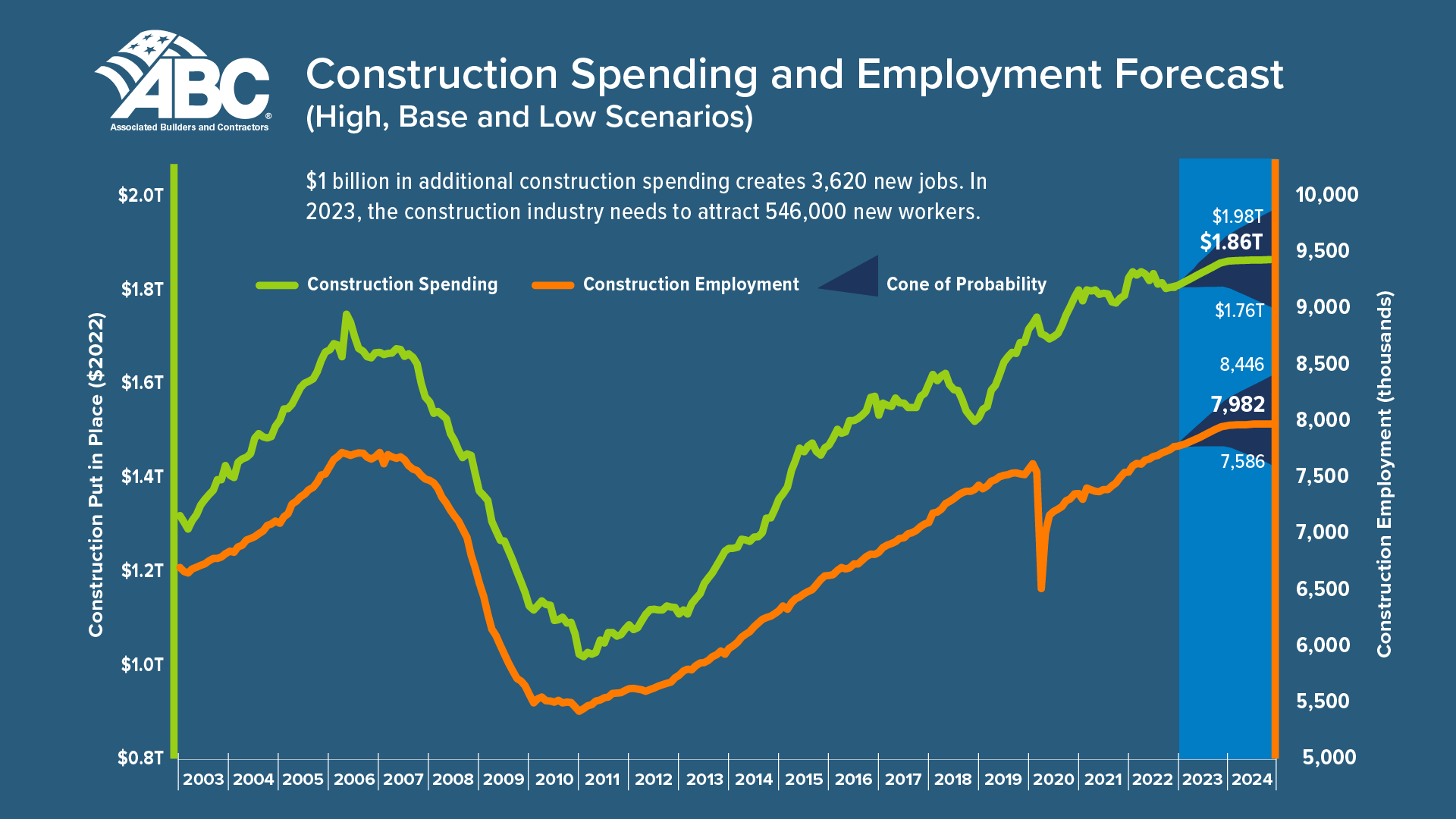

The U.S. construction industry needs to attract an estimated 546,000 additional workers on top of the normal pace of hiring in 2023 to meet demand for labor, according to a model developed by Associated Builders and Contractors.

The construction industry averaged more than 390,000 job openings per month in 2022, the highest level on record, and the industry unemployment rate of 4.6% in 2022 was the second lowest on record. National payroll construction employment was 231,000 higher in December 2022 than in December 2021.

ABC predicts demand for labor to increase by 3,620 new jobs for every $1 billion in new construction spending. New funding for large projects such as chip manufacturing plants, clean energy facilities, and infrastructure upgrades will continue to put pressure on the job market.

ABC predicts that in 2024, the industry will need to hire 324,000 new workers on top of its normal pacing, and that assumes overall construction spending slows significantly. The number of workers with licensed skills hasn’t been enough to keep up with demand, and the ranks of licensed carpenters has actually declined in the last decade.

Here is full release from Associated Builders and Contractors:

The U.S. construction industry will need to attract an estimated 546,000 additional workers on top of the normal pace of hiring in 2023 to meet the demand for labor, according to a proprietary model developed by Associated Builders and Contractors.

