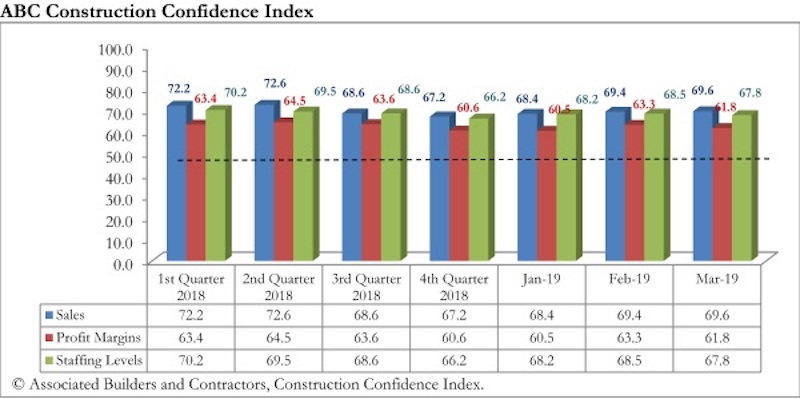

Construction industry leaders remained upbeat with respect to nonresidential construction prospects in March 2019, according to the latest Construction Confidence Index released today by Associated Builders and Contractors.

All three principal components measured by the survey—sales, profit margins and staffing levels— remained well above the diffusion index threshold of 50, signaling ongoing expansion in construction activity. While contractors are slightly less upbeat regarding profit margins and staffing levels than in February, more than 70% of contractors expect to increase staffing levels over the next six months, a reflection of continued elevated demand for construction services. Despite rising wage pressures, more than 56% of survey respondents anticipate rising profit margins, an indication that users of construction services remain willing to pay more to get projects delivered.

- The CCI for sales expectations increased from 69.4 to 69.6 in March.

- The CCI for profit margin expectations fell from 63.3 to 61.8.

- The CCI for staffing levels fell from 68.5 to 67.8.

“Last year, the U.S. economy grew 2.9%, and it expanded an additional 3.2% during the first quarter of 2019,” said ABC Chief Economist Anirban Basu. “All of this is consistent with the notion that demand for nonresidential construction services will remain elevated for the foreseeable future. The CCI findings are also consistent with ABC’s latest Construction Backlog Indicator report, which revealed that many contractors have a growing number of projects in their pipeline.

“A major source of influence on the data is the reemergence of public construction spending,” said Basu. “With nearly 10 years of economic expansion complete, many state and local governments are experiencing their best fiscal health in years, resulting in more funds to invest in roads, transit systems, schools, fire stations and police stations. The combination of spending growth in certain private construction categories and rising infrastructure outlays will keep the average American nonresidential contractor scrambling to retain and recruit workers, especially in the context of a national rate of unemployment effectively at a 50-year low.

“It should be noted that the most recent CCI survey was completed prior to the turmoil associated with the trade dispute between the United States and China, which may impact contractor confidence,” said Basu. “While global investors have exhibited concern, most construction activity involves U.S.-based enterprises providing services to U.S.-based customers, minimizing unease. That said, the imposition of tariffs has the potential to raise costs of equipment and other inputs, which could at least conceivably impact profit margins. Moreover, market turmoil can truncate the availability of financing to prospective construction projects.”

CCI is a diffusion index. Readings above 50 indicate growth, while readings below 50 are unfavorable.

ABC Construction Confidence Index, March 2019

Related Stories

Market Data | Jun 14, 2016

Transwestern: Market fundamentals and global stimulus driving economic growth

A new report from commercial real estate firm Transwestern indicates steady progress for the U.S. economy. Consistent job gains, wage growth, and consumer spending have offset declining corporate profits, and global stimulus plans appear to be effective.

Market Data | Jun 7, 2016

Global construction disputes took longer to resolve in 2015

The good news: the length and value of disputes in the U.S. fell last year, according to latest Arcadis report.

Market Data | Jun 3, 2016

JLL report: Retail renovation drives construction growth in 2016

Retail construction projects were up nearly 25% year-over-year, and the industrial and office construction sectors fared well, too. Economic uncertainty looms over everything, however.

Market Data | Jun 2, 2016

ABC: Nonresidential construction spending down in April

Lower building material prices, a sluggish U.S. economy, and hesitation among private developers all factor into the 2.1% drop.

Market Data | May 20, 2016

Report: Urban area population growth slows

Older Millennials are looking to buy homes and move away to more affordable suburbs and exurbs.

Market Data | May 17, 2016

Modest growth for AIA’s Architecture Billings Index in April

The American Institute of Architects reported the April ABI score was 50.6, down from the mark of 51.9 in the previous month. This score still reflects an increase in design services.

Market Data | Apr 29, 2016

ABC: Quarterly GDP growth slowest in two years

Bureau of Economic Analysis data indicates that the U.S. output is barely growing and that nonresidential investment is down.

Market Data | Apr 20, 2016

AIA: Architecture Billings Index ends first quarter on upswing

The multi-family residential sector fared the best. The Midwest was the only U.S. region that didn't see an increase in billings.

Building Technology | Apr 11, 2016

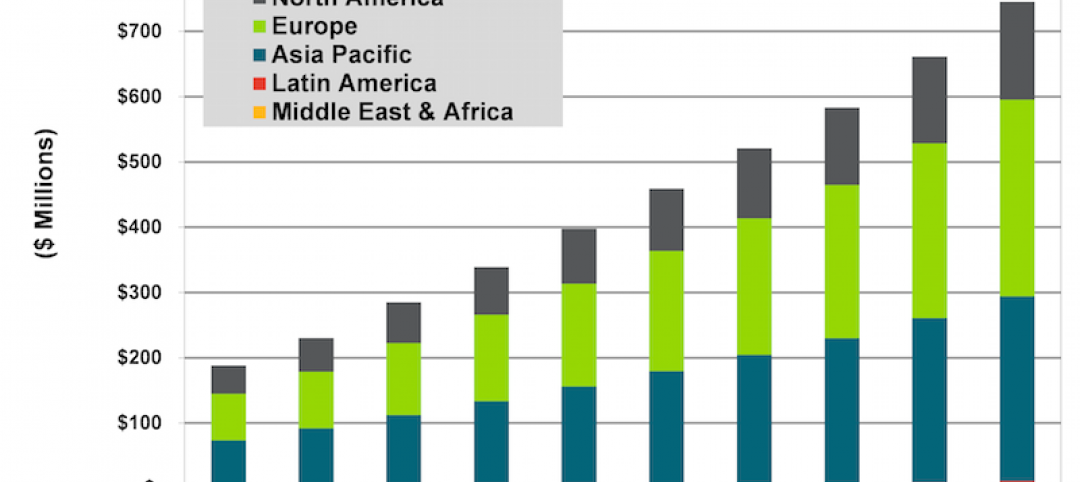

A nascent commercial wireless sensor market is poised to ascend in the next decade

Europe and Asia will propel that growth, according to a new report from Navigant.

Industry Research | Apr 7, 2016

CBRE provides latest insight into healthcare real estate investors’ strategies

Survey respondents are targeting smaller acquisitions, at a time when market cap rates are narrowing for different product types.