Construction employment in February remained below pre-pandemic levels in all but six states, according to an analysis by the Associated General Contractors of America of government employment data released today, while soaring materials costs and supply-chain problems threaten future employment. The association issued a Construction Inflation Alert detailing the problems and urged a rollback of tariffs and other supply impediments.

“Today’s figures show most states are still far from recovering the construction jobs lost a year ago,” said Ken Simonson, the association’s chief economist. “The overall economy is recovering, but huge price spikes and ever-lengthening delivery times threaten to set construction back further.”

The association’s new inflation alert documents a wide variety of materials undergoing steep and frequent price increases and delivery delays, Simonson noted. This combination threatens to hold up the start or completion of numerous projects and add to the downward pressure on construction employment, the economist warned.

Seasonally adjusted construction employment in February 2021 was lower than in February 2020—the last month before the pandemic forced many contractors to suspend work—in 44 states and the District of Columbia. Texas lost the most construction jobs over the period (-56,400 jobs or -7.2%), followed by New York (-41,100 jobs, -10.1%), California (-35,000 jobs, -3.8%), Louisiana (-20,400 jobs, -14.9%), and New Jersey (-18,200 jobs, -11.1%). Louisiana experienced the largest percentage loss, followed by Wyoming (-14.0%, -3,200 jobs), New Jersey, New York, and West Virginia (-9.3%, -3,100 jobs).

Only six states added construction jobs from February 2020 to February 2021. Utah added the most jobs (6,700 jobs, 5.9%), trailed by Idaho (4,500 jobs, 8.2%) and Arkansas (900 jobs, 1.7%). Idaho added the highest percentage, followed by Utah and Arkansas.

From January to February, 35 states lost construction jobs, 11 states added jobs, and there was no change in D.C., Idaho, Oregon, Rhode Island, and Vermont. New York had the largest loss of construction jobs for the month (-15,600 jobs or -4.1%), followed by Indiana (-6,100 jobs, -4.1%), Illinois (-5,600 jobs, -2.6%), and Iowa (-5,500 jobs, -6.9%). Iowa had the largest percentage decline, followed by Kansas (-4.9%, -3,100 jobs), New York, and Indiana. Utah added the most construction jobs and the highest percentage over the month (3,000 jobs, 2.5%), followed by South Carolina (2,200 jobs, 2.1%).

Association officials called on the Biden administration to roll back tariffs on a range of key construction materials, including lumber and steel, that are contributing to the price spikes. They also urged the administration and Congress to work together to find ways to ease shipping delays that are undermining established supply chains. This could include providing temporary hours-of-service relief and looking at ways to expand port capacity.

“The coronavirus has wreaked havoc on many supply chains, but some of the price increases are the result of misguided policy decisions, including tariffs,” said Stephen E. Sandherr, the association’s chief executive officer. “Cutting tariffs and addressing shipping delays will give a needed boost to many firms struggling to get back to pre-pandemic business and employment levels.”

View state February 2020-February 2021 data and rankings and January-February rankings. View AGC’s Inflation Alert.

