Construction employment in June remained below the levels reached before the pre-pandemic peak in February 2020 in 39 states, according to an analysis by the Associated General Contractors of America of government employment data released today. Association officials noted that many construction firms are struggling to cope with supply chain challenges and rising materials prices, which is undermining demand for new projects and impacting firms’ ability to hire new workers.

“The construction industry is a long way from full recovery in most states, in spite of a hot homebuilding market in many areas,” said Ken Simonson, the association’s chief economist. “Soaring materials costs, long production times for key items, and delayed deliveries are causing owners to postpone projects.”

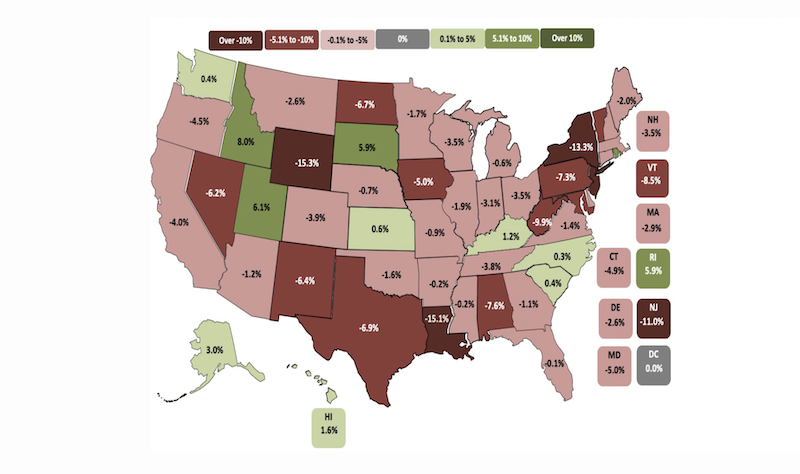

From February 2020—the month before the pandemic caused project shutdowns and cancellations—to last month, construction employment increased in only 11 states and was flat in the District of Columbia. New York shed the most construction jobs over the period (-54,300 jobs or -13.3%), followed by Texas (-54,100 jobs, -6.9%) and California (-36,500 jobs, -4.0%). Wyoming recorded the largest percentage loss (-15.3%, -3,500 jobs), followed by Louisiana (-15.1%, -20,700 jobs) and New York.

Of the states that added construction jobs since February 2020, Utah added the most (7,000 jobs, 6.1%), followed by Idaho (4,400 jobs, 8.0%), South Dakota (1,400 jobs, 5.9%) and Rhode Island (1,200 jobs, 5.9%). The largest percentage gain was in Idaho, followed by Utah, Rhode Island, and South Dakota.

From May to June construction employment decreased in 25 states, increased in 24 states and D.C., and held steady in Maine. The largest decline over the month occurred in New York, which lost 6,900 construction jobs or 1.9%, followed by Pennsylvania (-4,100 jobs, -1.6%) and Texas (-3,300 jobs, -1.3%). The steepest percentage declines since May occurred in Vermont (-3.5%, -500 jobs), followed by New York, Alabama (-1.9%, -1,700 jobs), and North Dakota (-1.9%, -500 jobs).

Georgia added the most construction jobs between May and June (5,700 jobs, 2.9%), followed by Kentucky (2,700 jobs, 3.4%) and Florida (2,500 jobs, 0.4%). Kentucky had the largest percentage gain for the month, followed by Alaska (3.0%, 500 jobs) and Georgia.

Association officials cautioned that construction employment is unlikely to grow in many parts of the country until many of the supply chain challenges impacting firms improve. They added that the President could help by removing tariffs on key construction materials. They added that ending the unemployment supplements would add to the pool of workers for manufacturers, shippers, and construction firms to hire.

“Easing tariffs will help, but what the construction supply chain needs are workers to manufacture the products, ship them to contractors and build the projects the economy demands,” said Stephen E. Sandherr, the association’s chief executive officer. “Unemployment supplements helped families survive the pandemic-related lock downs, but they are undermining the post-pandemic recovery.”

View state February 2020-June 2021 data, 16-month rankings, 1-month rankings, and map.

Related Stories

Market Data | May 18, 2022

Architecture Billings Index moderates slightly, remains strong

For the fifteenth consecutive month architecture firms reported increasing demand for design services in April, according to a new report today from The American Institute of Architects (AIA).

