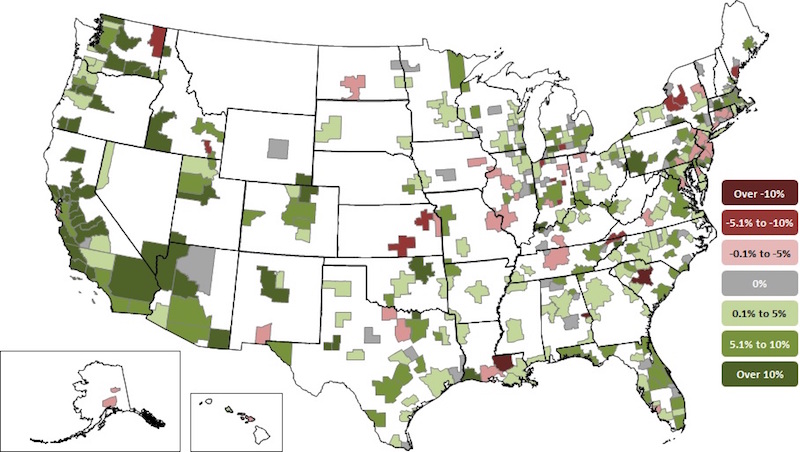

Construction employment increased in 257 out of 358 metro areas between February 2017 and February 2018, declined in 50 and stagnated in 51, according to a new analysis of federal employment data released today by the Associated General Contractors of America. Association officials said that the employment gains are occurring as construction firms in many parts of the country are having a hard time finding enough qualified workers to keep pace with demand.

"Growing private-sector demand for construction services is prompting construction firms to hire more people to complete projects," said Ken Simonson, the association's chief economist. "Yet tight labor markets, particularly for qualified construction workers, is making it increasingly difficult for firms to find people to bring on board."

Riverside-San Bernardino-Ontario, Calif. added the most construction jobs during the past year (12,000 jobs, 13%), followed by Phoenix-Mesa-Scottsdale, Ariz. (9,900 jobs, 9%); Dallas-Plano-Irving, Texas (9,700 jobs, 7%); Houston-The Woodlands-Sugar Land, Texas (9,300 jobs, 4%) and Los Angeles-Long Beach-Glendale, Calif. (7,700 jobs, 6%). The largest percentage gains occurred in the Merced, Calif. metro area (33%, 700 jobs) followed by Midland, Texas (22%, 5,400 jobs); Lake Charles, La. (21%, 4,700 jobs) and Weirton-Steubenville, W.V.-Ohio (21%, 300 jobs).

The largest job losses from February 2017 to February 2018 were in Baton Rouge, La. (-6,500 jobs, -12%), followed by St. Louis, Mo.-Ill. (-2,500 jobs, -4%); Columbia, S.C. (-2,200 jobs, -11%); Fort Worth-Arlington, Texas (-2,000 jobs, -3%) and Middlesex-Monmouth-Ocean, N.J. (-1,700 jobs, -5%). The largest percentage decreases for the year were in Auburn-Opelika, Ala. (-38%, -1,500 jobs) followed by Baton Rouge, Columbia, S.C. and Kokomo, Ind. (-9%, -100 jobs).

Association officials said that growing private sector demand in February is prompting many firms to add more staff as they work to complete projects. They added that the recently-enacted federal spending measure includes up to $10 billion in additional infrastructure funding for this year, meaning firms that perform public-sector work are likely to begin expanding as well amid tight labor market conditions.

"As demand for construction continues to expand, it will only get harder for many firms to find qualified workers to hire," said Stephen E. Sandherr, the association's chief executive officer. "Congress and the administration should work together to expand career and technical education opportunities so more high school students will opt for good-paying careers in construction."