“The construction industry must recruit hundreds of thousands of qualified, skilled construction professionals each year to build the places where we live, work, play, worship, learn and heal,” said Michael Bellaman, ABC president and CEO. “As the demand for construction services remains high, filling these roles with skilled craft professionals is vital to America’s economy and infrastructure rebuilding initiatives.”

ABC’s proprietary model uses the historical relationship between inflation-adjusted construction spending growth, sourced from the U.S. Census Bureau’s Construction Put in Place survey, as well as payroll construction employment, sourced from the U.S. Bureau of Labor Statistics, to convert anticipated increases in construction outlays into demand for construction labor at a rate of approximately 3,620 new jobs per billion dollars of additional construction spending. This increased demand is added to the current level of above-average job openings. Projected industry retirements, shifts to other industries and other forms of anticipated separation are also embodied within computations.

The construction industry averaged more than 390,000 job openings per month in 2022, the highest level on record, and the industry unemployment rate of 4.6% in 2022 was the second lowest on record, higher than only the 4.5% unemployment rate observed in 2019. National payroll construction employment was 231,000 higher in December 2022 than in December 2021.

“Despite sharp increases in interest rates over the past year, the shortage of construction workers will not disappear in the near future,” said ABC Chief Economist Anirban Basu. “First, while single-family home building activity has moderated, many contractors continue to experience substantial demand from a growing number of mega-projects associated with chip manufacturing plants, clean energy facilities and infrastructure. Second, too few younger workers are entering the skilled trades, meaning this is not only a construction labor shortage but also a skills shortage.

“With nearly 1 in 4 construction workers older than 55, retirements will continue to whittle away at the construction workforce,” said Basu. “Many of these older construction workers are also the most productive, refining their skills over time. The number of construction laborers, the most entry-level occupational title, has accounted for nearly 4 out of every 10 new construction workers since 2012. Meanwhile, the number of skilled workers has grown at a much slower pace or, in the case of certain occupations like carpenter, declined.

“To fill these important roles, ABC is working hard to recruit, educate and upskill the construction workforce through our national network of more than 800 apprenticeship, craft, safety and management education programs—including more than 300 government-registered apprenticeship programs across 20 different construction occupations—to build the people who build America,” said Bellaman. “ABC members invested $1.6 billion in 2021 to educate 1.3 million course attendees to build a construction workforce that is safe, skilled and productive.”

In 2024, the industry will need to bring in more than 342,000 new workers on top of normal hiring to meet industry demand, and that’s presuming that construction spending growth slows significantly next year.

View ABC’s methodology in creating the workforce shortage model.

Related Stories

Multifamily Housing | Jan 15, 2024

Multifamily rent growth rate unchanged at 0.3%

The National Multifamily Report by Yardi Matrix highlights the highs and lows of the multifamily market in 2023. Despite strong demand, rent growth remained unchanged at 0.3 percent.

Apartments | Jan 9, 2024

Apartment developer survey indicates dramatic decrease in starts this year

Over 56 developers, operators, and investors across the country were surveyed in John Burns Research and Consulting's recently-launched Apartment Developer and Investor Survey.

Self-Storage Facilities | Jan 5, 2024

The state of self-storage in early 2024

As the housing market cools down, storage facilities suffer from lower occupancy and falling rates, according to the December 2023 Yardi Matrix National Self Storage Report.

Urban Planning | Dec 18, 2023

The impacts of affordability, remote work, and personal safety on urban life

Data from Gensler's City Pulse Survey shows that although people are satisfied with their city's experience, it may not be enough.

MFPRO+ News | Dec 11, 2023

U.S. poorly prepared to house growing number of older adults

The U.S. is ill-prepared to provide adequate housing for the growing ranks of older people, according to a report from Harvard University’s Joint Center for Housing Studies. Over the next decade, the U.S. population older than 75 will increase by 45%, growing from 17 million to nearly 25 million, with many expected to struggle financially.

Industry Research | Dec 9, 2023

Two new reports provide guidance for choosing healthier building products

The authors, Perkins&Will and the Healthy Building Network, home in on drywall, flooring, and insulation.The authors, Perkins&Will and the Healthy Building Network, home in on drywall, flooring, and insulation.

Student Housing | Dec 5, 2023

October had fastest start ever for student housing preleasing

The student housing market for the upcoming 2024-2025 leasing season has started sooner and faster than ever.

Industry Research | Nov 28, 2023

Migration trends find top 10 states Americans are moving to

In the StorageCafe analysis of the latest migration trends, each U.S. state was looked at to see the moving patterns of people in the last few years. These are the top 10 states that people are moving to.

Market Data | Nov 27, 2023

Number of employees returning to the office varies significantly by city

While the return-to-the-office trend is felt across the country, the percentage of employees moving back to their offices varies significantly according to geography, according to Eptura’s Q3 Workplace Index.

MFPRO+ News | Nov 21, 2023

Renters value amenities that support a mobile, connected lifestyle

Multifamily renters prioritize features and amenities that reflect a mobile, connected lifestyle, according to the National Multifamily Housing Council (NMHC) and Grace Hill 2024 Renter Preferences Survey.