The Southeast and Texas offer the most favorable conditions for commercial construction, claiming seven of the top 10 markets in CBRE’s inaugural Development Opportunity Index. CBRE’s Index analyzes a spectrum of variables in the 50 largest U.S. markets to determine rate the highest for development opportunities across various asset classes.

U.S. construction activity is expected to bounce back in 2021, after a slowdown in 2020 due to challenges brought by COVID-19, including temporary work stoppages and difficulty sourcing various materials from abroad. Since the start of the pandemic, momentum has varied across commercial real estate sectors – development largely progressed in the multifamily and industrial & logistics sectors, but activity slowed—and in some cases stalled—for retail, hotels and speculative office development.

“We expect to see an uptick tenant fit-out projects in 2021 as employers redesign and reconfigure spaces to accommodate new standards in health, wellness and safety,” said Jim Dobleske, CBRE Global President of Project Management. “Costs, however, aren’t likely to change much; markets with high costs of land and labor won’t get much cheaper, if at all.”

CBRE’s Development Opportunity Index ranks markets based on development conditions including property performance across each of the major commercial real estate asset classes, construction costs, strength of supply, prior and forecast performance.

“Southern states continue to rate highly for development and construction conditions, though investors looking for development opportunities can find them in every market,” said James Millon, a Vice Chairman in CBRE’s Debt & Structured Finance practice. “Southern states often have job growth, in-migration and cost advantages that drive high volumes of construction activity.”

An overall top-10 ranking doesn’t necessarily mean that market is among the best for every asset class.

For example, CBRE’s analysts ranked San Jose as the best positioned market for office construction due to its supply growth and strong absorption. Phoenix – reflecting its shrinking vacancy and strong absorption -- and San Francisco – with strong rent growth – also are attractive office markets for development.

For industrial & logistics construction, Atlanta ranks highest due to its balance of strong inventory growth and net absorption. Also ranking well are Phoenix because of its affordable land and labor, and Dallas due to its relatively low costs and strong population growth.

Houston tops the index of ideal markets for retail construction due to that market’s strong consumer spending and sustained absorption of retail space. Next are Dallas and Atlanta, which both offer stable costs and good absorption of retail space.

For multifamily construction, the top markets are Orlando, Phoenix and Denver. Each offers strong population growth, job gains and relatively low costs.

To download the report, click here.

Related Stories

Market Data | May 18, 2022

Architecture Billings Index moderates slightly, remains strong

For the fifteenth consecutive month architecture firms reported increasing demand for design services in April, according to a new report today from The American Institute of Architects (AIA).

Market Data | May 12, 2022

Monthly construction input prices increase in April

Construction input prices increased 0.8% in April compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Market Data | May 10, 2022

Hybrid work could result in 20% less demand for office space

Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.

Market Data | May 6, 2022

Nonresidential construction spending down 1% in March

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Apr 29, 2022

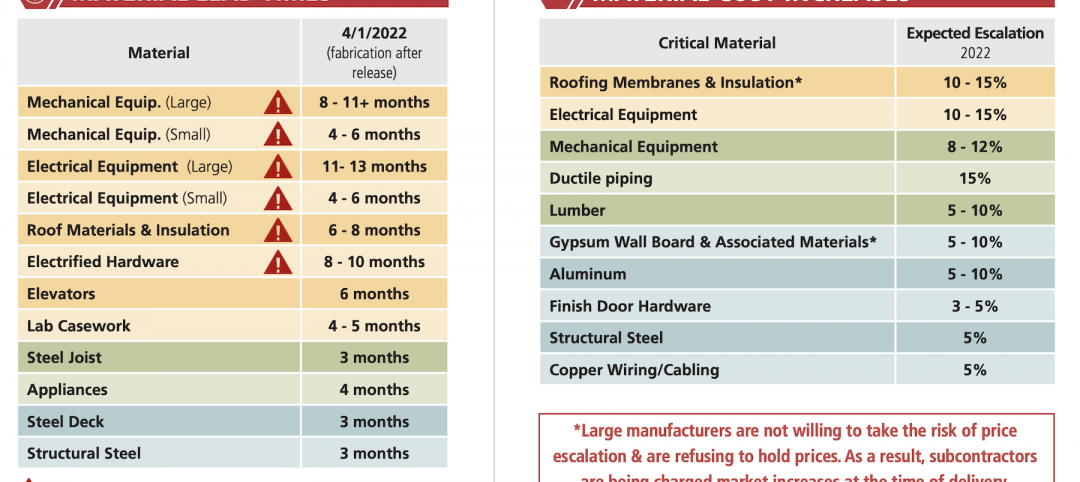

Global forces push construction prices higher

Consigli’s latest forecast predicts high single-digit increases for this year.

Market Data | Apr 29, 2022

U.S. economy contracts, investment in structures down, says ABC

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022.

Market Data | Apr 20, 2022

Pace of demand for design services rapidly accelerates

Demand for design services in March expanded sharply from February according to a new report today from The American Institute of Architects (AIA).

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

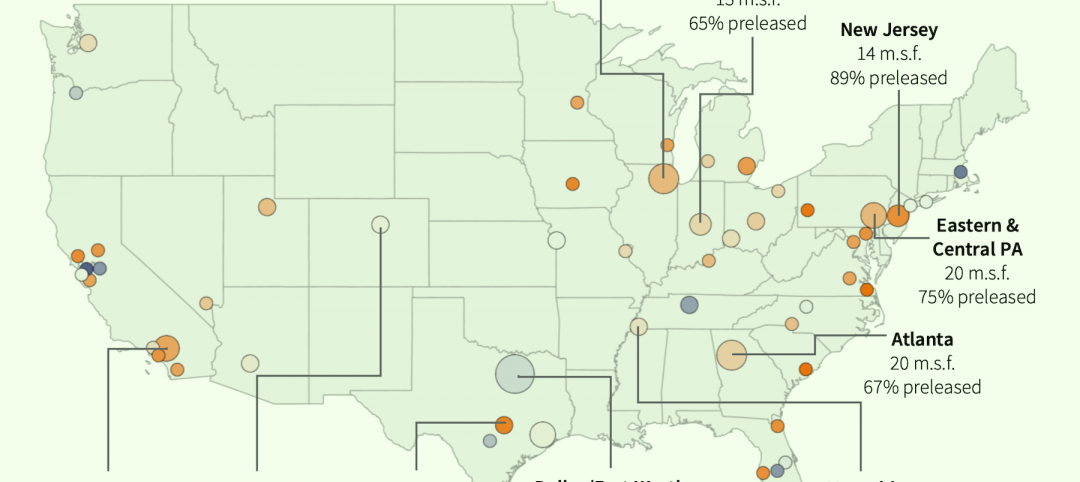

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment