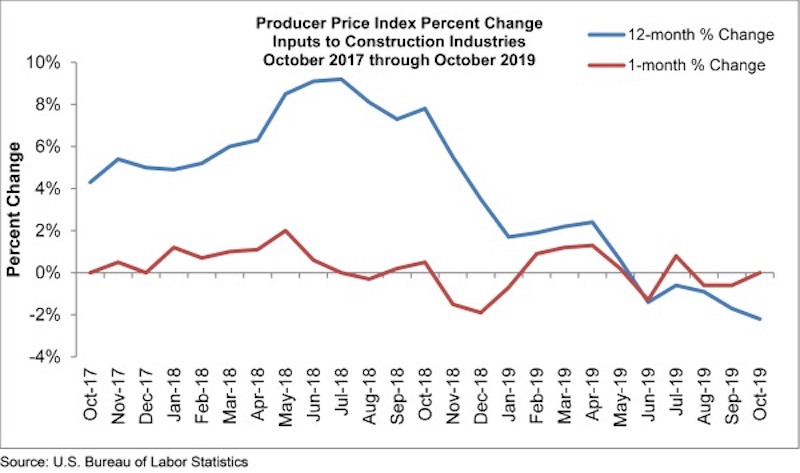

Construction input prices remained unchanged on a monthly basis in October but are down 2.2% year-over-year, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today. Nonresidential construction input prices fell 0.1% for the month and are down 2.0% compared to the same time last year.

Falling energy prices accounted for much of the year-over-year price decline. Among the eight subcategories that decreased, the most significant were in natural gas (-31.8%), crude petroleum (-29.8%) and unprocessed energy materials (-26.3%). Monthly natural gas prices, however, were up 7.7% from September, likely due in part to seasonal factors. Two other subcategories had year-over-year decreases greater than 10%: iron and steel (-16.1%) and steel mill products (-13.1%).

“New month, same story on materials prices,” said ABC Chief Economist Anirban Basu. “While the decline in crude petroleum prices in October may have been caused by a spike in oil prices in September due to an assault on Saudi facilities, price weakness was apparent in several other materials categories as well. Many categories experienced effectively no change in price whatsoever on a monthly basis, including key materials such as softwood lumber, concrete, plumbing fixtures and the segment that includes prepared asphalt.

“While the U.S. nonresidential construction sector remains busy and a majority of contractors expect to see an increase in sales over the next few months, according to ABC’s Construction Confidence Indicator, materials prices continue to languish due to a combination of a weakening global economy, a sturdy U.S. dollar and recently observed declines in investment in structures. The lifting of tariffs on certain producers of steel and aluminum earlier this year may also be playing a factor, with iron and steel prices down approximately 16% compared to one year ago and the price of steel mill products down more than 13%.

“Contractors can expect more seesawing in materials prices going forward as opposed to smooth declines,” said Basu. “There is evidence that certain parts of the global economy are firming, which will help stabilize the demand for certain materials. The U.S. dollar is no longer strengthening as it had been, in part because the Federal Reserve has pursued an easier money policy this year. That said, there could be a dip in oil prices next year as more supply comes online from nations such as Canada, Norway, Brazil and Guyana.”

Related Stories

Codes and Standards | Oct 26, 2022

‘Landmark study’ offers key recommendations for design-build delivery

The ACEC Research Institute and the University of Colorado Boulder released what the White House called a “landmark study” on the design-build delivery method.

Building Team | Oct 26, 2022

The U.S. hotel construction pipeline shows positive growth year-over-year at Q3 2022 close

According to the third quarter Construction Pipeline Trend Report for the United States from Lodging Econometrics (LE), the U.S. construction pipeline stands at 5,317 projects/629,489 rooms, up 10% by projects and 6% rooms Year-Over-Year (YOY).

Designers | Oct 19, 2022

Architecture Billings Index moderates but remains healthy

For the twentieth consecutive month architecture firms reported increasing demand for design services in September, according to a new report today from The American Institute of Architects (AIA).

Market Data | Oct 17, 2022

Calling all AEC professionals! BD+C editors need your expertise for our 2023 market forecast survey

The BD+C editorial team needs your help with an important research project. We are conducting research to understand the current state of the U.S. design and construction industry.

Market Data | Oct 14, 2022

ABC’s Construction Backlog Indicator Jumps in September; Contractor Confidence Remains Steady

Associated Builders and Contractors reports today that its Construction Backlog Indicator increased to 9.0 months in September, according to an ABC member survey conducted Sept. 20 to Oct. 5.

Market Data | Oct 12, 2022

ABC: Construction Input Prices Inched Down in September; Up 41% Since February 2020

Construction input prices dipped 0.1% in September compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Laboratories | Oct 5, 2022

Bigger is better for a maturing life sciences sector

CRB's latest report predicts more diversification and vertical integration in research and production.

Market Data | Aug 25, 2022

‘Disruptions’ will moderate construction spending through next year

JLL’s latest outlook predicts continued pricing volatility due to shortages in materials and labor

Market Data | Aug 2, 2022

Nonresidential construction spending falls 0.5% in June, says ABC

National nonresidential construction spending was down by 0.5% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Jul 28, 2022

The latest Beck Group report sees earlier project collaboration as one way out of the inflation/supply chain malaise

In the first six months of 2022, quarter-to-quarter inflation for construction materials showed signs of easing, but only slightly.