Construction spending declined for the fourth consecutive month in June as decreases in single-family, highway and educational projects outweighed increases in several private nonresidential categories, according to an analysis by the Associated General Contractors of America of government data released today. As state and local government face budget deficits, association officials cautioned that investments in infrastructure and other construction projects are likely to continue falling unless Congress and the Trump administration provide additional, targeted and dedicated infrastructure funding.

“Regrettably, the overall downward trend in spending is likely to continue and to spread to more project types as work that began before the pandemic hit finishes up,” said Ken Simonson, the association’s chief economist. “Unless the federal government invests heavily—and promptly—in infrastructure projects, both public and private nonresidential investment are likely to shrink further.”

Construction spending in June totaled $1.36 trillion at a seasonally adjusted annual rate, a decline of 0.7% from May and the lowest total in a year. After reaching a record high in February of $1.44 trillion, total spending has slumped by 6.0%, the steepest four-month contraction in a decade, the economist noted.

Public construction spending decreased by 0.7% in June, dragged down by a 1.7% drop in highway and street construction spending and a 2.7% decline in educational construction spending, the two largest public segments. The next-largest segment, transportation facilities, also contracted, by 0.6%.

Private nonresidential construction spending inched up 0.2% from May to June, led by a gain of 0.7% in the largest segment, power construction. Among other large private spending categories, commercial construction—comprising retail, warehouse and farm structures—slumped 1.3%, while manufacturing construction rose 1.7% and office construction edged up 0.3%.

Private residential construction spending shrank by 1.5% in June as spending on single-family homebuilding plunged 3.6% to its lowest level since late 2016. In contrast, new multifamily construction spending climbed for the third month in a row, posting a 3.0% increase from May.

Association officials said that state and local budgets are getting hammered by declining economic activity related to the ongoing pandemic. They urged Congress and the administration to quickly pass new infrastructure and recovery measures to help reverse the declines in public spending. They added that those new investments would help put many people back to work in good-paying construction careers.

“It will be hard to rebuild the economy if state and local governments lack the resources needed to improve roads, retrofit schools and keep drinking water safe,” said Stephen E. Sandherr, the association’s chief executive officer. “Instead of letting people languish in unemployment, Washington can put people back to work simply by boosting investments in needed infrastructure and other construction projects.”

Related Stories

| Jun 5, 2023

Communication is the key to AEC firms’ mental health programs and training

The core of recent awareness efforts—and their greatest challenge—is getting workers to come forward and share stories.

Contractors | May 24, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of April 2023

Contractor backlogs climbed slightly in April, from a seven-month low the previous month, according to Associated Builders and Contractors.

Multifamily Housing | May 23, 2023

One out of three office buildings in largest U.S. cities are suitable for residential conversion

Roughly one in three office buildings in the largest U.S. cities are well suited to be converted to multifamily residential properties, according to a study by global real estate firm Avison Young. Some 6,206 buildings across 10 U.S. cities present viable opportunities for conversion to residential use.

Industry Research | May 22, 2023

2023 High Growth Study shares tips for finding success in uncertain times

Lee Frederiksen, Managing Partner, Hinge, reveals key takeaways from the firm's recent High Growth study.

Multifamily Housing | May 8, 2023

The average multifamily rent was $1,709 in April 2023, up for the second straight month

Despite economic headwinds, the multifamily housing market continues to demonstrate resilience, according to a new Yardi Matrix report.

Market Data | May 2, 2023

Nonresidential construction spending up 0.7% in March 2023 versus previous month

National nonresidential construction spending increased by 0.7% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $997.1 billion for the month.

Hotel Facilities | May 2, 2023

U.S. hotel construction up 9% in the first quarter of 2023, led by Marriott and Hilton

In the latest United States Construction Pipeline Trend Report from Lodging Econometrics (LE), analysts report that construction pipeline projects in the U.S. continue to increase, standing at 5,545 projects/658,207 rooms at the close of Q1 2023. Up 9% by both projects and rooms year-over-year (YOY); project totals at Q1 ‘23 are just 338 projects, or 5.7%, behind the all-time high of 5,883 projects recorded in Q2 2008.

