Artificial intelligence (AI) is the next big step for retail and FMCG companies following the implementation of advanced big data and analytics (BDA) solutions, which can unlock huge data volumes in an automated way in real-time and ultimately lead to maximum profitability, according to data and analytics company GlobalData.

The company’s Disruptor Database revealed that although retailers have grown to their current size by capitalizing on profitable bits of digitalization, they are often challenged in understanding what their customers need at scale. There is a colossal amount of customer data with enterprises, but only a handful are able to generate value deemed from low conversion rates of below 5% overall.

This broadens the scope for retailers and consumer goods companies to use predictive analytics to enhance decisions related to supply chain management, customer behavior, staff allocation and the likelihood of goods being damaged, lost or returned.

Rena Bhattacharyya, Technology Research Director at GlobalData, says: “While most analysis related to understanding market trends, achieving greater customer personalization, and improving operational efficiency can be performed with BDA methods, AI in many cases is less cost intensive and faster - at times even instant.. Intelligent machine learning systems can replace expensive armies of data scientists and provide solutions or product recommendations in an automated way. The timing of the analytics is crucial, since opportunities for cost savings or additional sales are frequently limited to minutes or even seconds.”

What made their way through the experimental phase of AI in FMCG and retail are the use cases related to predictive analytics. For example, thanks to the integration of machine learning, eBay is now able to help sellers on its platform with solutions ranging from delivery time to fraud detection. It can also discover gaps in inventory of a particular product and alert related sellers to stock up on that item, as well as make price recommendations based on trending events automatically.

Procter & Gamble used deep learning technology to create a skin advisor service for its Olay brand. After screening millions of selfies and spotting key age characteristics, Olay’s service can provide women with personalized product recommendations based on skin analysis.

Leading retailers including Amazon, Alibaba, Lowe’s and Tesco are developing their own AI solutions for automation, analytics and robotics use cases. At the same time, many retailers have not implemented any AI solutions yet and are likely to fall behind their competitors.

“AI is the path to maximum profitability. It will be the technology platform that reaps the biggest rewards. Retail and FMCG companies looking to launch AI-based solutions should start by understanding the needs of their target customer base, focus on providing an omnichannel experience, and strive to achieve cost savings through greater efficiency,” concludes Bhattacharyya.

Related Stories

| Jun 5, 2023

Communication is the key to AEC firms’ mental health programs and training

The core of recent awareness efforts—and their greatest challenge—is getting workers to come forward and share stories.

Contractors | May 24, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of April 2023

Contractor backlogs climbed slightly in April, from a seven-month low the previous month, according to Associated Builders and Contractors.

Multifamily Housing | May 23, 2023

One out of three office buildings in largest U.S. cities are suitable for residential conversion

Roughly one in three office buildings in the largest U.S. cities are well suited to be converted to multifamily residential properties, according to a study by global real estate firm Avison Young. Some 6,206 buildings across 10 U.S. cities present viable opportunities for conversion to residential use.

Industry Research | May 22, 2023

2023 High Growth Study shares tips for finding success in uncertain times

Lee Frederiksen, Managing Partner, Hinge, reveals key takeaways from the firm's recent High Growth study.

Multifamily Housing | May 8, 2023

The average multifamily rent was $1,709 in April 2023, up for the second straight month

Despite economic headwinds, the multifamily housing market continues to demonstrate resilience, according to a new Yardi Matrix report.

Market Data | May 2, 2023

Nonresidential construction spending up 0.7% in March 2023 versus previous month

National nonresidential construction spending increased by 0.7% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $997.1 billion for the month.

Hotel Facilities | May 2, 2023

U.S. hotel construction up 9% in the first quarter of 2023, led by Marriott and Hilton

In the latest United States Construction Pipeline Trend Report from Lodging Econometrics (LE), analysts report that construction pipeline projects in the U.S. continue to increase, standing at 5,545 projects/658,207 rooms at the close of Q1 2023. Up 9% by both projects and rooms year-over-year (YOY); project totals at Q1 ‘23 are just 338 projects, or 5.7%, behind the all-time high of 5,883 projects recorded in Q2 2008.

