The Q2 2020 USG Corporation + U.S. Chamber of Commerce Commercial Construction Index (Index) released today plunged from 74 in Q1 to 56 in Q2. Two of the index’s three main indicators—confidence in new business and revenue expectations—both fell 26 points, to 50 and 44, respectively, revealing the severe impact of the coronavirus pandemic on the construction industry. However, the third indicator, backlog, dropped only a modest three points, remaining consistent with the first half of 2018. Survey results were largely collected in the month of April, at the height of shutdown restrictions.

The overall drop in the Index stemmed in part from the fact that very few contractors (16%) now express high confidence in the market’s ability to provide new business opportunities in the next 12 months (down from 54% in Q1), and there was a 30 percentage point drop in contractors expecting their revenues to increase (17% in Q2 from 47% in Q1). Meanwhile, the percentage expecting to see their revenues decrease in the next 12 months spiked from 2% in Q1 to 21% in Q2.

Yet several survey findings suggest that the commercial construction industry is poised for recovery. Contractors still have significant backlog, with 60% of contractors reporting they have at least six months of backlog (compared to 69% in Q1). More than eight in 10 (83%) say their revenue will increase or remain about the same in the next year. And, three in four contractors say they have moderate or high confidence that the next year will bring sufficient new business opportunities (and in the next two years, that percentage rises to 93%).

This quarter’s Index also reveals that the commercial construction industry is an important employer and is ready to hire more workers. One in three contractors (32%) plan to hire more workers in the next six months, while nearly half (48%) believe their workforce will stay the same. Only 15% expect to employ fewer people.

“Even as most construction has been deemed essential during the last few months, the loss of new projects and revenue has been severe. This industry is key to our economy, representing three million American jobs and $700 billion in spending," says Christopher Griffin, president and CEO of USG Corporation. “We’re watching closely signs of improvement, as commercial construction can serve as a bellwether for other economic development and recovery.”

Covid-19 Impacts

When the survey was taken in April 2020 the vast majority (87%) of contractors reported they were currently experiencing delays due to the coronavirus outbreak, with 87% expecting delays to continue into the summer and 73% expecting delays will remain in the fall.

However, contractors become less concerned about delayed projects as they look to the future. In April, over a third (35%) of contractors reported that at least 75% of their projects were delayed. Asked to look three months ahead, only 16% of contractors expected the same, and looking six months ahead, only 8% expect at least 75% of their projects to be delayed.

“No industry has been immune to the devastating impact of Covid-19,” said Neil Bradley, U.S. Chamber of Commerce executive vice president and chief policy officer. “However, the commercial construction industry appears poised for a quick recovery and a return to growth. This is good news for the economy and the millions of Americans who work in the industry. Congress can help by continuing to support the economy.”

Contractors quickly adapted their operations to comply with new safety guidelines. More than nine in 10 contractors (92%) said they changed work procedures to increase social distancing. And, contractors indicated worker health and safety is top of mind. Given a list to choose from of the most severe Covid-19 consequences for their business, three-quarters (75%) said worker health and safety is a top concern, followed by fewer projects (48%), and increases in workforce shortages (33%).

Asked how the pandemic will change how they do business in the future, contractors said adjustments to safety and work procedures would be the top change. They also expect big changes in more remote work for their staff and paying greater attention to language used in contracts.

On June 24, join USG Corporation and the U.S. Chamber of Commerce for a virtual panel discussion on Covid-19’s impact on the construction industry, where USG Corporation CEO Chris Griffin, U.S. Chamber of Commerce Senior Economist Curtis Dubay, and Association of the Wall and Ceiling Industry CEO Michael Stark will discuss these survey findings and more.

The Index is comprised of three leading indicators to gauge confidence in the commercial construction industry, generating a composite Index on the scale of 0 to 100 that serves as an indicator of health of the contractor segment on a quarterly basis. The survey was in the field April 4 - 27, 2020.

The Q2 2020 results from the three key drivers were:

- Backlog: The backlog indicator dropped three points to 73 (from 76 in Q1).

- New Business Confidence: The overall level of contractor confidence dropped to 50 (down 26 points from Q1).

- Revenue: Contractors’ revenue expectations over the next 12 months dropped to 44 (down 26 points from Q1).

The research was developed with Dodge Data & Analytics (DD&A), the leading provider of insights and data for the construction industry, by surveying commercial and institutional contractors.

Related Stories

Contractors | Apr 19, 2023

Rising labor, material prices cost subcontractors $97 billion in unplanned expenses

Subcontractors continue to bear the brunt of rising input costs for materials and labor, according to a survey of nearly 900 commercial construction professionals.

Data Centers | Apr 14, 2023

JLL's data center outlook: Cloud computing, AI driving exponential growth for data center industry

According to JLL’s new Global Data Center Outlook, the mass adoption of cloud computing and artificial intelligence (AI) is driving exponential growth for the data center industry, with hyperscale and edge computing leading investor demand.

