Construction employment declined in 99 out of 358 metro areas from March 2019 to last month as the coronavirus pandemic triggered the first shutdown orders and project cancellations, according to an analysis released by the Associated General Contractors of America today. Association officials urged federal and state officials to boost investments in infrastructure to help put more people to work amid rising unemployment levels.

“These new figures foreshadow even larger declines in construction employment throughout the country as the pandemic’s economic damage grows more severe,” said Ken Simonson, the association’s chief economist. “Unfortunately, the data for April and later months are sure to be much worse. In our latest survey, more than one-third of firms report they had furloughed or terminated workers—a direct result of growing cancellations.”

The largest percentage decline in construction employment between March 2019 and last month occurred in Laredo, Texas, which lost 19% or 800 jobs, followed by Lake Charles, La., which lost 18% (4,600 construction jobs). Lake Charles had the largest numerical decrease, followed by New York City, which lost 3,500 construction jobs (2%).

Construction employment increased over the year in 205 metro areas and was flat in 54. The largest percentage increases in construction employment occurred in Lewiston, Idaho-Wash. (23%, 300 jobs), followed by Walla Walla, Wash. (22%, 22 jobs). The largest numerical gain occurred in Dallas-Plano-Irving, Texas (10,200 jobs, 7%).

Association officials noted that new infrastructure investments would help offset some of the sudden and dramatic declines to demand for construction that have taken place since the start of the coronavirus pandemic. They noted, for example, that 68% of construction firms report in the association’s April 20-23 survey that they have had projects cancelled or delayed during the past two months.

“New infrastructure funding will put more people back to work in high-paying construction jobs in communities throughout the nation,” said Stephen E. Sandherr, the association’s chief executive officer. “New infrastructure funding will also give a needed boost to manufacturing and service sector firms that supply construction employers, all of which have been hard-hit by the coronavirus and the related economic shutdowns.”

View AGC’s coronavirus resources and survey. View comparative data here. View the metro employment data, rankings, highs and lows and top 10.

Related Stories

High-rise Construction | Jan 23, 2017

Growth spurt: A record-breaking 128 buildings of 200 meters or taller were completed in 2016

This marks the third consecutive record-breaking year for building completions over 200 meters.

Market Data | Jan 18, 2017

Fraud and risk incidents on the rise for construction, engineering, and infrastructure businesses

Seven of the 10 executives in the sector surveyed in the report said their company fell victim to fraud in the past year.

Market Data | Jan 18, 2017

Architecture Billings Index ends year on positive note

Architecture firms close 2016 with the strongest performance of the year.

Market Data | Jan 12, 2017

73% of construction firms plan to expand their payrolls in 2017

However, many firms remain worried about the availability of qualified workers.

Market Data | Jan 9, 2017

Trump market impact prompts surge in optimism for U.S. engineering firm leaders

The boost in firm leader optimism extends across almost the entire engineering marketplace.

Market Data | Jan 5, 2017

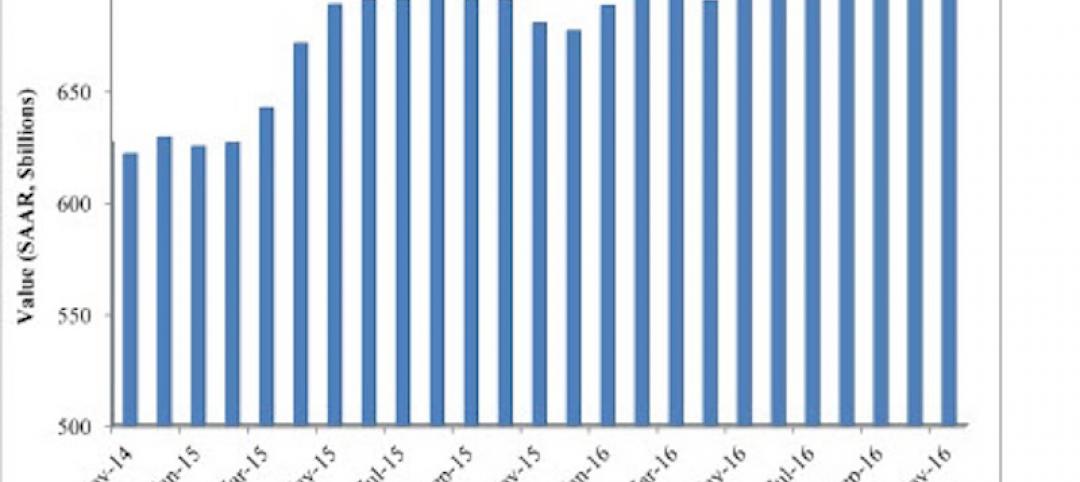

Nonresidential spending thrives in strong November spending report

Many construction firms have reported that they remain busy but have become concerned that work could dry up in certain markets in 2017 or 2018, says Anirban Basu, ABC Chief Economist.

