Construction employment increased by 84,000 jobs in October, with jobs added in both nonresidential and residential categories, according to an analysis by the Associated General Contractors of America of government data released today. Association officials cautioned, however, that the pandemic is causing a growing number of construction projects to be canceled or delayed, according to a survey the association released in late October.

“The employment data for October is good news, but our latest survey found that only a minority of contractors expect to add to their workforce in the next 12 months,” said Ken Simonson, the association’s chief economist. “As project cancellations mount, so too will job losses on the nonresidential side unless the federal government provides funding for infrastructure and relief for contractors.”

Construction employment climbed to 7,345,000 in October, an increase of 1.2% compared to September. However, employment in the sector is down by 294,000 or 3.9% since the most recent peak in February, just before the pandemic triggered widespread project cancellations. Despite the employment pickup in October, nonresidential construction employment—comprising nonresidential building, specialty trades, and heavy and civil engineering construction—remains 262,000 jobs or 5.6% below its recent peak in February, Simonson noted.

The construction economist added that residential construction, covering residential building and specialty trade contractors, has had a stronger recovery, with employment down by just 32,000 jobs or 1.1% since February. The industry’s unemployment rate in October was 6.8%, with 674,000 former construction workers idled. These figures were the lowest since the pandemic struck but considerably higher than the October 2019 figures of 4.0% and 398,000 workers, respectively, the economist added.

In the association’s October survey, which covered more than 1,000 contractors that perform all types of nonresidential and multifamily construction, three out of four respondents reported that a scheduled project had been postponed or canceled. Only 37% of respondents expect their headcount to increase over the next 12 months. That was a sharp drop from the 75% who predicted an increase in the association’s annual Hiring and Business Outlook Survey released last December.

Association officials said they were encouraged by reports that Congress plans to consider new coronavirus relief measures before the end of the year. They noted that new measures, including investments in infrastructure, new Paycheck Protection Program flexibility and tax relief, and liability reforms will help offset the impacts of the growing number of project cancellations and delays.

“Congressional leaders understand that employers cannot afford to wait until next year for relief from the broad economic impacts of the coronavirus pandemic,” said Stephen E. Sandherr, the association’s chief executive officer. “We stand ready to work with Congress to make sure any new relief measures include new infrastructure investments, tax relief and liability reform so honest firms don’t fall victim to predatory lawyers seeking to profit from the coronavirus.”

Related Stories

High-rise Construction | Jan 23, 2017

Growth spurt: A record-breaking 128 buildings of 200 meters or taller were completed in 2016

This marks the third consecutive record-breaking year for building completions over 200 meters.

Market Data | Jan 18, 2017

Fraud and risk incidents on the rise for construction, engineering, and infrastructure businesses

Seven of the 10 executives in the sector surveyed in the report said their company fell victim to fraud in the past year.

Market Data | Jan 18, 2017

Architecture Billings Index ends year on positive note

Architecture firms close 2016 with the strongest performance of the year.

Market Data | Jan 12, 2017

73% of construction firms plan to expand their payrolls in 2017

However, many firms remain worried about the availability of qualified workers.

Market Data | Jan 9, 2017

Trump market impact prompts surge in optimism for U.S. engineering firm leaders

The boost in firm leader optimism extends across almost the entire engineering marketplace.

Market Data | Jan 5, 2017

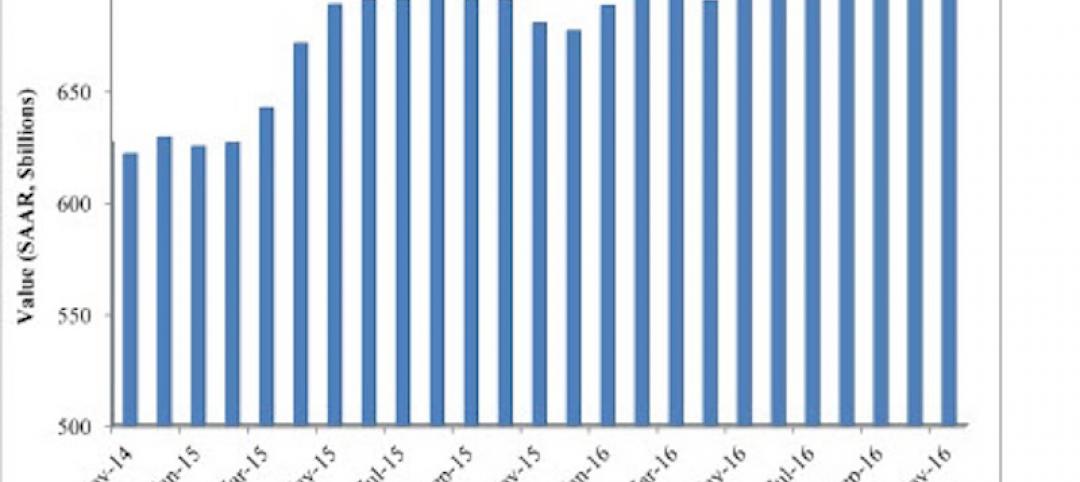

Nonresidential spending thrives in strong November spending report

Many construction firms have reported that they remain busy but have become concerned that work could dry up in certain markets in 2017 or 2018, says Anirban Basu, ABC Chief Economist.