Market Data | May 1, 2023

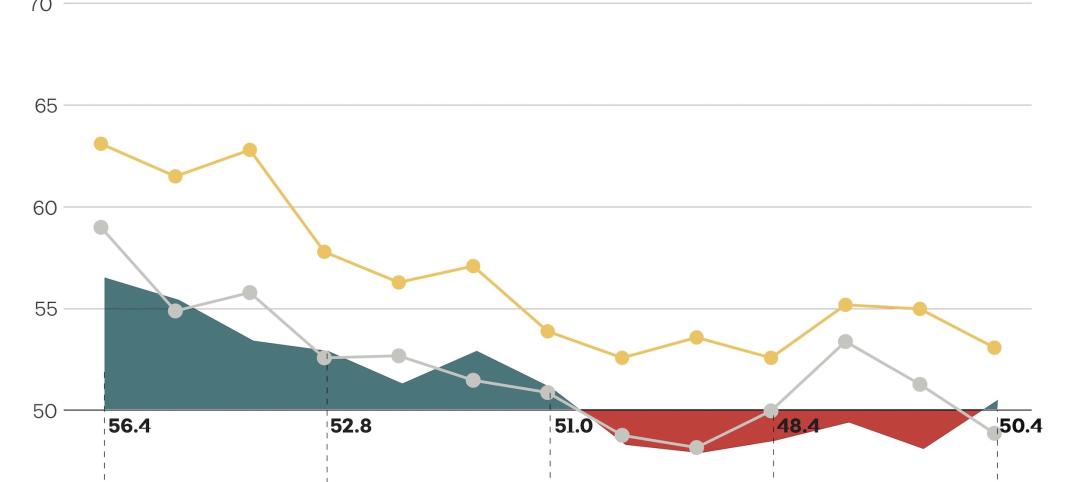

AEC firm proposal activity rebounds in the first quarter of 2023: PSMJ report

Proposal activity for architecture, engineering and construction (A/E/C) firms increased significantly in the 1st Quarter of 2023, according to PSMJ’s Quarterly Market Forecast (QMF) survey. The predictive measure of the industry’s health rebounded to a net plus/minus index (NPMI) of 32.8 in the first three months of the year.

Industry Research | Apr 25, 2023

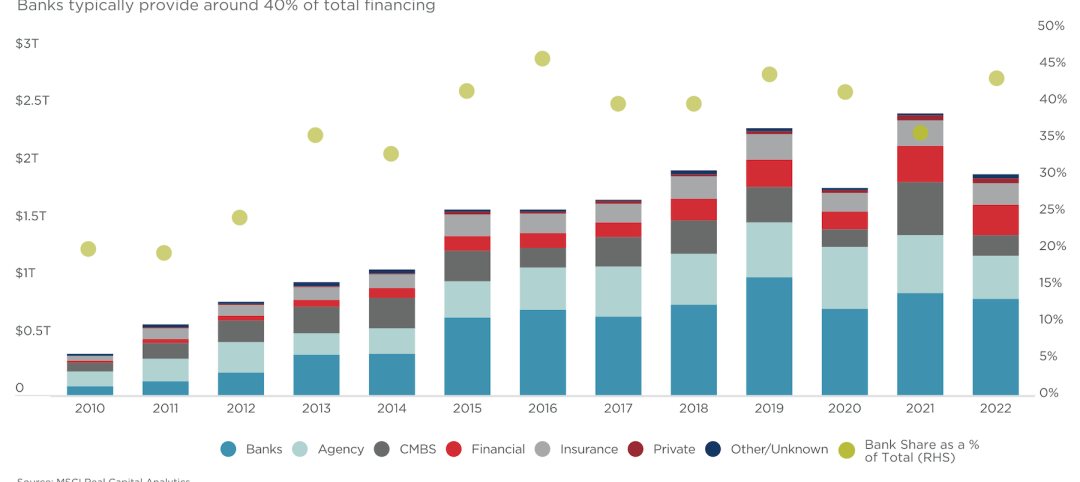

The commercial real estate sector shouldn’t panic (yet) about recent bank failures

A new Cushman & Wakefield report depicts a “well capitalized” banking industry that is responding assertively to isolated weaknesses, but is also tightening its lending.

Architects | Apr 21, 2023

Architecture billings improve slightly in March

Architecture firms reported a modest increase in March billings. This positive news was tempered by a slight decrease in new design contracts according to a new report released today from The American Institute of Architects (AIA). March was the first time since last September in which billings improved.