Market Data | Dec 21, 2016

Architecture Billings Index up slightly in November

New design contracts also return to positive levels, signifying future growth in construction activity.

Market Data | Dec 21, 2016

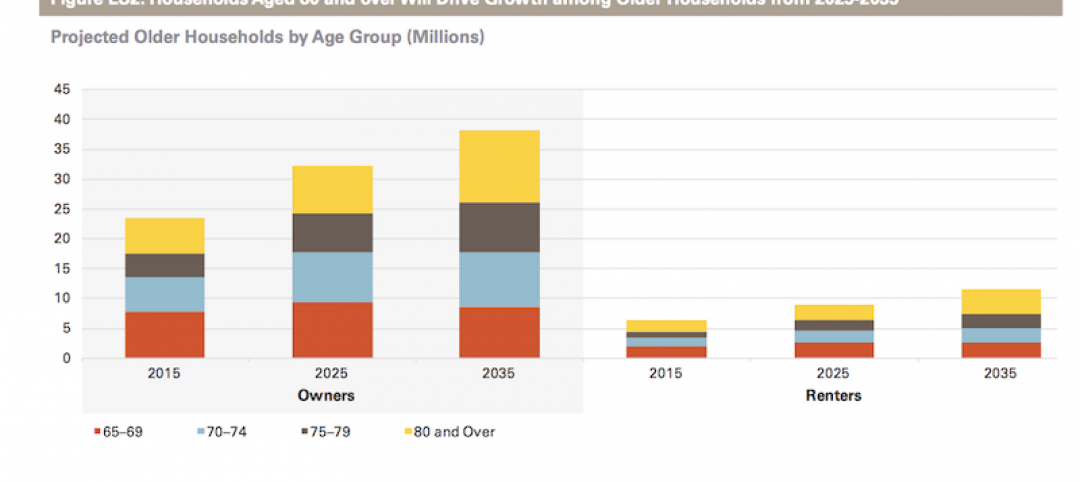

Will housing adjust to an aging population?

New Joint Center report projects 66% increase in senior heads of households by 2035.

Market Data | Dec 13, 2016

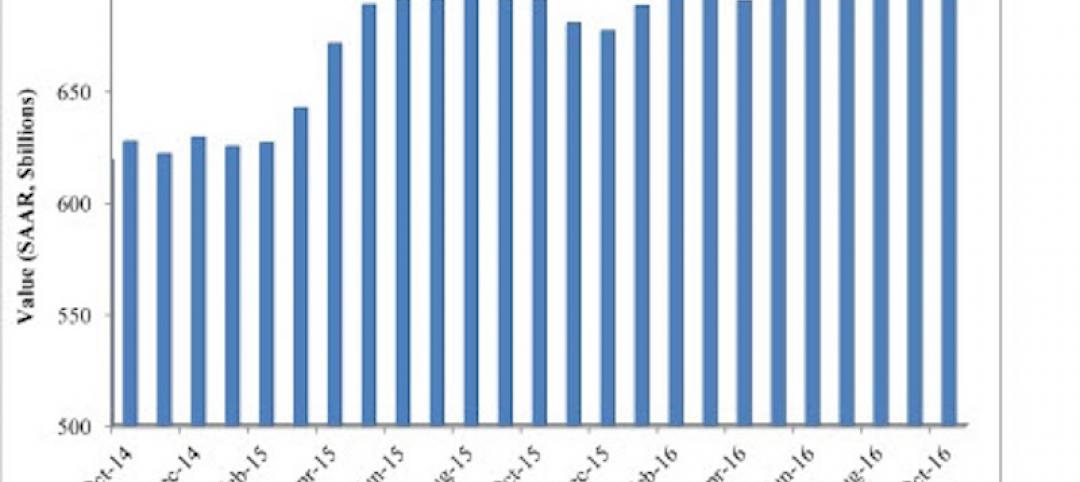

ABC predicts modest growth for 2017 nonresidential construction sector; warns of vulnerability for contractor

“The U.S. economy continues to expand amid a weak global economy and, despite risks to the construction industry, nonresidential spending should expand 3.5 percent in 2017,” says ABC Chief Economist Anirban Basu.

Market Data | Dec 2, 2016

Nonresidential construction spending gains momentum

Nonresidential spending is now 2.6 percent higher than at the same time one year ago.