Market Data | May 12, 2022

Monthly construction input prices increase in April

Construction input prices increased 0.8% in April compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Market Data | May 10, 2022

Hybrid work could result in 20% less demand for office space

Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.

Market Data | May 6, 2022

Nonresidential construction spending down 1% in March

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Apr 29, 2022

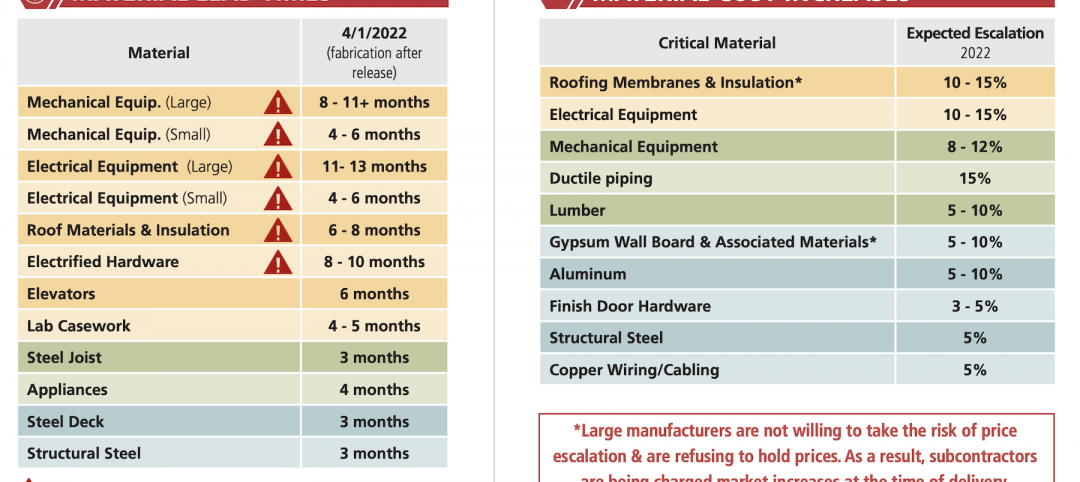

Global forces push construction prices higher

Consigli’s latest forecast predicts high single-digit increases for this year.

Market Data | Apr 29, 2022

U.S. economy contracts, investment in structures down, says ABC

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022.

Market Data | Apr 20, 2022

Pace of demand for design services rapidly accelerates

Demand for design services in March expanded sharply from February according to a new report today from The American Institute of Architects (AIA).

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

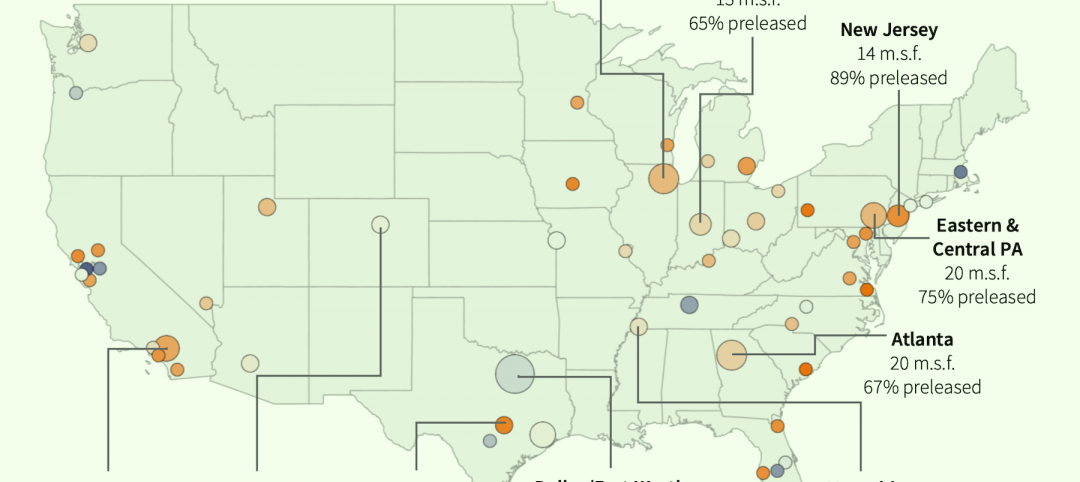

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment