The relatively steep slowdown in the growth in construction spending in recent years might suggest that this year might result in a decline in overall spending. However, quite the contrary, the AIA Consensus Construction Forecast panel is projecting a modest pick-up in the growth rate, and another solid performance in 2019. There appear to be several factors behind this optimism:

1. Rebuilding and repairs from natural disasters: The National Oceanographic and Atmospheric Administration recently reported its 2017 estimate of losses from major natural disasters like hurricanes, wildfires, and flooding. At $306 billion, it easily shattered the previous record of $215 billion (adjusted for inflation) set in 2005 from the impacts of Katrina, Rita, Wilma, and Dennis. While the totality of these loss figures won’t be directly translated into rebuilding and repair activity, they will produce significant opportunities for the construction sector. Existing research suggests that the duration of rebuilding activity after natural disasters is significant, with the peak in spending generally occurring two to three years after the event.

2. Tax reform implications for construction: The recently enacted tax reform package dramatically reduced the nominal tax rates for businesses, and some of these savings will likely be reinvested back into the businesses. With capital expenditures able to be expensed rather than depreciated under the tax act, businesses have even more incentive to invest in their businesses. The impact of tax reform on business profitability will vary by industry, with more capital intensive industries (e.g. utilities, real estate, and transportation) and those with higher effective tax rates (e.g. agriculture, financial services) potentially benefiting the most. In contrast, the single-family housing market recovery is likely to be slowed by the tax package. The lower limits for the deductibility of mortgage interest, as well as the cap set on state and local tax deductions (including property taxes) reduce the tax preferences for homeownership, and likely will moderate growth in house prices, particularly for upper-end homes in areas with high state and local tax rates.

3. Possibility of an infrastructure package: A priority of the Trump administration has been an infrastructure investment program. There have been several versions floated, with the current iteration calling for a $200-billion federal investment over the coming decade leveraging and additional $800 billion in state, local, and private investment. The details of such a program, and the likelihood of its being implemented, should unfold over the coming weeks.

4. Strong consumer and business confidence levels: Consumer sentiment—as measured by the University of Michigan consumer sentiment index—turned up in the latter part of 2017, with fourth-quarter figures at their highest levels in almost two decades. Likewise, business confidence levels in 2017, as measured by the Conference Board’s CEO business confidence survey, were at their highest point since before the last recession. These indicators suggest broad confidence in economic conditions across both households and businesses, and a willingness to spend and invest.

5. Leading economic indicators for the construction sector: While there are several “special circumstances” that may provide growth opportunities for the construction sector this year, there are other more basic indicators that point to growth. AIA’s ABI has been signaling growth in design activity for most of the past year, which would point to a comparable upturn in construction activity throughout 2018. Even more significant, the AIA’s index for new design projects coming into architecture firms saw an even sharper upturn than the overall ABI in 2017, demonstrating a growing pipeline for design activity. Additionally, both Dodge Data and Analytics and ConstructConnect reported strong gains in nonresidential building starts in 2017, demonstrating considerable building activity currently under way.

Related Stories

Designers | Oct 12, 2016

Perkins Eastman and EwingCole co-publish new white paper examining the benefits and challenges of design research

The survey’s findings, combined with input from the EDRA conference, informed the content produced for “Where Are We Now?”

Market Data | Oct 11, 2016

Building design revenue topped $28 billion in 2015

Growing profitability at architecture firms has led to reinvestment and expansion

Market Data | Oct 4, 2016

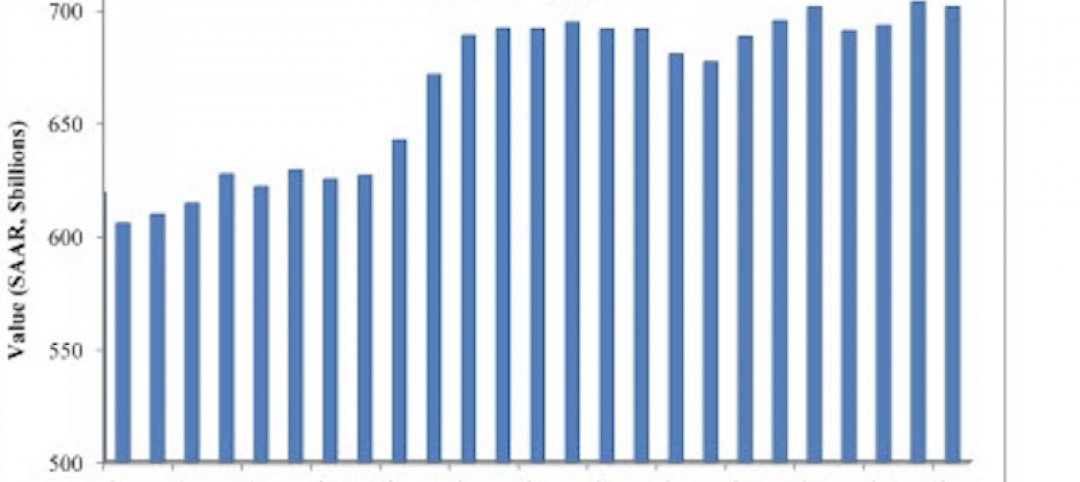

Nonresidential spending slips in August

Public sector spending is declining faster than the private sector.

Industry Research | Oct 3, 2016

Structure Tone survey shows cost is still a major barrier to building green

Climate change, resilience and wellness are also growing concerns.

Industry Research | Sep 28, 2016

Worldwide hotel construction shows modest year-over-year growth

Overall construction for hotel projects is up, but the current number of hotels currently being built has dipped slightly from one year ago.

Industry Research | Sep 27, 2016

Sterling Risk Sentiment Index indicates risk exposure perception remains stable in construction industry

Nearly half (45%) of those polled say election year uncertainty has a negative effect on risk perception in the construction market.

Industry Research | Sep 21, 2016

The global penetration of smart meters is expected to reach approximately 53% by the end of 2025

Large-scale smart meter deployments are underway across Western Europe, while new deployments continue among later adopters in the United States.

Industry Research | Sep 12, 2016

Evidence linking classroom design to improved learning mounts

A study finds the impact can be as much as 25% per year.

Healthcare Facilities | Sep 6, 2016

Chicago Faucets releases white paper: Reducing the risk of HAIs in healthcare facilities

The white paper discusses in detail four options used to mitigate transmission of waterborne bacteria

Market Data | Sep 2, 2016

Nonresidential spending inches lower in July while June data is upwardly revised to eight-year record

Nonresidential construction spending has been suppressed over the last year or so with the primary factor being the lack of momentum in public spending.