Construction spending in December exhibited sharply varied trends, with downturns from a year earlier in every private category, mixed results for public construction, and double-digit increases in residential construction, according to an analysis of new federal construction spending data by the Associated General Contractors of America. Association officials said the new figures demonstrate how the pandemic is boosting demand for new housing while undermining demand for most other types of construction projects.

“Private nonresidential construction has declined for six months in a row, and the slide is accelerating,” said Ken Simonson, the association’s chief economist. “While some categories of public construction have held up so far, state and local budget problems are likely to drive a downturn in public project starts in the next few months.”

Construction spending in December totaled $1.49 trillion at a seasonally adjusted annual rate, an increase of 1.0% from the pace in November and 5.7% higher than in December 2019. But the gains were limited to residential construction, which soared 3.1% for the month and 20.7% year-over-year. Meanwhile, private and public nonresidential spending fell 0.8% from November and 4.8% from a year earlier¬.

Private nonresidential construction spending slumped 1.7% from November to December and 9.8 from December 2019. All 11 private nonresidential categories in the government report declined from a year earlier.

The largest private nonresidential segment, power construction, fell 10.8% year-over-year despite a gain of 0.6% from November to December. Among the other large private nonresidential project types, commercial construction—comprising retail, warehouse and farm structures—slipped 1.4% year-over-year and 2.8% for the month. Manufacturing construction tumbled 17.6% from a year earlier and 5.6% for the month. Office construction declined 3.3% year-over-year despite edging up 0.2% in December. Healthcare construction fell 8.7% from the year before and 3.0% since November.

Public construction spending increased 3.0% year-over-year and 0.5% for the month. Results were mixed among the largest segments. Highway and street construction rose 3.9% from a year earlier and 0.9% for the month. Educational construction increased 4.5% year-over-year and 0.6% in December. But spending on transportation facilities declined 1.0% for the year despite a gain of 0.9% in December.

Private residential construction spending increased for the seventh-straight month, jumping 20.7 year-over-year and 3.1% in December. Single-family homebuilding leaped 23.8% compared to December 2019 and 5.8% for the month. Multifamily construction spending climbed 17.8% for the year and inched up 0.1% for the month.

Association officials said commercial construction was likely to suffer amid weakening demand unless Congress and the Biden administration enact new recovery measures, including backfilling local construction budgets and passing new infrastructure funding. They said the new federal investments were needed to sustain construction employment levels in many parts of the country until private sector demand recovers.

“Even as they work out details on the latest coronavirus relief plan, Congress and the Biden administration need to start work on measures to rebuild the economy and recover lost jobs,” said Stephen E. Sandherr, the association’s chief executive officer. “One of the most effective ways to help the newly unemployed will be to rebuild aging infrastructure and maintain state and local construction budgets.”

Related Stories

Multifamily Housing | Aug 12, 2016

Apartment completions in largest metros on pace to increase by 50% in 2016

Texas is leading this multifamily construction boom, according to latest RENTCafé estimates.

Market Data | Jul 29, 2016

ABC: Output expands, but nonresidential fixed investment falters

Nonresidential fixed investment fell for a third consecutive quarter, as indicated by Bureau of Economic Analysis data.

Industry Research | Jul 26, 2016

AIA consensus forecast sees construction spending on rise through next year

But several factors could make the industry downshift.

Architects | Jul 20, 2016

AIA: Architecture Billings Index remains on solid footing

The June ABI score was down from May, but the figure was positive for the fifth consecutive month.

Market Data | Jul 7, 2016

Airbnb alleged to worsen housing crunch in New York City

Allegedly removing thousands of housing units from market, driving up rents.

Market Data | Jul 6, 2016

Construction spending falls 0.8% from April to May

The private and public sectors have a combined estimated seasonally adjusted annual rate of $1.14 trillion.

Market Data | Jul 6, 2016

A thriving economy and influx of businesses spur construction in downtown Seattle

Development investment is twice what it was five years ago.

Multifamily Housing | Jul 5, 2016

Apartments continue to shrink, rents continue to rise

Latest survey by RENTCafé tracks size changes in 95 metros.

Multifamily Housing | Jun 22, 2016

Can multifamily construction keep up with projected demand?

The Joint Center for Housing Studies’ latest disection of America’s housing market finds moderate- and low-priced rentals in short supply.

Contractors | Jun 21, 2016

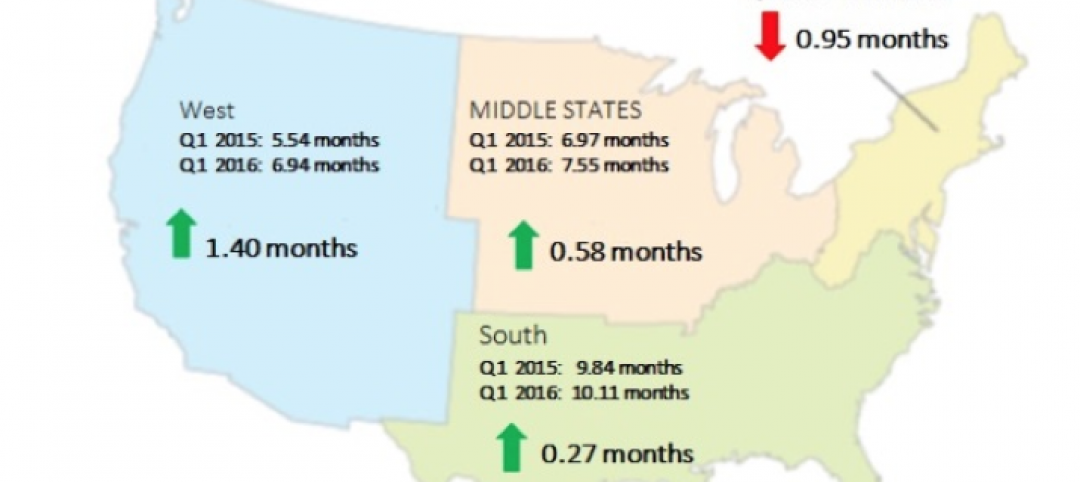

Bigness counts when it comes to construction backlogs

Large companies that can attract talent are better able to commit to more work, according to a national trade group for builders and contractors.