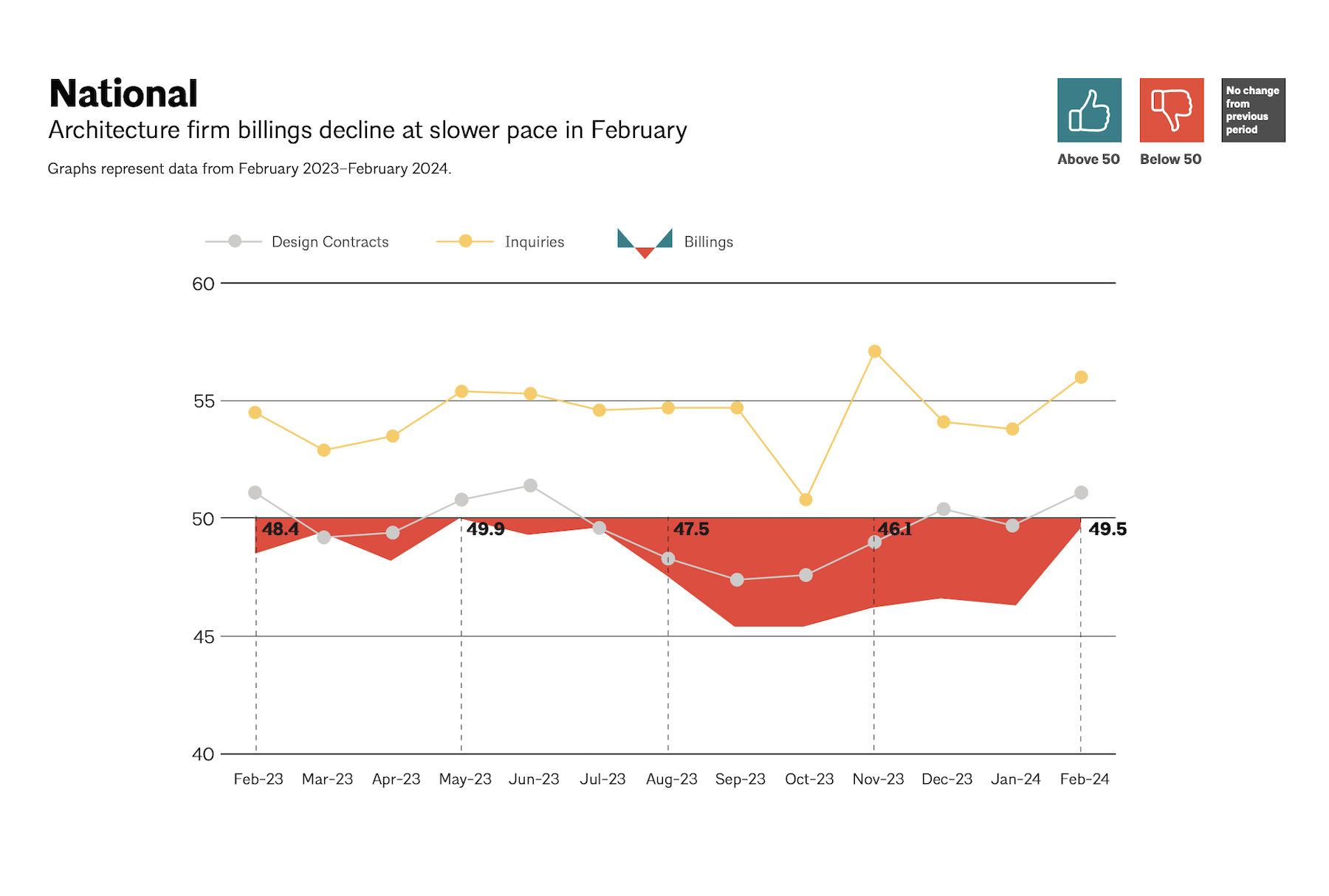

Architecture firm billings continued to decline in February, with an AIA/Deltek Architecture Billings Index (ABI) score of 49.5 for the month. However, February’s score marks the most modest easing in billings since July 2023 and suggests that the recent slowdown may be receding.

“There are indicators this month that business conditions at firms may finally begin to pick up in the coming months. Inquiries into new projects grew at their fastest pace since November, and the value of newly signed design contracts increased at their fastest pace since last summer,” said Kermit Baker, PhD, AIA Chief Economist." Given the moderation of inflation for construction costs and prospects for lower interest rates in the coming months, there are positive signs for future growth.”