Market Data | Dec 21, 2016

Architecture Billings Index up slightly in November

New design contracts also return to positive levels, signifying future growth in construction activity.

Market Data | Dec 21, 2016

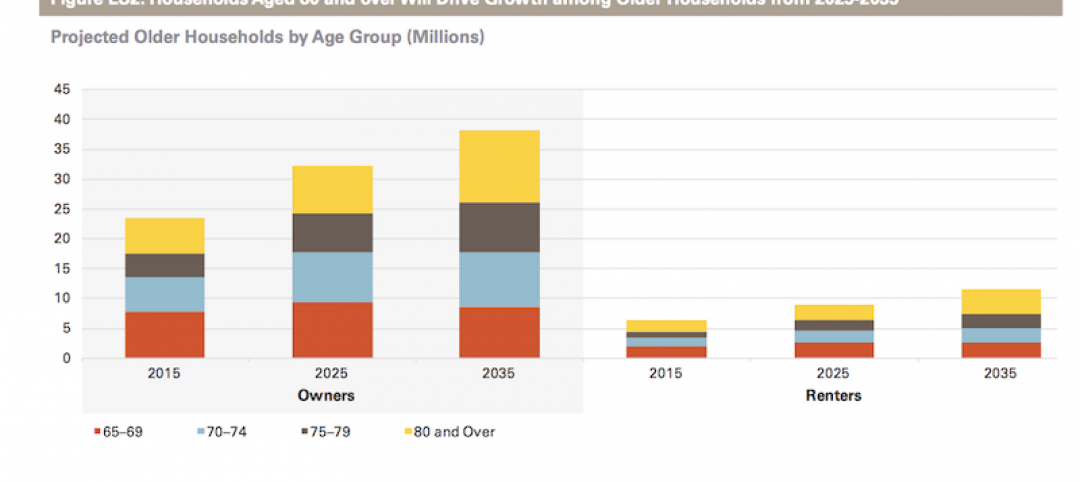

Will housing adjust to an aging population?

New Joint Center report projects 66% increase in senior heads of households by 2035.

Market Data | Dec 13, 2016

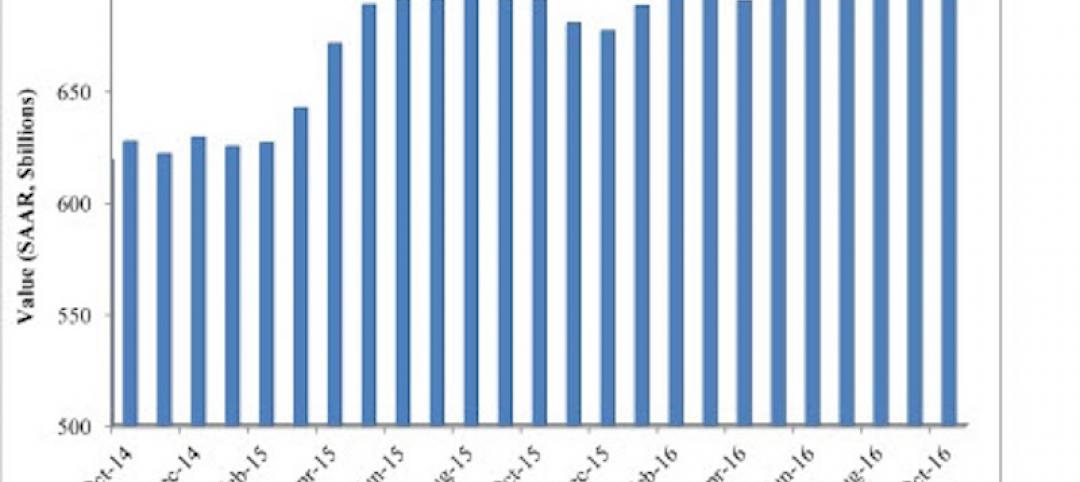

ABC predicts modest growth for 2017 nonresidential construction sector; warns of vulnerability for contractor

“The U.S. economy continues to expand amid a weak global economy and, despite risks to the construction industry, nonresidential spending should expand 3.5 percent in 2017,” says ABC Chief Economist Anirban Basu.

Market Data | Dec 2, 2016

Nonresidential construction spending gains momentum

Nonresidential spending is now 2.6 percent higher than at the same time one year ago.