Market Data | May 1, 2023

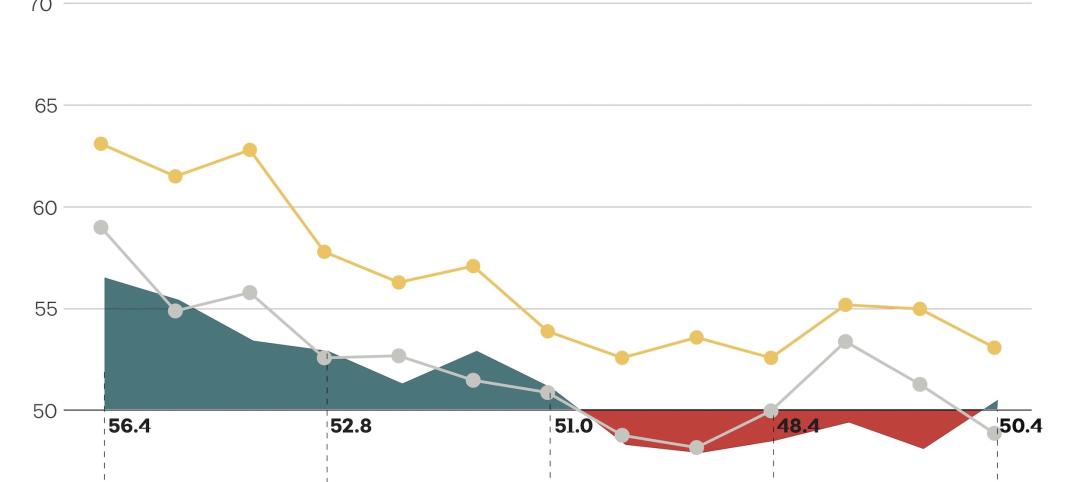

AEC firm proposal activity rebounds in the first quarter of 2023: PSMJ report

Proposal activity for architecture, engineering and construction (A/E/C) firms increased significantly in the 1st Quarter of 2023, according to PSMJ’s Quarterly Market Forecast (QMF) survey. The predictive measure of the industry’s health rebounded to a net plus/minus index (NPMI) of 32.8 in the first three months of the year.

Industry Research | Apr 25, 2023

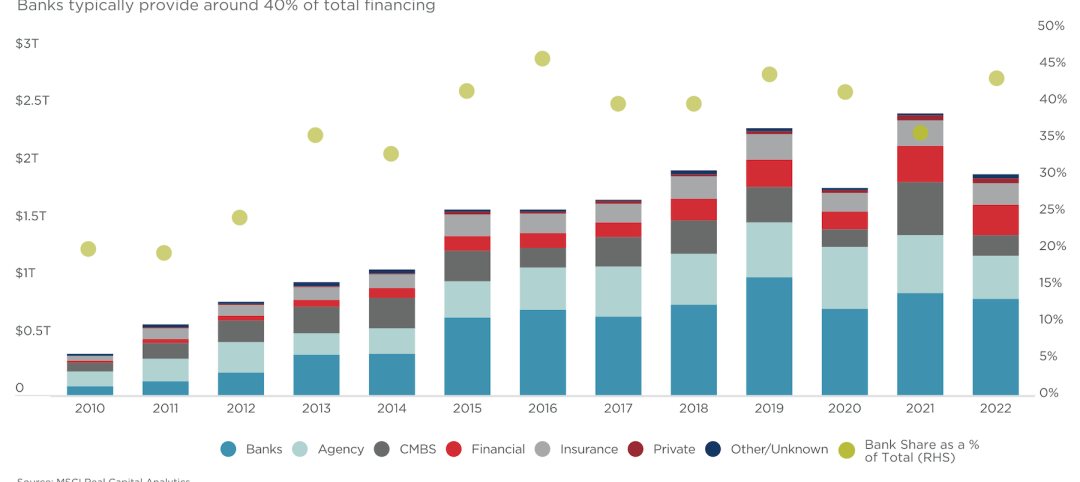

The commercial real estate sector shouldn’t panic (yet) about recent bank failures

A new Cushman & Wakefield report depicts a “well capitalized” banking industry that is responding assertively to isolated weaknesses, but is also tightening its lending.

Architects | Apr 21, 2023

Architecture billings improve slightly in March

Architecture firms reported a modest increase in March billings. This positive news was tempered by a slight decrease in new design contracts according to a new report released today from The American Institute of Architects (AIA). March was the first time since last September in which billings improved.