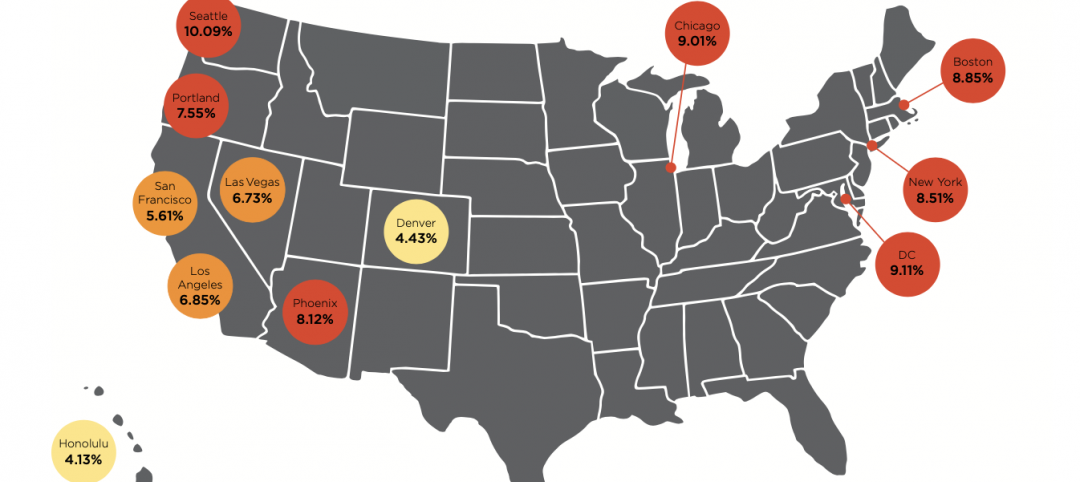

The Midwest as a region is still reporting billings growth, despite business conditions remaining weak across the country in February. Firms located in the Midwest reported growth for the last three months, and for four of the last five months.

The ABI score is a leading economic indicator of construction activity, providing an approximately nine-to-twelve-month glimpse into the future of nonresidential construction spending activity. The score is derived from a monthly survey of architecture firms that measures the change in the number of services provided to clients.

Key ABI highlights for February include:

- Regional averages: Northeast (44.0); Midwest (50.8); South (47.7); West (47.2)

- Sector index breakdown: commercial/industrial (46.1); institutional (50.7); mixed practice (firms that do not have at least half of their billings in any one other category) (47.1); multifamily residential (44.9)

- Project inquiries index: 56.0

- Design contracts index: 51.1

The regional and sector categories are calculated as three-month moving averages and may not always average out to the national score.

Related Stories

Market Data | Jan 27, 2022

Record high counts for franchise companies in the early planning stage at the end of Q4'21

Through year-end 2021, Marriott, Hilton, and IHG branded hotels represented 585 new hotel openings with 73,415 rooms.

Market Data | Jan 27, 2022

Dallas leads as the top market by project count in the U.S. hotel construction pipeline at year-end 2021

The market with the greatest number of projects already in the ground, at the end of the fourth quarter, is New York with 90 projects/14,513 rooms.

Market Data | Jan 26, 2022

2022 construction forecast: Healthcare, retail, industrial sectors to lead ‘healthy rebound’ for nonresidential construction

A panel of construction industry economists forecasts 5.4 percent growth for the nonresidential building sector in 2022, and a 6.1 percent bump in 2023.

Market Data | Jan 24, 2022

U.S. hotel construction pipeline stands at 4,814 projects/581,953 rooms at year-end 2021

Projects scheduled to start construction in the next 12 months stand at 1,821 projects/210,890 rooms at the end of the fourth quarter.

Market Data | Jan 19, 2022

Architecture firms end 2021 on a strong note

December’s Architectural Billings Index (ABI) score of 52.0 was an increase from 51.0 in November.

Market Data | Jan 13, 2022

Materials prices soar 20% in 2021 despite moderating in December

Most contractors in association survey list costs as top concern in 2022.

Market Data | Jan 12, 2022

Construction firms forsee growing demand for most types of projects

Seventy-four percent of firms plan to hire in 2022 despite supply-chain and labor challenges.

Market Data | Jan 7, 2022

Construction adds 22,000 jobs in December

Jobless rate falls to 5% as ongoing nonresidential recovery offsets rare dip in residential total.

Market Data | Jan 6, 2022

Inflation tempers optimism about construction in North America

Rider Levett Bucknall’s latest report cites labor shortages and supply chain snags among causes for cost increases.

Market Data | Jan 6, 2022

A new survey offers a snapshot of New York’s construction market

Anchin’s poll of 20 AEC clients finds a “growing optimism,” but also multiple pressure points.