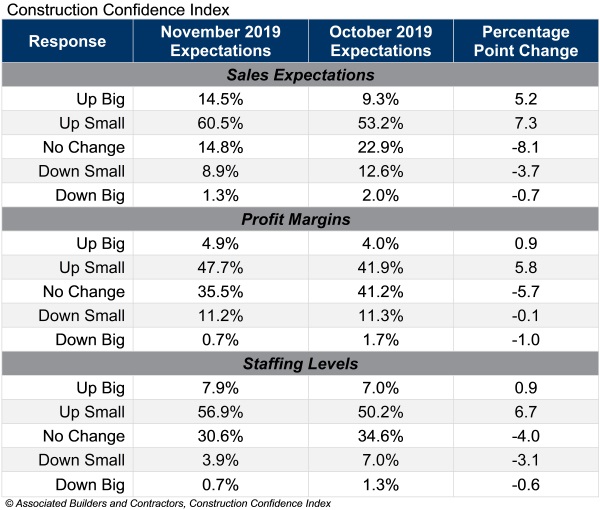

Confidence among U.S. construction industry leaders increased in November 2019 with respect to sales, profit margins, and staffing, according to the Associated Builders and Contractors Construction Confidence Index.

Sales and profit margin expectations reached their highest levels since May 2019, while staffing expectations reached their highest level since April 2019.

Three-quarters of contractors expect sales to rise over the next six months and, as a result, nearly 65% expect to increase their staffing levels, indicating that the average contractor will face even greater challenges recruiting and retaining talent through the first half of 2020.

More than 50% of contractors expect their profit margins to increase over the next six months for the first time since August 2019. Fewer than 12% expect margins to decline, strongly suggesting that demand for construction services remains elevated and purchasers are willing to pay enough to offset rising compensation costs.

• The CCI for sales expectations increased from 63.8 to 69.5 in November.

• The CCI for profit margin expectations increased from 58.8 to 61.3.

• The CCI for staffing levels increased from 63.6 to 66.9.

“The U.S. economy retains significant momentum entering 2020,” said ABC chief economist Anirban Basu. “Accordingly, the nonresidential construction outlook remains stable. The duration of the economic expansion—already record-shattering—has more room to run. ABC’s Construction Backlog Indicator remained virtually unchanged at 8.8 months in November, and with job growth still apparent, demand for office and other forms of commercial construction will persist. Improved state and local government finances working in conjunction with ultra-low interest rates are helping to fuel additional spending in a variety of infrastructure-related categories, including water systems, flood control and public safety. Though there will always be reasons for concern, including those related to geopolitics, the achievement of a first phase trade deal with China and the new United States-Mexico-Canada trade agreement, which replaced NAFTA, should provide much-needed certainty regarding near-term economic prospects.”

CCI is a diffusion index. Readings above 50 indicate growth, while readings below 50 are unfavorable.

Related Stories

Hotel Facilities | Jul 28, 2022

As travel returns, U.S. hotel construction pipeline growth follows

According to the recently released United States Construction Pipeline Trend Report from Lodging Econometrics (LE), the total U.S. construction pipeline stands at 5,220 projects/621,268 rooms at the close of 2022’s second quarter, up 9% Year-Over-Year (YOY) by projects and 4% YOY by rooms.

Codes and Standards | Jul 22, 2022

Hurricane-resistant construction may be greatly undervalued

New research led by an MIT graduate student at the school’s Concrete Sustainability Hub suggests that the value of buildings constructed to resist wind damage in hurricanes may be significantly underestimated.

Market Data | Jul 21, 2022

Architecture Billings Index continues to stabilize but remains healthy

Architecture firms reported increasing demand for design services in June, according to a new report today from The American Institute of Architects (AIA).

Market Data | Jul 21, 2022

Despite deteriorating economic conditions, nonresidential construction spending projected to increase through 2023

Construction spending on buildings is projected to increase just over nine percent this year and another six percent in 2023, according to a new report from the American Institute of Architects (AIA).

Building Team | Jul 18, 2022

Understanding the growing design-build market

FMI’s new analysis of the design-build market forecast for the next fives years shows that this delivery method will continue to grow, despite challenges from the COVID-19 pandemic.

Market Data | Jul 1, 2022

Nonresidential construction spending slightly dips in May, says ABC

National nonresidential construction spending was down by 0.6% in May, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Jun 30, 2022

Yardi Matrix releases new national rent growth forecast

Rents in most American cities continue to rise slightly each month, but are not duplicating the rapid escalation rates exhibited in 2021.

Market Data | Jun 22, 2022

Architecture Billings Index slows but remains strong

Architecture firms reported increasing demand for design services in May, according to a new report today from The American Institute of Architects (AIA).

Building Team | Jun 17, 2022

Data analytics in design and construction: from confusion to clarity and the data-driven future

Data helps virtual design and construction (VDC) teams predict project risks and navigate change, which is especially vital in today’s fluctuating construction environment.

Market Data | Jun 15, 2022

ABC’s construction backlog rises in May; contractor confidence falters

Associated Builders and Contractors reports today that its Construction Backlog Indicator increased to nine months in May from 8.8 months in April, according to an ABC member survey conducted May 17 to June 3. The reading is up one month from May 2021.