Healthcare Facilities | Apr 13, 2023

Healthcare construction costs for 2023

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

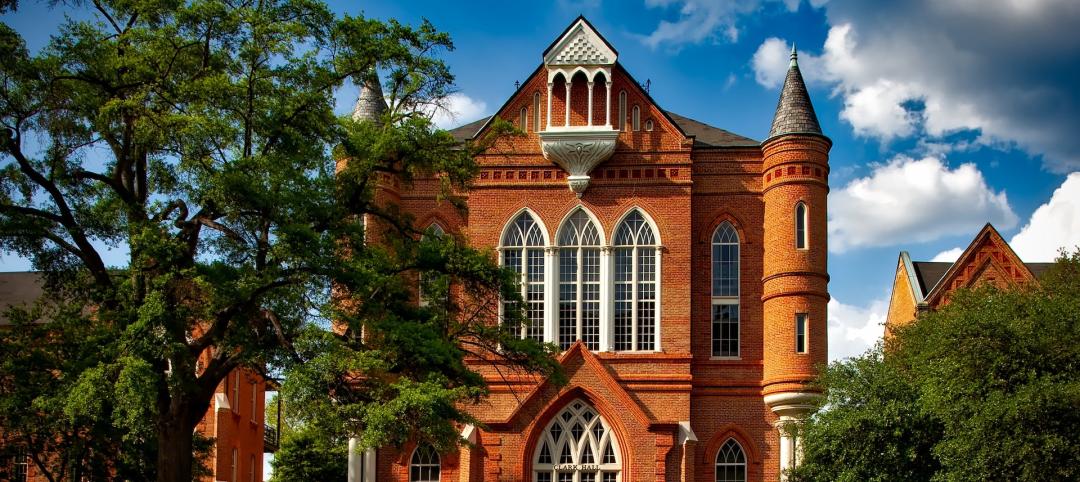

Higher Education | Apr 13, 2023

Higher education construction costs for 2023

Fresh data from Gordian breaks down the average cost per square foot for a two-story college classroom building across 10 U.S. cities.

Market Data | Apr 13, 2023

Construction input prices down year-over-year for first time since August 2020

Construction input prices increased 0.2% in March, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices rose 0.4% for the month.

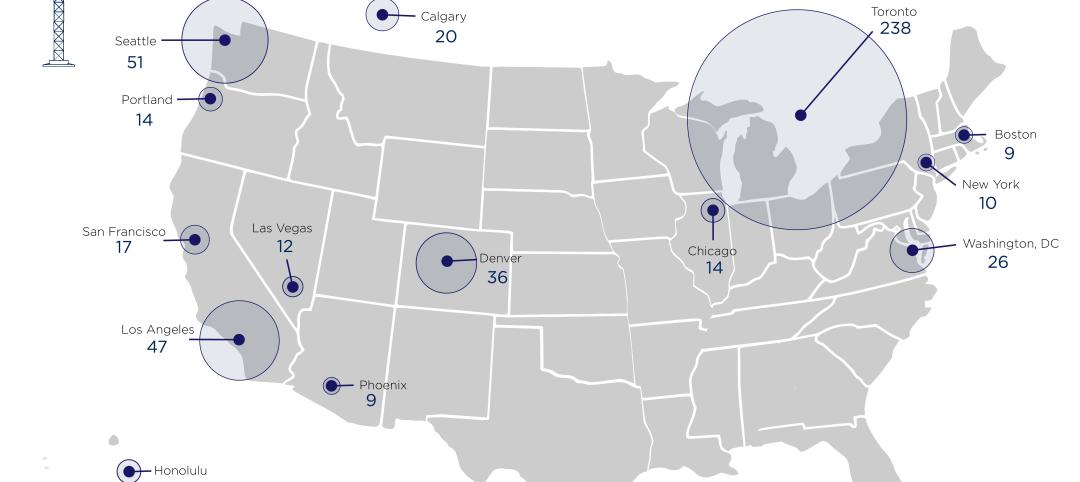

Market Data | Apr 11, 2023

Construction crane count reaches all-time high in Q1 2023

Toronto, Seattle, Los Angeles, and Denver top the list of U.S/Canadian cities with the greatest number of fixed cranes on construction sites, according to Rider Levett Bucknall's RLB Crane Index for North America for Q1 2023.

Contractors | Apr 11, 2023

The average U.S. contractor has 8.7 months worth of construction work in the pipeline, as of March 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.7 months in March, according to an ABC member survey conducted March 20 to April 3. The reading is 0.4 months higher than in March 2022.

Market Data | Apr 6, 2023

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.

Market Data | Apr 4, 2023

Nonresidential construction spending up 0.4% in February 2023

National nonresidential construction spending increased 0.4% in February, according to an Associated Builders and Contractors analysis of data published by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $982.2 billion for the month, up 16.8% from the previous year.

Multifamily Housing | Mar 24, 2023

Average size of new apartments dropped sharply in 2022

The average size of new apartments in 2022 dropped sharply in 2022, as tracked by RentCafe. Across the U.S., the average new apartment size was 887 sf, down 30 sf from 2021, which was the largest year-over-year decrease.