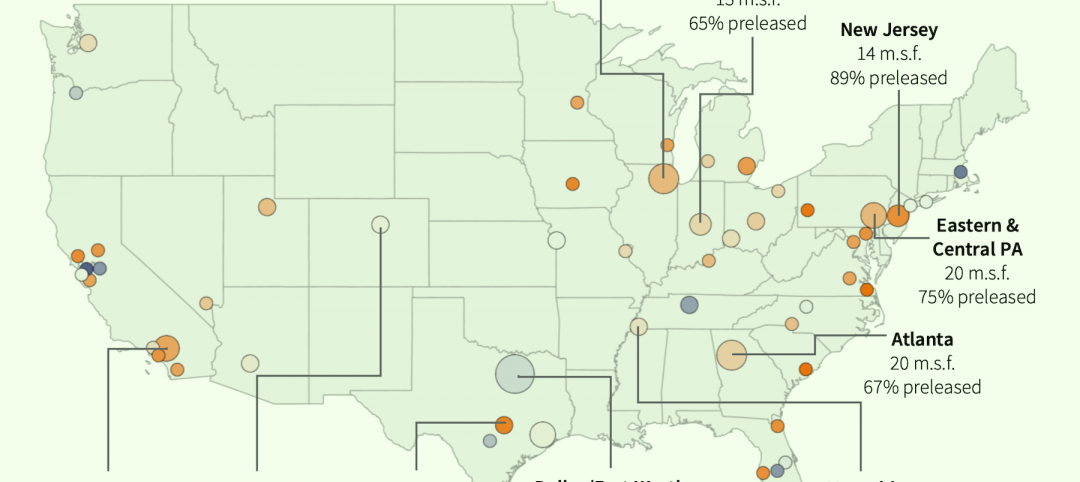

View the metro employment data by rank and state. View metro employment map.

Related Stories

Market Data | May 18, 2022

Architecture Billings Index moderates slightly, remains strong

For the fifteenth consecutive month architecture firms reported increasing demand for design services in April, according to a new report today from The American Institute of Architects (AIA).

Market Data | May 12, 2022

Monthly construction input prices increase in April

Construction input prices increased 0.8% in April compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Market Data | May 10, 2022

Hybrid work could result in 20% less demand for office space

Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.

Market Data | May 6, 2022

Nonresidential construction spending down 1% in March

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Apr 29, 2022

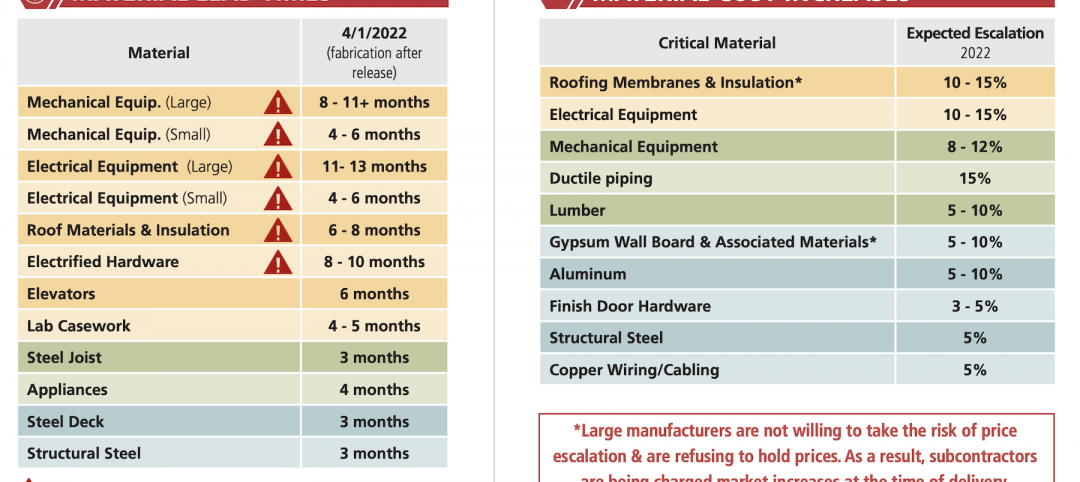

Global forces push construction prices higher

Consigli’s latest forecast predicts high single-digit increases for this year.

Market Data | Apr 29, 2022

U.S. economy contracts, investment in structures down, says ABC

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022.

Market Data | Apr 20, 2022

Pace of demand for design services rapidly accelerates

Demand for design services in March expanded sharply from February according to a new report today from The American Institute of Architects (AIA).

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment