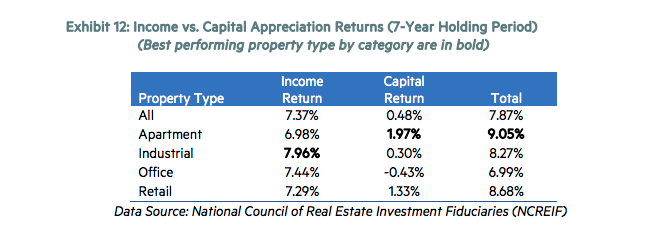

Apartments outperform other commercial real estate property types, on both a risk-adjusted and unadjusted basis, regardless of holding period, geographic region, metro size, and growth rate according to new research from the National Multifamily Housing Council Research Foundation.

In the first work of research funded by NMHC’s Research Foundation since it was launched in late 2016, Professors Dr. Mark J. Eppli (Marquette University) and Dr. Charles C. Tu (University of San Diego) examine a wide range of property and financial market characteristics to try to determine if apartment market over-performance stands up to the test of time.

“Over the last three decades, apartments have become a desired asset class among both domestic and foreign real estate investors because of their strong returns coupled with relatively low risk,” said Mark Obrinsky, NMHC’s Chief Economist. “Despite the different characteristics of apartment, office, retail, and industrial properties, one might expect competitive markets to reduce, even eliminate, the higher risk-adjusted returns on apartments. This research finds that not to be the case, however.”

According to the authors, part of the reason that apartment returns outperform other asset classes is because investors tend to underestimate capital expenditures for both office and industrial properties.

Drs. Eppli and Tu examined a wide range of property and financial market characteristics to try to find insights into expected investment returns. One result they documented is that acquiring properties immediately after a downturn boosts returns.

“We are delighted to publish this first research report from the NMHC Research Foundation,” said NMHC President and CEO Doug Bibby. “As the multifamily industry grows in sophistication, so must the quality and breadth of our analysis. Filling that need was our goal in creating the Foundation and this paper is one of many forthcoming works that will provide leading, actionable information for the apartment market.”

Related Stories

Multifamily Housing | Apr 12, 2024

Habitat starts leasing Cassidy on Canal, a new luxury rental high-rise in Chicago

New 33-story Class A rental tower, designed by SCB, will offer 343 rental units.

MFPRO+ News | Apr 10, 2024

5 key design trends shaping tomorrow’s rental apartments

The multifamily landscape is ever-evolving as changing demographics, health concerns, and work patterns shape what tenants are looking for in their next home.

Mixed-Use | Apr 9, 2024

A surging master-planned community in Utah gets its own entertainment district

Since its construction began two decades ago, Daybreak, the 4,100-acre master-planned community in South Jordan, Utah, has been a catalyst and model for regional growth. The latest addition is a 200-acre mixed-use entertainment district that will serve as a walkable and bikeable neighborhood within the community, anchored by a minor-league baseball park and a cinema/entertainment complex.

Multifamily Housing | Apr 9, 2024

March reports record gains in multifamily rent growth in 20 months

Asking rents for multifamily units increased $8 during the month to $1,721; year-over-year growth grew 30 basis points to 0.9 percent—a normal seasonal growth pattern according to Yardi Matrix.

Industry Research | Apr 4, 2024

Expenses per multifamily unit reach $8,950 nationally

Overall expenses per multifamily unit rose to $8,950, a 7.1% increase year-over-year (YOY) as of January 2024, according to an examination of more than 20,000 properties analyzed by Yardi Matrix.

Affordable Housing | Apr 1, 2024

Biden Administration considers ways to influence local housing regulations

The Biden Administration is considering how to spur more affordable housing construction with strategies to influence reform of local housing regulations.

Affordable Housing | Apr 1, 2024

Chicago voters nix ‘mansion tax’ to fund efforts to reduce homelessness

Chicago voters in March rejected a proposed “mansion tax” that would have funded efforts to reduce homelessness in the city.

Standards | Apr 1, 2024

New technical bulletin covers window opening control devices

A new technical bulletin clarifies the definition of a window opening control device (WOCD) to promote greater understanding of the role of WOCDs and provide an understanding of a WOCD’s function.

Adaptive Reuse | Mar 26, 2024

Adaptive Reuse Scorecard released to help developers assess project viability

Lamar Johnson Collaborative announced the debut of the firm’s Adaptive Reuse Scorecard, a proprietary methodology to quickly analyze the viability of converting buildings to other uses.

Green | Mar 25, 2024

Zero-carbon multifamily development designed for transactive energy

Living EmPower House, which is set to be the first zero-carbon, replicable, and equitable multifamily development designed for transactive energy, recently was awarded a $9 million Next EPIC Grant Construction Loan from the State of California.