Based on data from over *11,000 tracked large-scale country wide construction projects, GlobalData, a leading data and analytics company, finds that 10 major US states account for nearly 60% of the total US construction project pipeline value (US$3.7 trillion).

GlobalData’s latest report: ‘Project Insight - Construction in Key US States’ reveals that, California, Texas and New York are among the states with the highest value of construction projects in the pipeline. With a total of 1,302 projects worth US$524.6bn, California, for example, has both the largest number and value of projects in the US construction project pipeline, with infrastructure projects and mixed-use developments, representing a combined 56% of California’s total pipeline value.

Dariana Tani, Economist at GlobalData explains: “The construction of mixed-use developments is booming across many US states, with the building of American city centers and suburbs coming to resemble one another due to changing demands from consumers and homebuyers. This is particularly the case for states such as Florida, California and New York. In Florida, the construction of mixed-use properties is growing faster than any other US state, with five of the top 10 largest construction projects in Florida being mixed-use construction projects, according to GlobalData.”

The desire to live, work, shop and play within walkable distances is not only unique to millennials and baby boomers, but also older generations who want to live in well-connected urban communities.

Tani adds: “The tech industry is also creating new demand to build more residential and commercial buildings, as well as transport infrastructure to accommodate the influx of workers. Big tech companies such as Google, Apple, Facebook, Microsoft and Amazon are encouraging significant investment. Among the most notable projects in the pipeline are Facebook’s US$850m Willow Campus Mixed-Use Development in San Francisco, Google’s US$800m Residential Development in Mountain View and Microsoft’s US$1bn Redmond Headquarters Redevelopment.”

*These projects are at all stages of development from announcement to execution.

Related Stories

Market Data | Jun 14, 2016

Transwestern: Market fundamentals and global stimulus driving economic growth

A new report from commercial real estate firm Transwestern indicates steady progress for the U.S. economy. Consistent job gains, wage growth, and consumer spending have offset declining corporate profits, and global stimulus plans appear to be effective.

Market Data | Jun 7, 2016

Global construction disputes took longer to resolve in 2015

The good news: the length and value of disputes in the U.S. fell last year, according to latest Arcadis report.

Market Data | Jun 3, 2016

JLL report: Retail renovation drives construction growth in 2016

Retail construction projects were up nearly 25% year-over-year, and the industrial and office construction sectors fared well, too. Economic uncertainty looms over everything, however.

Market Data | Jun 2, 2016

ABC: Nonresidential construction spending down in April

Lower building material prices, a sluggish U.S. economy, and hesitation among private developers all factor into the 2.1% drop.

Market Data | May 20, 2016

Report: Urban area population growth slows

Older Millennials are looking to buy homes and move away to more affordable suburbs and exurbs.

Market Data | May 17, 2016

Modest growth for AIA’s Architecture Billings Index in April

The American Institute of Architects reported the April ABI score was 50.6, down from the mark of 51.9 in the previous month. This score still reflects an increase in design services.

Market Data | Apr 29, 2016

ABC: Quarterly GDP growth slowest in two years

Bureau of Economic Analysis data indicates that the U.S. output is barely growing and that nonresidential investment is down.

Market Data | Apr 20, 2016

AIA: Architecture Billings Index ends first quarter on upswing

The multi-family residential sector fared the best. The Midwest was the only U.S. region that didn't see an increase in billings.

Building Technology | Apr 11, 2016

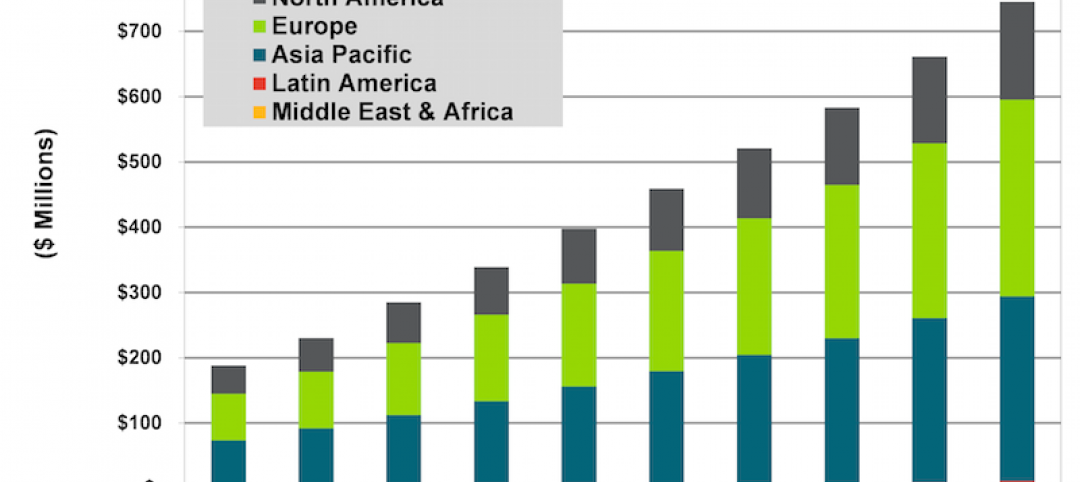

A nascent commercial wireless sensor market is poised to ascend in the next decade

Europe and Asia will propel that growth, according to a new report from Navigant.

Industry Research | Apr 7, 2016

CBRE provides latest insight into healthcare real estate investors’ strategies

Survey respondents are targeting smaller acquisitions, at a time when market cap rates are narrowing for different product types.