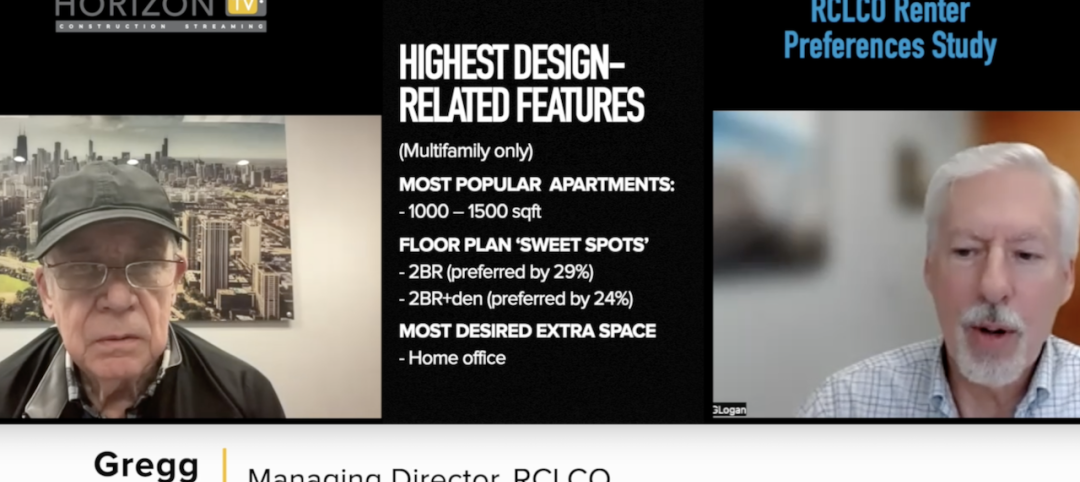

Apartments | Aug 22, 2023

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

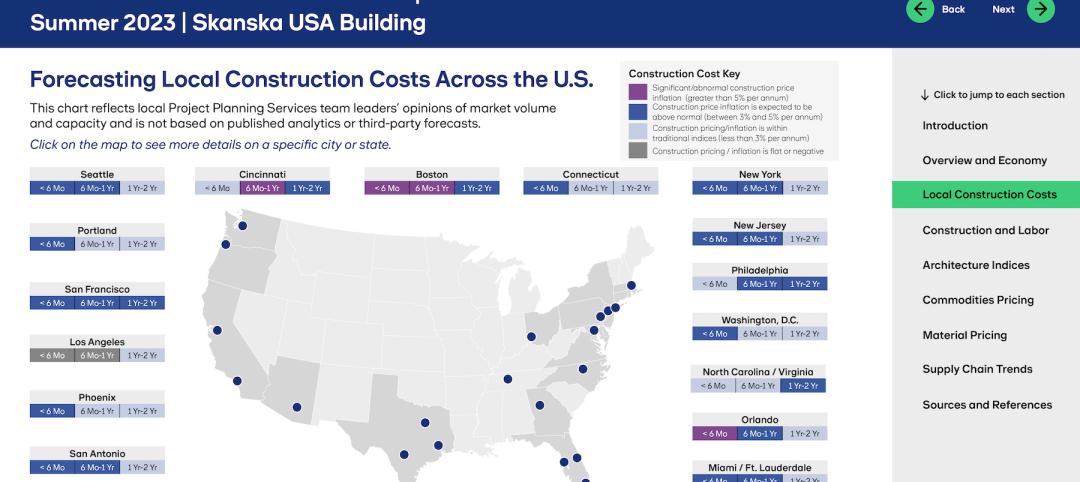

Market Data | Aug 18, 2023

Construction soldiers on, despite rising materials and labor costs

Quarterly analyses from Skanska, Mortenson, and Gordian show nonresidential building still subject to materials and labor volatility, and regional disparities.

Apartments | Aug 14, 2023

Yardi Matrix updates near-term multifamily supply forecast

The multifamily housing supply could increase by up to nearly 7% by the end of 2023, states the latest Multifamily Supply Forecast from Yardi Matrix.

Hotel Facilities | Aug 2, 2023

Top 5 markets for hotel construction

According to the United States Construction Pipeline Trend Report by Lodging Econometrics (LE) for Q2 2023, the five markets with the largest hotel construction pipelines are Dallas with a record-high 184 projects/21,501 rooms, Atlanta with 141 projects/17,993 rooms, Phoenix with 119 projects/16,107 rooms, Nashville with 116 projects/15,346 rooms, and Los Angeles with 112 projects/17,797 rooms.

Market Data | Aug 1, 2023

Nonresidential construction spending increases slightly in June

National nonresidential construction spending increased 0.1% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. Spending is up 18% over the past 12 months. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.07 trillion in June.

Hotel Facilities | Jul 27, 2023

U.S. hotel construction pipeline remains steady with 5,572 projects in the works

The hotel construction pipeline grew incrementally in Q2 2023 as developers and franchise companies push through short-term challenges while envisioning long-term prospects, according to Lodging Econometrics.

Hotel Facilities | Jul 26, 2023

Hospitality building construction costs for 2023

Data from Gordian breaks down the average cost per square foot for 15-story hotels, restaurants, fast food restaurants, and movie theaters across 10 U.S. cities: Boston, Chicago, Las Vegas, Los Angeles, Miami, New Orleans, New York, Phoenix, Seattle, and Washington, D.C.

Market Data | Jul 24, 2023

Leading economists call for 2% increase in building construction spending in 2024

Following a 19.7% surge in spending for commercial, institutional, and industrial buildings in 2023, leading construction industry economists expect spending growth to come back to earth in 2024, according to the July 2023 AIA Consensus Construction Forecast Panel.

Contractors | Jul 13, 2023

Construction input prices remain unchanged in June, inflation slowing

Construction input prices remained unchanged in June compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices were also unchanged for the month.

Contractors | Jul 11, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of June 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.9 months in June 2023, according to an ABC member survey conducted June 20 to July 5. The reading is unchanged from June 2022.