Related Stories

Industry Research | Jun 26, 2017

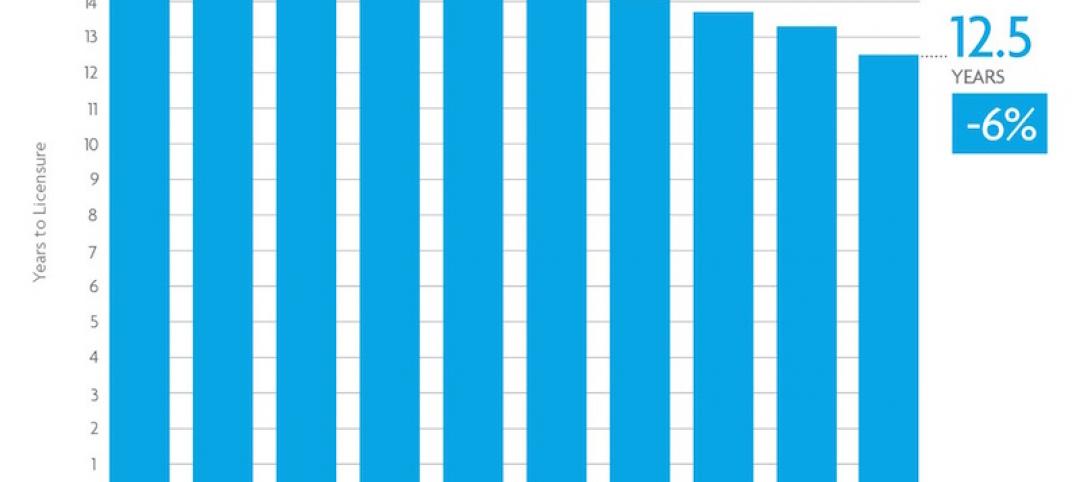

Time to earn an architecture license continues to drop

This trend is driven by candidates completing the experience and examination programs concurrently and more quickly.

Industry Research | Jun 22, 2017

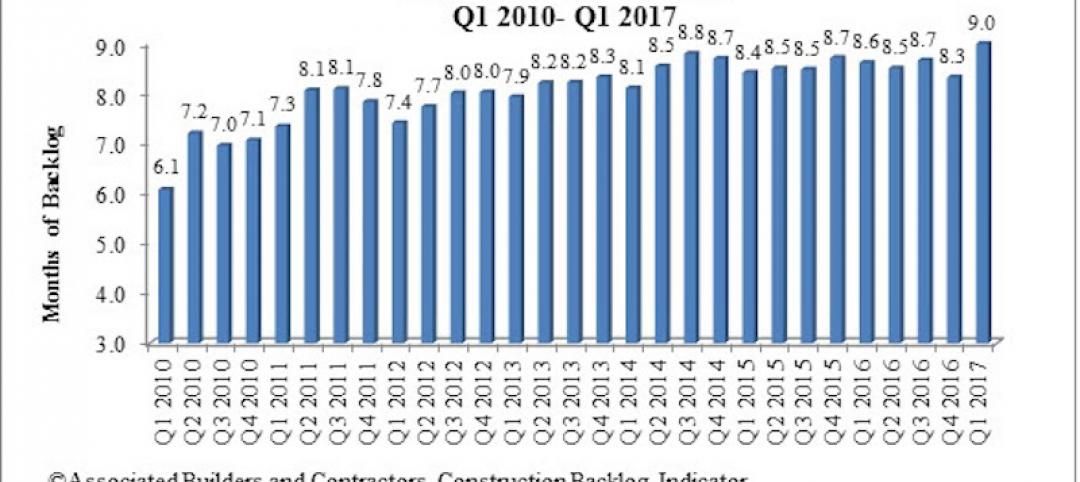

ABC's Construction Backlog Indicator rebounds in 2017

The first quarter showed gains in all categories.

Market Data | Jun 21, 2017

Design billings maintain solid footing, strong momentum reflected in project inquiries/design contracts

Balanced growth results in billings gains in all sectors.

Market Data | Jun 16, 2017

Residential construction was strong, but not enough, in 2016

The Joint Center for Housing Studies’ latest report expects minorities and millennials to account for the lion’s share of household formations through 2035.

Industry Research | Jun 15, 2017

Commercial Construction Index indicates high revenue and employment expectations for 2017

USG Corporation (USG) and U.S. Chamber of Commerce release survey results gauging confidence among industry leaders.

Market Data | Jun 2, 2017

Nonresidential construction spending falls in 13 of 16 segments in April

Nonresidential construction spending fell 1.7% in April 2017, totaling $696.3 billion on a seasonally adjusted, annualized basis, according to analysis of U.S. Census Bureau data released today by Associated Builders and Contractors.

Industry Research | May 25, 2017

Project labor agreement mandates inflate cost of construction 13%

Ohio schools built under government-mandated project labor agreements (PLAs) cost 13.12 percent more than schools that were bid and constructed through fair and open competition.

Market Data | May 24, 2017

Design billings increasing entering height of construction season

All regions report positive business conditions.

Market Data | May 24, 2017

The top franchise companies in the construction pipeline

3 franchise companies comprise 65% of all rooms in the Total Pipeline.

Industry Research | May 24, 2017

These buildings paid the highest property taxes in 2016

Office buildings dominate the list, but a residential community climbed as high as number two on the list.