Artificial intelligence (AI) is the next big step for retail and FMCG companies following the implementation of advanced big data and analytics (BDA) solutions, which can unlock huge data volumes in an automated way in real-time and ultimately lead to maximum profitability, according to data and analytics company GlobalData.

The company’s Disruptor Database revealed that although retailers have grown to their current size by capitalizing on profitable bits of digitalization, they are often challenged in understanding what their customers need at scale. There is a colossal amount of customer data with enterprises, but only a handful are able to generate value deemed from low conversion rates of below 5% overall.

This broadens the scope for retailers and consumer goods companies to use predictive analytics to enhance decisions related to supply chain management, customer behavior, staff allocation and the likelihood of goods being damaged, lost or returned.

Rena Bhattacharyya, Technology Research Director at GlobalData, says: “While most analysis related to understanding market trends, achieving greater customer personalization, and improving operational efficiency can be performed with BDA methods, AI in many cases is less cost intensive and faster - at times even instant.. Intelligent machine learning systems can replace expensive armies of data scientists and provide solutions or product recommendations in an automated way. The timing of the analytics is crucial, since opportunities for cost savings or additional sales are frequently limited to minutes or even seconds.”

What made their way through the experimental phase of AI in FMCG and retail are the use cases related to predictive analytics. For example, thanks to the integration of machine learning, eBay is now able to help sellers on its platform with solutions ranging from delivery time to fraud detection. It can also discover gaps in inventory of a particular product and alert related sellers to stock up on that item, as well as make price recommendations based on trending events automatically.

Procter & Gamble used deep learning technology to create a skin advisor service for its Olay brand. After screening millions of selfies and spotting key age characteristics, Olay’s service can provide women with personalized product recommendations based on skin analysis.

Leading retailers including Amazon, Alibaba, Lowe’s and Tesco are developing their own AI solutions for automation, analytics and robotics use cases. At the same time, many retailers have not implemented any AI solutions yet and are likely to fall behind their competitors.

“AI is the path to maximum profitability. It will be the technology platform that reaps the biggest rewards. Retail and FMCG companies looking to launch AI-based solutions should start by understanding the needs of their target customer base, focus on providing an omnichannel experience, and strive to achieve cost savings through greater efficiency,” concludes Bhattacharyya.

Related Stories

Market Data | May 18, 2022

Architecture Billings Index moderates slightly, remains strong

For the fifteenth consecutive month architecture firms reported increasing demand for design services in April, according to a new report today from The American Institute of Architects (AIA).

Market Data | May 12, 2022

Monthly construction input prices increase in April

Construction input prices increased 0.8% in April compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Market Data | May 10, 2022

Hybrid work could result in 20% less demand for office space

Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.

Market Data | May 6, 2022

Nonresidential construction spending down 1% in March

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Apr 29, 2022

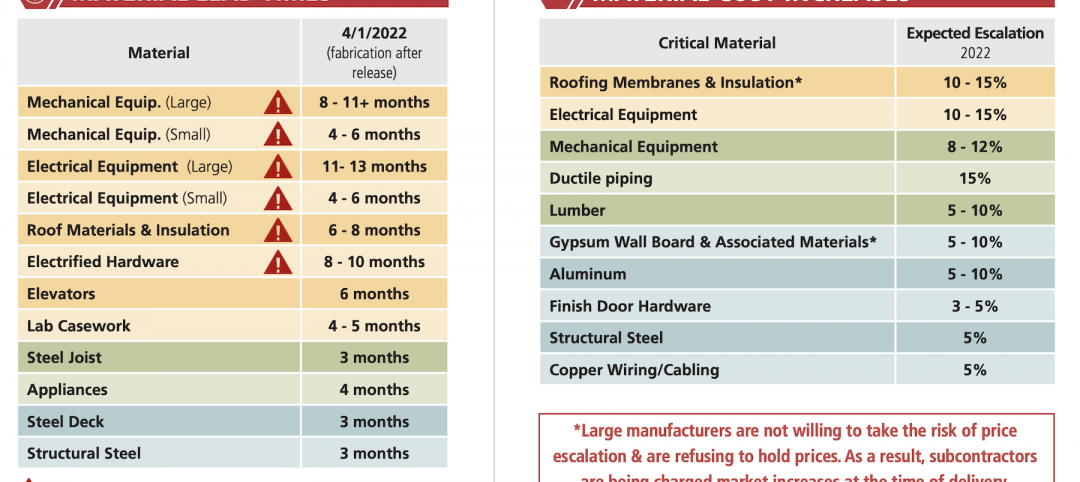

Global forces push construction prices higher

Consigli’s latest forecast predicts high single-digit increases for this year.

Market Data | Apr 29, 2022

U.S. economy contracts, investment in structures down, says ABC

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022.

Market Data | Apr 20, 2022

Pace of demand for design services rapidly accelerates

Demand for design services in March expanded sharply from February according to a new report today from The American Institute of Architects (AIA).

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

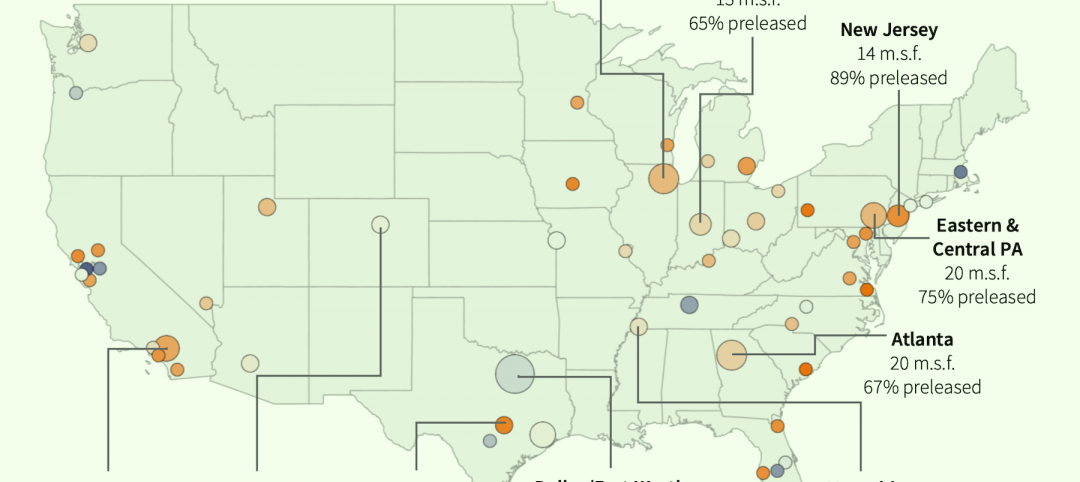

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment