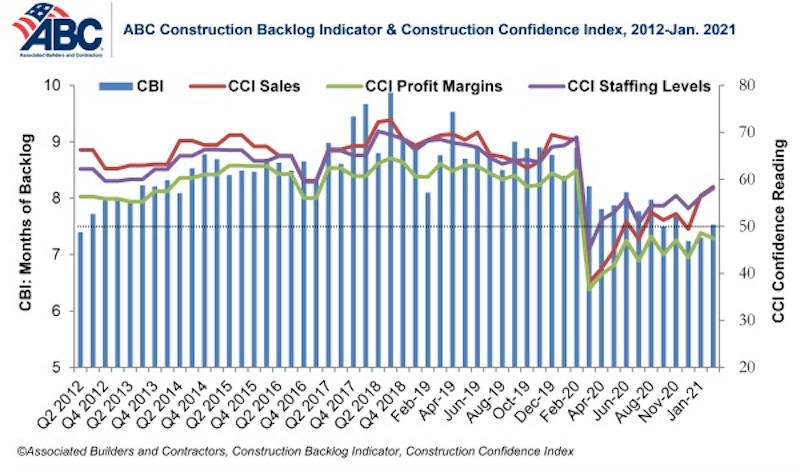

Associated Builders and Contractors reported today that its Construction Backlog Indicator rose to 7.5 months in January 2021, an increase of 0.2 months from its December 2020 reading, according to an ABC member survey conducted from Jan. 20 to Feb. 2. Despite the monthly uptick, backlog is 0.9 months lower than in January 2020.

ABC’s Construction Confidence Index readings for sales and staffing levels increased in January and remain above the threshold of 50, indicating expectations of growth over the next six months. The index reading for profit margins remained below that threshold, slipping to 47.5 in January.

“Though nonresidential construction spending has continued to recede for the better part of a year, the growing consensus is that the next six months will be a period of improvement,” said ABC Chief Economist Anirban Basu. “While backlog is down substantially from its January 2020 level and profit margins remain under pressure, more than half of contractors expect sales to rise over the next six months and nearly half expect to increase staffing levels.

“The anticipation is that the second half of the year will be spectacular for the U.S. economy from a growth perspective, which will help lift industry fortunes as 2022 approaches,” said Basu. “But that is not the entire story. There are also public health and supply chain considerations. During the COVID-19 pandemic, many contractors experienced repeated interruptions in project work. Acquiring key materials and equipment has also become more difficult, with occasional price shocks for certain commodities. With vaccinations proceeding apace, many contractors will benefit from fewer interruptions going forward and the restart of many postponed projects.”

Related Stories

Market Data | Oct 31, 2016

Nonresidential fixed investment expands again during solid third quarter

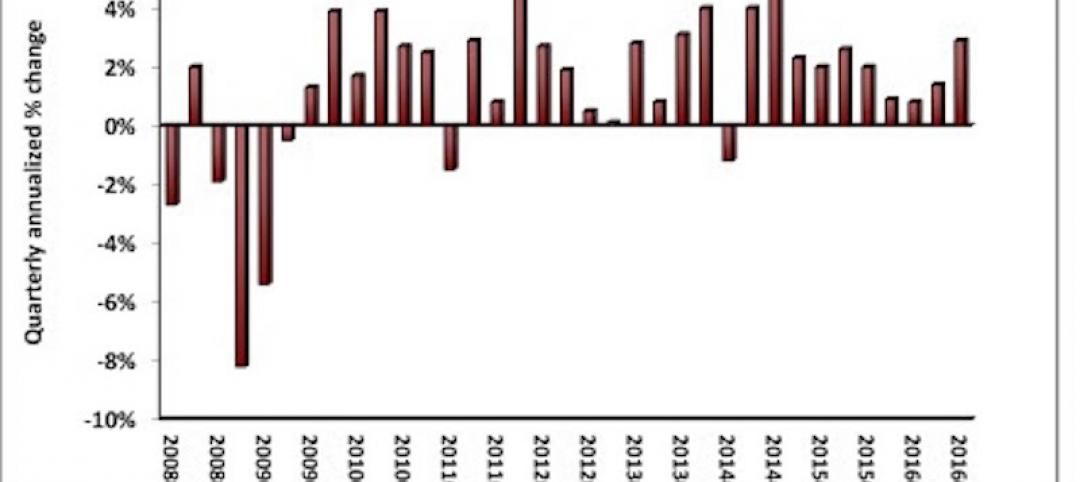

The acceleration in real GDP growth was driven by a combination of factors, including an upturn in exports, a smaller decrease in state and local government spending and an upturn in federal government spending, says ABC Chief Economist Anirban Basu.

Market Data | Oct 28, 2016

U.S. construction solid and stable in Q3 of 2016; Presidential election seen as influence on industry for 2017

Rider Levett Bucknall’s Third Quarter 2016 USA Construction Cost Report puts the complete spectrum of construction sectors and markets in perspective as it assesses the current state of the industry.

Industry Research | Oct 25, 2016

New HOK/CoreNet Global report explores impact of coworking on corporate real rstate

“Although coworking space makes up less than one percent of the world’s office space, it represents an important workforce trend and highlights the strong desire of today’s employees to have workplace choices, community and flexibility,” says Kay Sargent, Director of WorkPlace at HOK.

Market Data | Oct 24, 2016

New construction starts in 2017 to increase 5% to $713 billion

Dodge Outlook Report predicts moderate growth for most project types – single family housing, commercial and institutional building, and public works, while multifamily housing levels off and electric utilities/gas plants decline.

High-rise Construction | Oct 21, 2016

The world’s 100 tallest buildings: Which architects have designed the most?

Two firms stand well above the others when it comes to the number of tall buildings they have designed.

Market Data | Oct 19, 2016

Architecture Billings Index slips consecutive months for first time since 2012

“This recent backslide should act as a warning signal,” said AIA Chief Economist, Kermit Baker.

Market Data | Oct 11, 2016

Building design revenue topped $28 billion in 2015

Growing profitability at architecture firms has led to reinvestment and expansion

Market Data | Oct 4, 2016

Nonresidential spending slips in August

Public sector spending is declining faster than the private sector.

Industry Research | Oct 3, 2016

Structure Tone survey shows cost is still a major barrier to building green

Climate change, resilience and wellness are also growing concerns.

Industry Research | Sep 27, 2016

Sterling Risk Sentiment Index indicates risk exposure perception remains stable in construction industry

Nearly half (45%) of those polled say election year uncertainty has a negative effect on risk perception in the construction market.